Photo/VCG

June 8 (NBD) - Shares of Baofeng Group Co., Ltd. (Baofeng Group, 300431.SZ) plunged sharply in the past two trading days after the company announced a mini private placement plan on Tuesday to raise 50 million yuan (7.8 million U.S. dollars).

According to its original plan, the company aimed to raise 2 billion yuan (312.5 million U.S. dollars) by issuing additional 50 million shares.

The slimmed financing plan raised concerns over the company's capital crunch. Baofeng Group explains that the 50-million-yuan financing plan is in line with its R&D strategy.

But as of the first quarter of 2018, the company's cash on the balance sheet only reached 118 million yuan (18.4 million U.S. dollars). In addition, its financial expenses kept surging from 2016 to 2018.

Its market value has shrunk over 30 billion yuan (4.7 billion U.S. dollars) from the highest point.

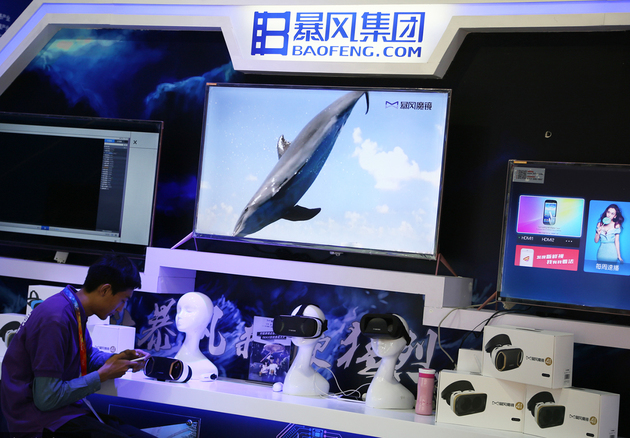

With the declining share price, the company diversified its product mix by expanding to the VR and TV business. In the first quarter of 2018, losses of its TV business narrowed by 45 percent.

However, the rise in TV prices and number of network terminals didn't improve the company's financial performence. In the January-March period, revenue of Baofeng Group was 387 million yuan (60.5 million U.S. dollars), down 13.7 percent year on year, while net profits attributable to shareholders stood at about -29.5 million yuan (-4.6 million U.S. dollars), down 79.27 percent.

Email: tanyuhan@nbd.com.cn

川公网安备 51019002001991号

川公网安备 51019002001991号