At the start of 2026, the global geo-economic landscape remains volatile and financial market uncertainty stays elevated, once again thrusting gold into the global investor spotlight. Despite the current "rally followed by a pullback and sideways trading" trend in international gold prices, discussions regarding its future growth potential have never ceased.

Recently, in an exclusive interview with National Business Daily (NBD), Juan Carlos Artigas— Regional CEO, Americas and Head of Global Research, World Gold Council— provided an in-depth analysis of the core drivers of the 2026 gold market.

He noted that gold is undergoing a "structural shift" fueled by a combination of central bank demand and safe-haven sentiment, establishing itself as an indispensable liquidity moat within asset allocation.

Juan Carlos Artigas Photo/X

Has the Pricing Logic Changed? Truth Behind "Decoupling" of Gold and US Treasury Yields

NBD: You have long categorized gold’s performance into four drivers: Economic Expansion, Risk/Uncertainty, Opportunity Cost, and Momentum. In the current 2026 macro environment, which pillar do you believe is the primary engine behind gold's current valuation?

Juan Carlos Artigas: Gold’s performance is categorized by the interplay of our four key drivers, but in 2026a further rise in risk and uncertainty has significantly contributed to current valuations. Elevated geoeconomic tensions and pockets of financial‑market stress have increased demand for high‑quality safe-haven assets like gold.

The current geopolitical environment has also put pressure on the US dollar, which in turn has reduced gold’s opportunity cost. Finally, despite its recent volatility, gold’s price performance has attracted investment flows and generated positive momentum.

NBD: The historical negative correlation between gold and US real yields has weakened significantly. Do you view this "breakdown" as a temporary anomaly driven by geopolitics, or a fundamental paradigm shift in how the market prices fiat currency risk?

Juan Carlos Artigas: Movements in the gold price are influenced by a combination of drivers, not just real yields.And while there has seemingly been a weakening in the negative correlation between gold and real yields, it was mitigated by other supportive forces that outweighed the headwinds from rising real rates. For example,significantly higher geopolitical risk, strong central bank buying, and a wider investor base have all provided meaningful lifts to the gold price.

In our view, the relationship between gold and real yields has not disappeared. It has simply become less dominant during a phase when other macro forces have become key drivers.

16 Consecutive Years of Net Buying: Central Bank Gold Purchases Signals a "Structural Change"

NBD: Is the 2025 slowdown in buying a sign that reserves have reached a saturation point? How will central bank gold buying trends change?

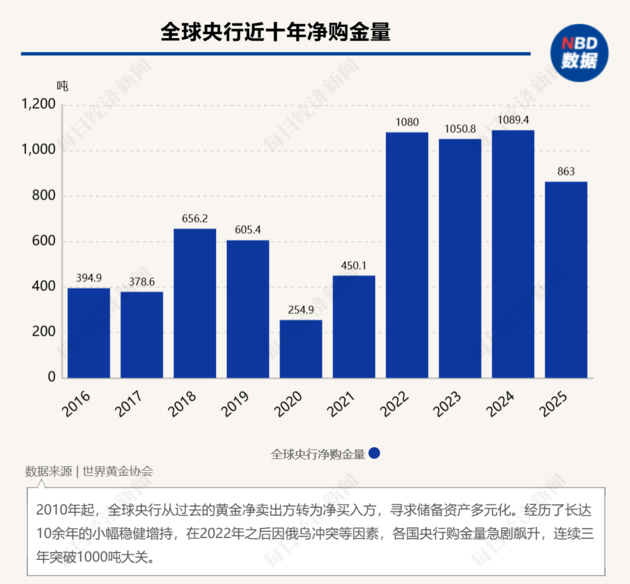

Juan Carlos Artigas: Central banks have been net buyers for over 16 years marking a key structural change in the gold market. However, the pace of these purchases has accelerated in recent years, surpassing 1,000t per year between 2022 and 2024. Central banks bought 863 tonnesin 2025. As we discussed in our latest Gold Demand Trends report, while this level was below previous highs, it still remains well above average.

Our Central Bank Gold Reserves Survey suggests that central banks’ appetite for gold has been driven by a combination of central banksresponding to gold’s performance during times of crisis, its role as a store of value as well as its diversification and inflation hedging characteristics. In addition, emerging market central banks have also cited the relevance of gold as means to diversify geopolitical risk as one of their top drivers.

Further, emerging market central banks hold approx. 15% of the foreign reserves in gold – half of the percentage developed markets do. And while not all central banks have a fixed percentage target, this highlights that there’s still potential room for growth.

Against this backdrop, we expect central bank demand for gold to continue.

NBD: With concerns over US fiscal sustainability and debt levels dominating headlines, is gold officially transitioning from a "complementary asset" to a "primary competitor" for US Treasuries as a High-Quality Liquid Asset (HQLA)?

Juan Carlos Artigas: Gold is not currently classified as a High‑Quality Liquid Asset (HQLA) under Basel III, but its market characteristics and behavior resemble those of many assets that are considered HQLAs.

During historical periods of market stress,gold has demonstrated liquidity characteristics comparable to – and in some cases better than – long-term US Treasuries, including robust market depth, stable bid–ask spreads, and orderly trading even amid heightened volatility.

In today’s environment, many reserve managers increasingly view gold as a credible, non‑sovereign alternative that strengthens liquidity buffers and enhances portfolio resilience.

Offsetting the "Double Whammy" in Stocks and Bonds: Gold as the 2026 "Anchor" for Portfolio Diversification

NBD: In a world of persistent inflation volatility, the traditional 60/40 portfolio has struggled. Based on WGC’s Qaurum model, what is the optimal percentage of gold for a diversified portfolio in 2026 to achieve the best risk-adjusted returns?

Juan Carlos Artigas: Qaurum is designed as a gold valuation framework, not an assetallocation optimizer. Ultimately, optimal allocations depend on an investor’s broader objectives, risk tolerance, and asset mix.

However, Qaurum does suggest that an environment of heightened volatility and market risk is usually linked with strong gold performance.

At the same time, ourasset allocation analysis indicates that gold has historically improved riskadjusted returns across a variety of macro environments – including those with inflation volatility – by adding diversification, reducing drawdowns, and enhancing longterm portfolio resilience, especially as bond-stock correlation increases. adjusted returns across a variety of macro environments term portfolio resilience

NBD: In 2026, what is the WGC’s projected "ceiling" for gold?

Juan Carlos Artigas: The World Gold Council does not forecast the price of gold. We do, however, outline a range of potential scenarios for gold based on hypothetical macroeconomic scenarios and our gold valuation framework. In our Gold Outlook 2026, we illustrate how different combinations of economic growth, nominal rates, inflation, risk conditions, and investor flows could influence gold’s trajectory in the year ahead.

For example, a deterioration of macroeconomic or geopolitical conditions could push gold prices higher, but sustained resolution of geoeconomic risks and an increase in interest rates could curtail gold’s performance.

NBD: Recent years have seen a surge in over-the-counter (OTC) buying and unallocated gold accumulation. How is the WGC improving its methodology to capture this "invisible" demand, and is it now more influential than traditional ETF flows in setting the global spot price?

Juan Carlos Artigas: Over-the-counter (OTC) demand is, by its nature, more difficult to directly quantify. In our Gold Demand Trends report, we infer OTC demand from the balance between our estimates of directly quantifiable sectors of demand and supply. However, this balance also includes changes in inventories across exchanges, wholesalers, and fabricators, as well as any statistical residual.

We complement our analysis through anecdotal evidence, as well as other available information such as trade flows, vault holdings,and activity in derivatives exchanges to assess strength in the OTC market.

And while OTC flows can be highly influential in certain periods, particularly when large institutions or sovereign buyers transact outside public markets, there’s a diverse set of economic actors actively participating in the gold market.These include jewellery consumers, technology buyers, investors – whether through bars, coins, gold ETFs or vaulted gold – as well as central banks. In the long-term, it is the contribution of all these actors that ultimately determines gold’s performance.

川公网安备 51019002001991号

川公网安备 51019002001991号