Major auction houses have recently released their performance reports. Christie's concluded the first half of 2025 with a total sales volume of $2.1 billion, showing strong momentum in the global auction market despite a slight 1% year-on-year decline. According to data from market research firm ArtTactic, Christie's, Sotheby's, and Phillips collectively achieved $3.98 billion in auction sales during this period.

National Business Daily(NBD)noticed that Christie's auctioned seven of the top ten highest-priced artworks globally in the first half of this year. The Asia-Pacific region made a significant contribution to the $2.1 billion auction turnover during this period, representing 21% of the total. Notably, Asian spring auctions generated $284 million in sales.The total hammer price reached 108% of the low estimate, with a sell-through rate of nearly 90%. These figures highlight the vibrancy of this regional market.

Recently, LVMH (parent company of LV) and Kering (parent company of Gucci) have released their interim financial reports, both reporting declining revenues and profits in the first half of the year. Interestingly, while the primary market remains sluggish, the secondary art market is defying the trend. This subtle contrast has sparked curiosity: Is market capital flowing into the high-end auction sector?

As the autumn auction season approaches, NBD exclusively interviewed Francis Belin, President of Christie's Asia Pacific. He was dressed in a crisp suit, with sharp eyes, yet exuded affability in conversation. Francis Belin previously worked at McKinsey, Richemont, and Swarovski. After taking charge of Christie's Asia-Pacific region in 2019,he not only restructured Christie's Hong Kong headquarters but also recruited Cheng Shoukang, a retired auction industry veteran, to join the team.

Christie's Asia Pacific President Francis Belin (Pang Zhifeng) Photo/Cong Sen (NBD)

Francis Belin holds Chinese collectors in high regard, having collaborated with pop star Jay Chou to curate the 2023 autumn auction that ultimately achieved a record-breaking HK$118 million sale. This year, Christie's has relocated two of its spring auctions to Shanghai. He has witnessed the fluctuations in the performance of the Asia-Pacific region and also discerned the changes in collectors' mindsets. Despite being decisive and efficient in his work, Francis Belin finds personal fulfillment in his "tiny happinesses": he enjoys cycling —— at least 150 days annually, indulges in evening sizzles, and has developed an obsessive passion for historical literature.

As the transaction volume from Generation Z collectors doubles and WeChat bidding changes the rules, the collision between auction houses and the new generation is reshaping the definition of collecting. The market turning point has arrived. How will this force reshape the global art landscape?

The inflection point has arrived? Important auction returns, Chinese collectors rise in the generational shift

Behind the $2.1 billion spring auction turnover, Asia-Pacific collectors accounted for over 15% of the global market. During the interview, Francis Belin frequently highlighted Chinese collectors' growing influence in international auctions, with millennial and Gen Z buyers demonstrating particularly strong performance. To better engage younger audiences, Christie's is trying to convey the stories of auction items through more social platforms. Addressing market challenges, Francis Belin expressed cautious optimism, noting that recovering collector confidence and the return of significant artworks signal a potential turning point.

NBD: How would you evaluate the performance of the 2025 spring auctions?

Francis Belin: This achievement is truly encouraging, with Asian collectors demonstrating particularly remarkable engagement. The Asia-Pacific region has now become a cornerstone of Christie's global strategy, accounting for 25% to 30% of our total auction sales. Last year, clients from this region contributed 26% of our annual total. Our investors unanimously hope to and will continue to increase investment here.

NBD: What is the role of Chinese collectors among Asian collectors and what are the new changes?

Francis Belin: Asia, particularly China, has brought a younger group of collectors to Christie's global business. Mainland Chinese buyers have been the driving force behind new entrants joining Christie's. Despite multiple challenges from industry and other sectors, as well as widespread performance declines in luxury enterprises, Chinese collectors continue to demonstrate strong market engagement. In fact, this group showed exceptional activity last year.

It's noteworthy that Chinese collectors' philosophy of collection continues to evolve: They no longer view collecting as consumption, but rather understand it as safeguarding the long-term value of artworks, valuing both their asset attributes and cultural-historical significance. This collection philosophy that emphasizes both investment and culture is being recognized by a growing number of Chinese collectors.

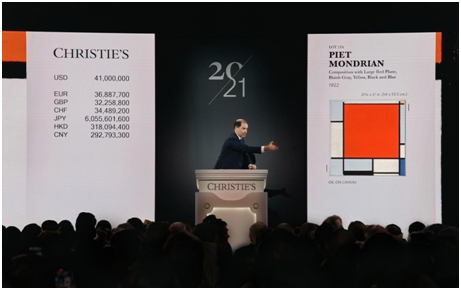

In May, Composition with Large Red Plane. Yellow. Black. Grey and Blue sold for $47.6 million, making it the highest-priced artwork of 2025 to date. Photo/Provided by interviewee

NBD: Millennials collectors now account for 40 to 60 percent of the total auction sales from Asian collectors. How does Christie's reach young collectors?

Francis Belin: This trend has been intensifying over the past six to seven years, reaching its peak in 2023 when the total purchases by Gen Z collectors in the Asia-Pacific region more than doubled compared to 2022.We believe that collectors who start their collecting journey earlier tend to maintain longer engagement cycles. That's why we're prioritizing youth cultivation. By strengthening partnerships with Chinese social media platforms, we're not only showcasing auction value but also gaining insights into emerging aesthetic trends among Chinese collectors.

NBD: What are your expectations for the Asia-Pacific region this year?

Francis Belin: We maintain a cautiously optimistic outlook on market prospects. Over the past three years, the main challenge facing the market has been reflected in the increased difficulty in sourcing auction items, rather than in transaction performance. However, positive signals have emerged since the second half of last year—— Asian collectors' participation in global auctions has shown sustained growth, with Hong Kong and Shanghai auction houses achieving breakthroughs in consignment efforts. Marking the Shanghai Spring Auction this year as a milestone, the modern and contemporary art sector from the previous 12 months (mid-2024 to mid-2025) demonstrated stronger performance compared to the same period. Despite market contraction, our transaction prices remain resilient, with multiple categories breaking sales records. Most notably, the resurgence of collector confidence is driving more significant artworks to return to the market. All indicators suggest this pivotal turning point is approaching.

WeChat and other rewriting the auction "dialogue": collectors dig into niche areas, from Ming-style furniture to lunar meteorites

The expanding ranks of Chinese collectors are witnessing a subtle shift in their preferences. Francis Belin observes that as young collectors navigate between Ming-style furniture and digital art, and acquire both antique watches and lunar meteorites, a new era of diversified and professional collecting is quietly emerging. From interactions within auction houses to digital connections, the dialogue between collectors and artworks continues to deepen. This dynamic showcases not only the clash between tradition and modernity but also the expansion of cultural horizons—— What exactly are we collecting? Behind this lies not only the accumulation of wealth, but also the expansion of cultural confidence and aesthetic horizons. In this digital age, how auction houses can attract more participants into the auction world has become a pressing new challenge.

NBD: The ranks of collectors are expanding. What has changed in the taste of Chinese people?

Francis Belin: There's a prevalent stereotype that young Chinese collectors only focus on contemporary or digital art. In reality, they're actively involved across all auction categories with diverse interests spanning Chinese calligraphy and painting, classical art, modern art, and contemporary works. These young collectors even make up a significant portion of transactions in Ming-style furniture and Chinese ceramics. This is truly impressive—it shows that despite their relatively young age, Chinese collectors have already built substantial collections and done thorough research.

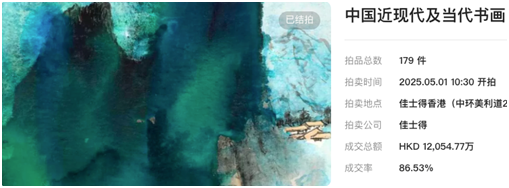

In May this year, Zhang Daqian's work "Drifting boat seeks Peach Blossom Spring" was sold for HK$14.29 million

NBD: What "potential stocks" are Chinese collectors looking at?

Francis Belin: Chinese collectors are increasingly specializing in specific auction categories. Take watches as an example: while contemporary pieces were once the primary focus, the trend has shifted toward vintage models from the 1960s and 1970s. These collectible items typically come with higher entry barriers, requiring buyers to possess specialized knowledge and discerning eye to appreciate their value.

Chinese collectors are showing growing interest in works by Western modern art masters. On April 3rd this year, we auctioned pieces by artists including Giorgio de Chirico and Raoul Dufy in Shanghai. Meanwhile, Chinese collectors are expanding their cross-category interests: rare manuscripts by Einstein and lunar meteorites have also been acquired by them.

Sabado por la Noche (Saturday Night), which sold for more than HK $113 million, was the most expensive item sold in the Asian market in the first half of this year. Photo/Provided by the interviewee

NBD: Chinese collectors are diversified and specialized. In the next step, how do you think we should attract more people to the auction?

Francis Belin: This year, we held two auctions in mainland China for the first time and plan to host another one in the second half. We expect to expand our activities in China by organizing preview exhibitions in cities like Beijing, Shanghai, and Hong Kong. We also actively engage with collectors. In my view, a market's maturity isn't just reflected in continuous transactions of items, but more importantly in buyers' ability to connect with auction pieces and develop genuine interest. These interactions extend beyond auction events or listed items, serving to cultivate broader public engagement across diverse categories.

Some auction items may not initially attract collectors 'interest, but as they develop curiosity and seek to learn more about them, future purchases could increase. Not everyone can visit our auction houses or galleries in person, so we engage young Chinese collectors through platforms like RedBook and WeChat. Taking WeChat as an example, we've built an all-in-one digital service system from browsing items to online bidding. This deeply digitized, highly convenient interaction model perfectly aligns with the "mobile-first" consumption habits of new-generation collectors, reshaping how auction houses connect with collectors. We firmly believe that continuous investment and innovation in the digital realm are crucial to Christie's success.

Exploring the low value area? Targeting the interests of collectors for accurate acquisition and expanding the new territory of auction

From a consulting role at McKinsey to a retail position at Swarovski, and then to a management role at Christie's, Francis Belin's career has spanned a remarkable range of experiences. These diverse backgrounds have provided him with more perspectives in managing Christie's Asia-Pacific region. He believes the auction industry is fundamentally knowledge-intensive, built upon professional expertise, art appreciation, and interpersonal trust. Regardless of market fluctuations, the core of his work is to build a top-tier team of experts and lead this team while striking a balance between rationality and sensibility.

NBD: From the financial data, the Asia Pacific customers accounted for 26% of the total transaction volume in 2024 (28% in 2023). How do you view this decline?

Francis Belin: The decline is slight. Last year, the Asia-Pacific market picked up significantly, and the regional turnover accounted for 30% in the second half of the year, up from 22% in the first half. This positive trend has laid a good foundation for the sustained growth in 2025.

NBD: Do you consider mergers and acquisitions or strategic cooperation to increase your market share? How does Christie's select acquisition targets?

Francis Belin: Strategic acquisitions form part of our long-term strategy. Our acquisition approach is always rooted in collectors 'interests and market opportunities, featuring clear objectives and strategic vision. For instance, after identifying a gap in the antique car auction market, we decisively entered this field by acquiring Gooding & Company. We also revived live auctions for premium wines at New York auctions, launching the cellar of William I. Koch which achieved 100% sell-through with total sales reaching $28.8 million. Additionally, we will announce significant partnerships in North America's wine and spirits sector.

Some of Christie's lots sold in the first half of this year. Photo/Christie's website

川公网安备 51019002001991号

川公网安备 51019002001991号