Photo/VCG

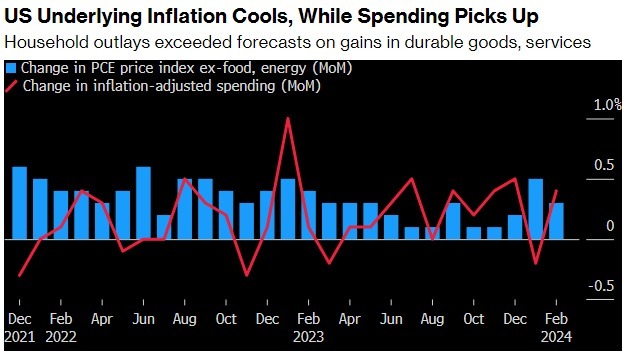

On Friday, March 29th, Eastern Time, data released by the U.S. Department of Commerce showed that headline PCE price rose to 2.5% y/y in February from 2.4% y/y in January, but core PCE price inflation (which excludes food and energy) slowed to 2.8% y/y from 2.9% y/y. Both are in line with market expectations.

Later that day, Federal Reserve Chairman Jerome Powell said in an interview in San Francisco that February’s PCE inflation “pretty much in-line with our expectations”. But Powell reiterated it won't be appropriate to lower rates until officials are sure inflation is on track toward 2%.

In addition to Powell, earlier this week, Federal Reserve Governor Waller also “hawked” again, adding uncertainty to the Fed’s monetary policy for the year. The speeches of the two senior Fed officials led to a further delay in the market’s expectations for the Fed’s interest rate cuts.

Michael Pearce, deputy chief U.S. economist at Oxford Economics, said in an email to NBD that the loosening of labor market conditions, stable inflation expectations, and likely disinflation in rents to come all make us confident that inflation will still trend slightly lower over this year. He expects the date of the Fed's first rate cut to be pushed back from May to June.

Shamik Dhar, Chief Economist at BNY Mellon in New York, also told NBD that he continues to expect the Fed's easing cycle to kick off mid-year and progress in line with current market pricing (-3 cuts in'24).

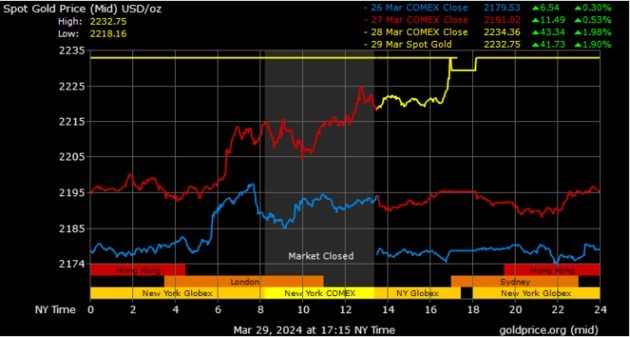

Against the backdrop of delayed interest rate cut expectations, spot gold continued to hit a new high of $2232.76 per ounce this week. UBS pointed out that although the Fed’s interest rate cut expectations have been postponed, the market generally expects it to maintain a loose stance. Even if inflation is stubborn and economic data is strong, this means that real interest rates will further decline, which is beneficial to the rise in gold prices.

Photo/GoldPrice

Jerome Powell: more “favorable” data needed

As the latest PCE inflation data is released, Fed officials are facing a complex situation where they must find the right timing for interest rate cuts amidst fluctuating economic data.

In his speech on Friday, Powell mentioned that he still expects the inflation rate to fall to the Fed’s 2% target. However, the PCE data for February and other recent economic data indicate that the path to achieving this inflation target is “sometimes bumpy”. He emphasized that "It's good to see something coming in in line with expectations," he said, adding that the latest readings aren't as good as what policymakers saw. “We’re not going to overreact to these two months of data, nor are we going to ignore them,” said Powell.

Photo/Bloomberg

In addition to Powell, Fed Governor Waller also “hawked” this week, stating that there is no need to rush to cut interest rates. It is worth mentioning that Waller emphasized “no need to rush to action” four times in this speech.

NBD noticed that there are indeed some large institutions and economists who believe that perhaps the Fed does not need to cut interest rates at all. For example, Qian Wang, a global economist at Vanguard Group, said: “We expect that this year may see a situation where inflation still remains at the level of 2.5%~3%, and economic growth is also higher than the long-term trend level (that is, more than 2%). I believe that under this circumstance, the Fed cannot declare ‘mission accomplished’. On this point, the Fed will continue to rely on the data released one after another, and so will the market.”

In fact, investors initially hoped that the Fed would start to cut interest rates significantly at the beginning of this year, but the wording of Fed officials in the past few months has become more cautious, insisting that they hope to take action after having greater confidence in controlling inflation. Powell’s speech on Friday reiterated this position.

Financial Times also pointed out that the new round of inflation may disrupt the expected pace of the Fed’s interest rate cuts. In recent months, oil prices have risen rapidly again, which once again reminds the market that price pressures will make the Fed’s monetary policy more complicated this year.

Citibank economist Andrew Hollenhorst recently pointed out in a research report that the interruption of shipping in the Panama Canal and the Suez Canal, and the collapse of a bridge in the Port of Baltimore leading to the interruption of shipping on the east coast of the United States, mean that commodity prices are also “increasingly susceptible to upward risks”.

Recent inflation data also reflects this. In February, the continuous rise in energy costs pushed up the overall growth of the US PCE, with a single item increase of 2.3% in February. The rise in commodity prices (an increase of 0.5%) also brought more inflationary pressure.

The Fed is divided on interest rate cuts

The Federal Reserve is divided on the number of interest rate cuts it will make this year. Of the 19 members, 10 predict at least three cuts, while the other 9 predict two or fewer. Of the latter group, two predict the Fed will hold steady this year, and one "hawk" even believes rates will not start to decline until the end of next year.

In addition to the rebound in the PCE index, the Fed's "reluctance to cut rates" is also partly due to the strong job market and resilient economy in the United States.

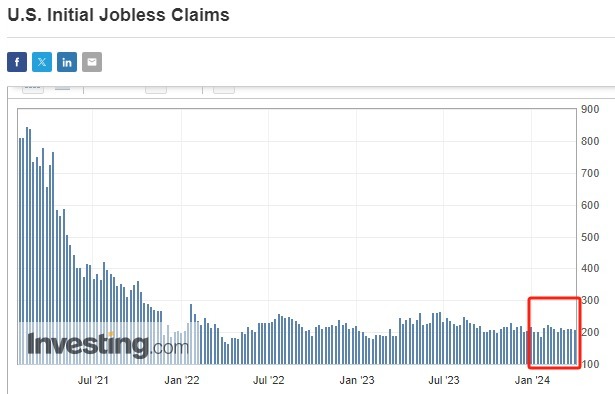

Specifically, while non-farm payrolls in the United States increased by 275,000 in February, the lowest since November 2023, and the unemployment rate rose to 3.9%, the highest since January 2022. There are not many signs of a slowdown in employment. Initial jobless claims remain at a historic low of 210,000 per week. Another new metric from Vanguard shows that hiring has picked up recently, especially for high-income tech workers.

Photo/Investing.com

The recent number of initial jobless claims in the United States has remained at a historic low of around 210,000.

Final revised data released by the U.S. Commerce Department on March 28 showed that real U.S. GDP grew at an annual rate of 3.4% in the fourth quarter of 2023, up 0.2 percentage points from the previous revised data. This data suggests that the US economy is still very healthy, despite the Fed's aggressive rate cuts over the past three years to curb inflation, pushing rates to their highest level since the financial crisis.

On March 27, 2024, S&P Global Ratings affirmed its 'AA+' long-term and 'A-1+' short-term unsolicited sovereign credit ratings on the U.S. The outlook on the long-term rating remains stable. The transfer and convertibility assessment remains 'AAA'. S&P said: "The US economy is diversified and resilient, with strong economic growth, flexible monetary policy, and its unique position as the issuer of the world's major reserve currency supporting the US sovereign rating."

"A diversified and resilient economy with solid growth, extensive monetary policy flexibility, and benefits associated with the unique status as the issuer of the world's leading reserve currency underpin the U.S. sovereign rating," S&P said.

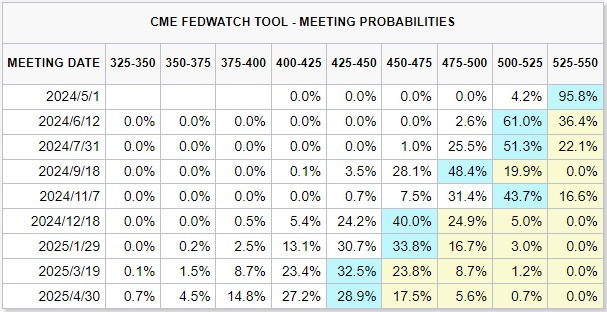

Photo/CME

Michael Pearce, deputy chief U.S. economist at Oxford Economics, said in an email to NBD that as anticipated, the PCE deflator came in cooler than the CPI, though the 0.3% rise in the core PCE deflator is still too warm to be counted as the "continued good news" on inflation the Fed is looking for. Headline and core inflation have settled between 2.5-3.0% in recent months, which is still significantly above the Fed's 2% target.

Nonetheless, the loosening of labor market conditions, stable inflation expectations, and likely disinflation in rents to come all make us confident that inflation will still trend slightly lower over the course of this year. That should be enough to give the Fed confidence to begin removing some of the policy tightness later this year, though the resilience of the real economy means policymakers are in no rush, Michael added.

In an email response to NBD, Shamik Dhar, chief economist at New York Mellon Bank, also expects the Fed's easing cycle to kick off mid-year and progress in line with current market pricing(-3 cuts in'24). Note that market pricing previously expected many more cuts, but has moderated and moved in line with our view in recent months.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice, please check before using.

川公网安备 51019002001991号

川公网安备 51019002001991号