Historically, the Lunar New Year (Spring Festival) has been the "golden window" for creating national-level products in China—transforming WeChat into a payment titan and Douyin into a short-video hegemon.

In 2026, the battlefield has shifted from mobile internet traffic to AI-native dominance.

As the 2026 Spring Festival approaches, the "Big Four" are deploying aggressive tactics to acquire users:

Tencent (Yuanbao): Launching a 1 billion yuan cash giveaway. CEO Pony Ma aim to "replicate the WeChat Red Envelope miracle." Tencent is also testing "Yuanbao Pai," an AI-driven social feature for shared screen experiences and music.

Baidu (Ernie): Offering 500 million yuan in rewards. Baidu is the "Chief AI Partner" for the Beijing TV Spring Festival Gala, rolling out nearly 100 AI-themed interactive features.

ByteDance (Doubao): Securing the role of Exclusive AI Cloud Partner for the CCTV Spring Festival Gala via its Volcano Engine arm.

Alibaba (Qwen): Focusing on gala sponsorships (Bilibili and Jiangsu TV) and deep integration across the Alibaba ecosystem (Taobao, Alipay, FlyPig).

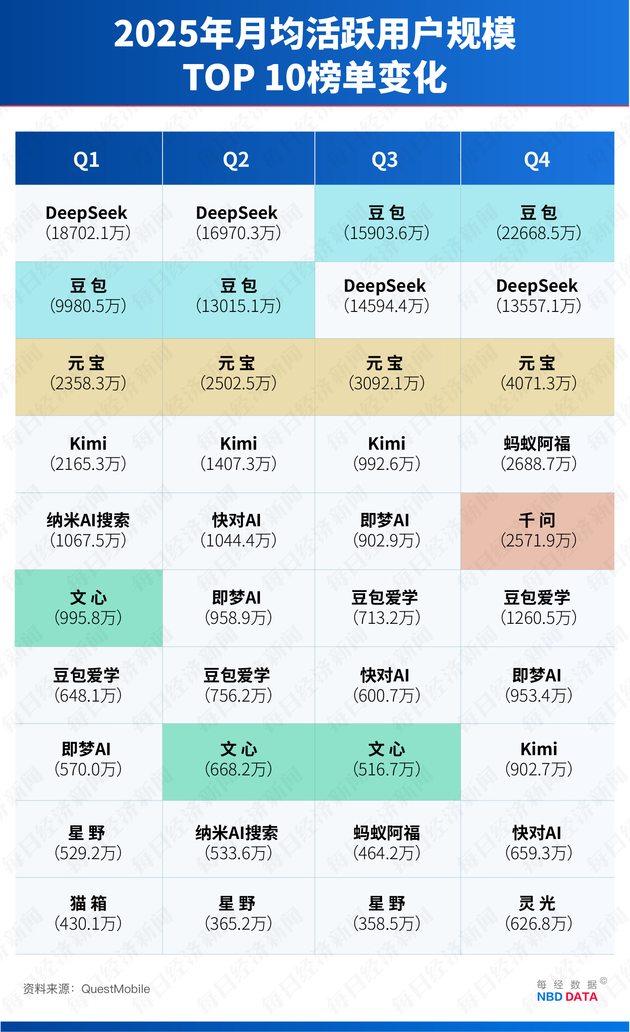

In the fourth quarter of 2025, the total monthly active users (MAU) of China's top five AI applications reached 455 million.

ByteDance has successfully converted its traffic engine into AI leadership, widening its lead over DeepSeek to 90 million users.

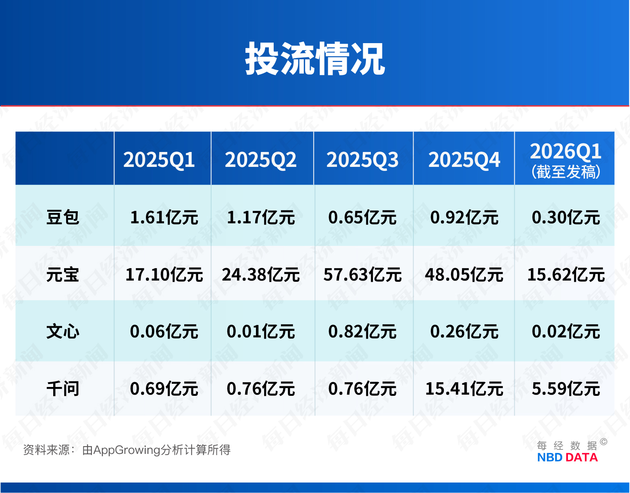

Tencent’s aggressive spend (15B yuan) is unprecedented—its Q3 marketing spend alone exceeded the annual total of its three main rivals combined.

Previously B2B-focused, Alibaba’s AI arm saw explosive growth after integrating into the "Alibaba Ecosystem" and ramping up Q4 spend to 1.5 billion yuan.

While the standalone Ernie app struggled, Baidu successfully migrated users to the Ernie Assistant within the main Baidu App, maintaining a massive user base.

The 2025 data reveals a shift from general market expansion to "user grab."

While the "Red Envelope War" remains a staple, experts suggest the AI era demands a different metric for success.

"This is no longer just a traffic war; it is an AI Land Grab," says Professor Hu Yanping with Shanghai University of Finance and Economics.

He notes that while massive subsidies can drive short-term downloads, the "law of diminishing returns" applies as platforms compete for the same audience. The ultimate "winner" will not be determined by traffic alone, but by:

Firstly, user retention is strictly tied to how "smart" and "useful" the AI is.

Secondly, success in AI-assisted booking, e-commerce, and healthcare will drive the industry toward a multi-trillion RMB market.

川公网安备 51019002001991号

川公网安备 51019002001991号