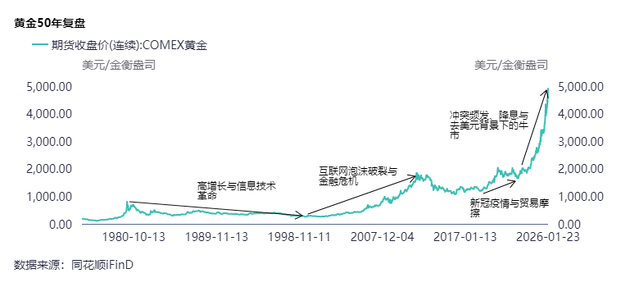

In an unprecedented moment in financial history, international gold prices have officially breached the $5,000 per ounce threshold on January 26, 2026. This milestone marks a staggering 83% ascent within a year, signaling a profound shift in the global monetary landscape.

Market experts suggest this historic surge is not driven by mere speculation, but by a "deep resonance" of structural forces.

Firstly, with U.S. national debt exceeding $38 trillion and the perceived "weaponization of finance" in geopolitical conflicts, the credibility of the U.S. dollar as the world’s primary reserve currency is wavering.

Secondly, central banks have transitioned from passive holders to aggressive buyers. The People’s Bank of China, for instance, extended its buying streak to 14 consecutive months, adding 860,000 ounces in 2025 alone.

Thirdly, from trade tensions between the U.S. and EU to disputes over Greenland and instability in the Middle East, a "permanent state of risk" has cemented gold’s role as the ultimate safe haven.

File photo/Liu Guomei (NBD)

Last but not the least, as Fed Chair Jerome Powell prepares to step down in May, markets anticipate a more "dovish" successor, lowering the opportunity cost of holding non-yielding assets like gold.

While the $5,000 mark is psychologically significant, analysts warn of potential short-term volatility.

"The core issue today is a fundamental breakdown of global trust," says Wang Yanqing, analyst at CSC Financial. "While a de-escalation in regional conflicts could trigger a technical pullback, the long-term upward trajectory remains intact due to the transition from a unipolar to a multipolar world."

Jiang Shu, Chief Analyst at Xirang Industrial, notes that while "Trump 2.0" policies and economic "hard landing" fears provide fundamental support, investors should remain wary. Historically, significant corrections often occur just as the market becomes convinced that prices will only go up.

Historically, gold bull markets last approximately a decade (e.g., 1971–1980 and 2001–2011). The current cycle, which began in 2019, is now entering its seventh year.

According to industry veterans, the end of the 1970s bull market was signaled by the restoration of confidence in the U.S. economy. This time, however, a return to absolute dollar dominance is viewed as unlikely. Dollar credit is tied to U.S. productivity. While AI is a massive catalyst, it has yet to achieve the scale necessary to systemically reconstruct the dollar’s credit foundation.

Therefore, the bull market may reach its finale only when a new, stable international currency framework emerges to replace the current vacuum of trust.

川公网安备 51019002001991号

川公网安备 51019002001991号