Photo/Liu Guo Mei (NBD)

Despite the unexpected jump in US inflation data in January, Federal Reserve Chairman Powell revealed in this week’s two monetary policy report hearings that the Fed is “not far” from gaining the confidence needed to start cutting interest rates. He said, “If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

Powell’s “dovish” remarks strengthened the market’s expectation that the Fed will start a rate-cutting cycle within the year. Against this backdrop, precious metals such as gold tend to be more favored by investors than assets such as bonds. On March 7, London spot gold prices hit a record high, rising to $2,164.78 per ounce, and COMEX gold futures prices surged to $2,172.2 per ounce, also refreshing the historical record.

Zhan Dapeng, director of non-ferrous research at Everbright Futures, explained in an interview with the NBD that the irrational rise of overseas risk assets stimulated the demand for safe-haven, and gold investment heated up.

Looking at the performance of commodities in the rate-cutting cycle in recent years, gold also performed well. In the rate-cutting cycle after the global financial crisis in 2007, gold’s cumulative increase in this period reached nearly 31%.

Looking ahead, Zhan Dapeng told NBD that he expects the gold price to rise to around $2,500 per ounce at most in this round. But he also reminded investors that the rise in gold prices is not “smooth”, and there are two major factors to be wary of.

Is a rate cut coming soon? Gold hits record high after Powell’s “dovish” remarks

According to Reuters, Federal Reserve Chairman Powell testified before Congress on March 6 and 7, local time, confirming the market’s expectation that the Fed will start a rate-cutting cycle this year.

Powell said on the 6th, “We think that the policy rate may have reached the peak of this tightening cycle. It may be appropriate to start easing policy restrictions sometime this year, if the economy evolves broadly as anticipated. But there is uncertainty about the economic outlook, and we cannot ensure sustained progress in achieving the 2% inflation target.”

The next day, he further said that the Fed was “not far” from gaining the confidence needed to start cutting rates. “We are more confident that inflation will sustainably stay at 2%, and when we do gain that confidence (which is soon), it will be appropriate to lower the restrictive interest rate level.”

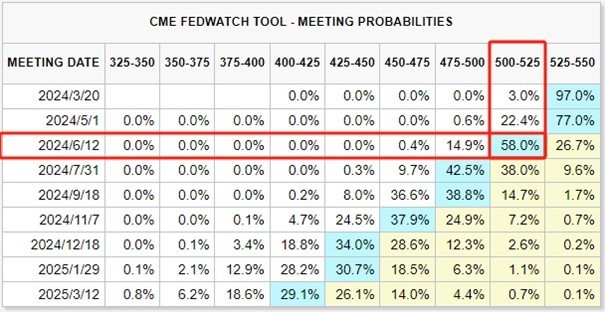

Although Powell did not give a clear signal of the timing of the rate cut, after his testimony, the CME “Fed Watch” tool showed that as of press time, the futures market believed that the probability of a rate cut at the Fed’s mid-June meeting had reached 58%, and that four 25-basis-point rate cuts were expected this year, totaling 100 basis points.

Photo/CME Group

Apart from Powell’s “dovish” remarks, the employment report released on the 6th showed that the US labor market conditions softened, lowering the US bond yields and the dollar, and further driving the market demand for gold.

On March 7, London spot gold prices hit a record high, rising to $2,164.78 per ounce, and COMEX gold futures prices surged to $2,172.2 per ounce, also refreshing the historical record. As of press time, the gold price has risen for eight consecutive days, and the current price is $2,186.2 per ounce.

Regarding the recent surge in gold prices, Zhan Dapeng, director of non-ferrous research at Everbright Futures, explained in an interview with NBD that “we think it is mainly based on the irrational rise of overseas risk assets such as US stocks and Bitcoin, which stimulated the demand for safe-haven. In addition, the Fed’s transition from a rate-hiking cycle to a rate-cutting cycle is a certainty event within the year. Before the first rate cut, the market’s bullish expectations are strong, so the probability of gold continuing to fluctuate upward is relatively high.”

In addition, in Zhan Dapeng’s view, there is another factor that accelerates the rise of gold. He added, “Fed Governor Waller recently said that the Fed should increase the proportion of short-term US debt in its balance sheet and reduce the mortgage-backed securities (MBS) it holds to zero. This is considered to be a ‘reverse twist operation’, and the market also thinks it is a sign that the Fed is considering exiting the balance sheet contraction.” Zhan Dapeng added to NBD.

How did gold and other commodities perform in the past three rate-cutting cycles?

According to Reuters, the Fed started an aggressive rate-hiking cycle in March 2022, which increased the returns of competitive assets such as bonds and also boosted the dollar, making it more expensive for investors outside the US to buy gold. Therefore, when the market began to expect lower interest rates, investing in precious metals became more attractive than investing in bonds and other assets.

At the same time, in times of geopolitical and financial market instability, precious metals led by gold were also used as a reliable store of value. Data showed that since the escalation of the Middle East situation, the international gold price had risen by more than $300 per ounce.

Therefore, after the Fed released the signal that a rate cut or “not far away”, reviewing the trend of commodities led by gold in the past rate-cutting cycles has a very important reference significance for the investment of commodities in the upcoming new rate-cutting cycle.

By combing through the cumulative gains and losses of commodities led by gold in the three major rate-cutting cycles of the Fed since the 21st century, NBD found that the gold price showed a growth trend in the rate-cutting cycle, and the cumulative increase of gold reached nearly 31% in the rate-cutting cycle after the global financial crisis in 2007. The silver price, due to the influence of commodity attributes, showed a violent fluctuation state in the rate-cutting cycle, and fell by a single-digit percentage in the three rate-cutting cycles sorted out by NBD.

Central banks are busy hoarding gold, analysts expect a short-term rise to $2,500 per ounce

The market expects the Fed to lower interest rates soon, but that’s not the only reason for the rising gold price. Some analysts also said that (even though gold ETFs lost some money), central banks from China and other countries and individual investors from India kept buying gold, which also pushed up the gold price.

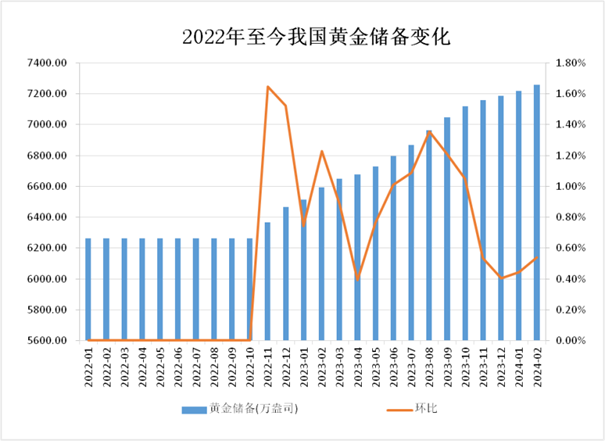

Photo/Wind

On March 7, the People’s Bank of China said that by the end of February 2024, China had 72.58 million ounces of gold, which was 390,000 ounces more than the month before. This was the 16th month in a row that the People’s Bank of China bought more gold. According to Wind data, this was the longest time that the central bank kept buying more gold since they had data. During this time, they bought 9.94 million ounces (about 282 tons) more gold. Based on the latest price of gold ($2,156.7 per ounce), they spent about $21.44 billion (about RMB 1,542 billion) more on gold.

Other central banks around the world also kept buying more gold. The World Gold Council (WGC) said that central banks bought gold at a very fast rate, because they wanted to diversify their reserves and protect themselves from geopolitical and economic risks. In 2023, central banks bought 1,037 tons more gold, which was only 45 tons less than the record they set in 2022.

The report also said that because there was a lot of demand for gold in the over-the-counter market and central banks kept buying more gold, the total amount of gold used in 2023 went up by about 3%, to 4,899 tons, which was the most since 2010.

Zhan Dapeng told NBD what he thought would happen next. He said he thought the gold price could go up to $2,500 per ounce in this cycle. But he also warned investors that there were some risks. One was that US inflation was strong, and the Fed might not lower interest rates as much as the market wanted. The other was that high gold prices might make people buy less physical gold around the world.

Huatai Securities also said that gold prices moved a lot recently, but they usually don’t stay high for a long time, so gold prices might go up and down in the short term.

While gold prices went up, silver prices also went up by 8% in the last few days, but not as much as gold. The current price of silver is $24.09 per ounce, which is the highest since January 3. UBS said that if the US data was weak and the Fed eased its policy more, silver might go up more and catch up with gold.

Zhan Dapeng also said that the reason gold prices went up was that people were taking more risks in the overseas markets, and this also helped other precious metals and some non-ferrous metals. He said that investors should think about two things when they choose what to buy: one was silver, which had a shortage of supply and benefited from the growth of solar energy, and might go up more later; the other was non-ferrous metals like copper and aluminum, which were also good for the new energy industry.

Disclaimer: The information and data in this article are only for reference and do not mean you should invest in anything. Check before you use.

川公网安备 51019002001991号

川公网安备 51019002001991号