Photo/VCG

In Q2 2025, the AI application market saw intensified competition. While Q1 marked the "Year of Scenarios" where leading players rapidly expanded through capital and traffic, Q2 signaled a shift from an incremental "blitzkrieg" to a positional "trench warfare" for existing users. Users' initial enthusiasm quickly evolved into a demand for practical value, rigorously testing each application's ability to retain engagement. Growth narratives solely reliant on model concepts and marketing blitzes began to fade, with genuine product strength, scenario penetration, and ecosystem building capabilities becoming critical determinants of success.

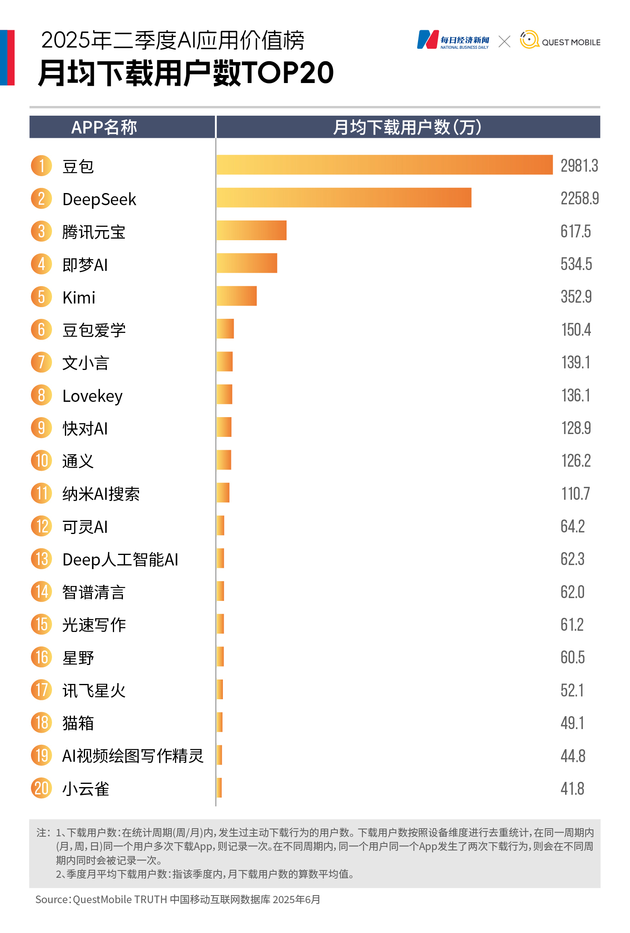

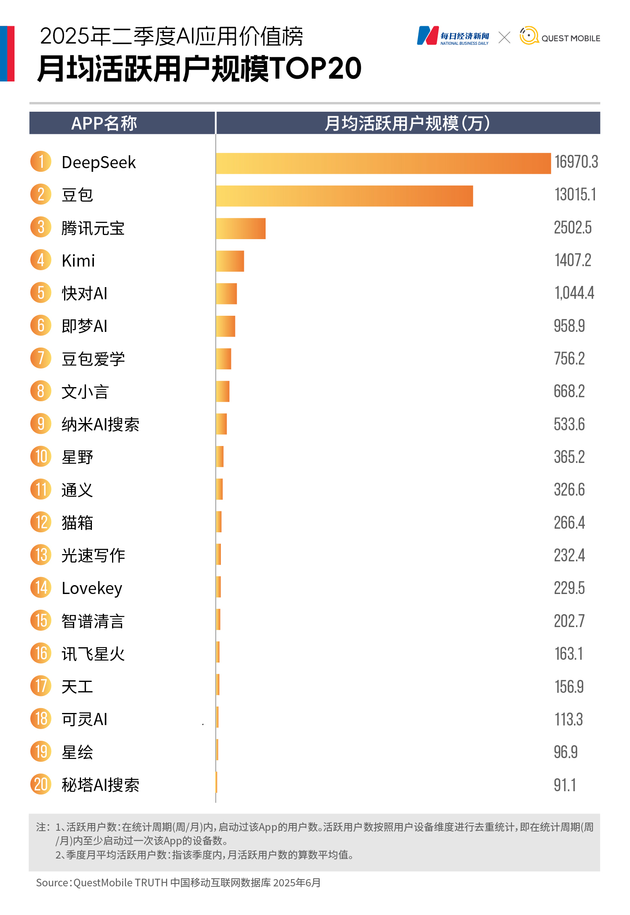

National Business Daily (NBD) collaborated with QuestMobile to release the "2025 Q2 AI App Value Ranking," which, based on two core metrics—average monthly downloads and Monthly Active Users (MAU)—reveals new dynamics in this "mid-game" battle for AI applications.

Data indicates that Q1 champion DeepSeek's luster faded, with Doubao emerging as the leader in downloads. AI intelligent assistant applications like Kimi, Zhipu, Wenxiaoyan, and Tongyi collectively experienced a decline in MAU, and Kling's MAU dropped by over 16%.

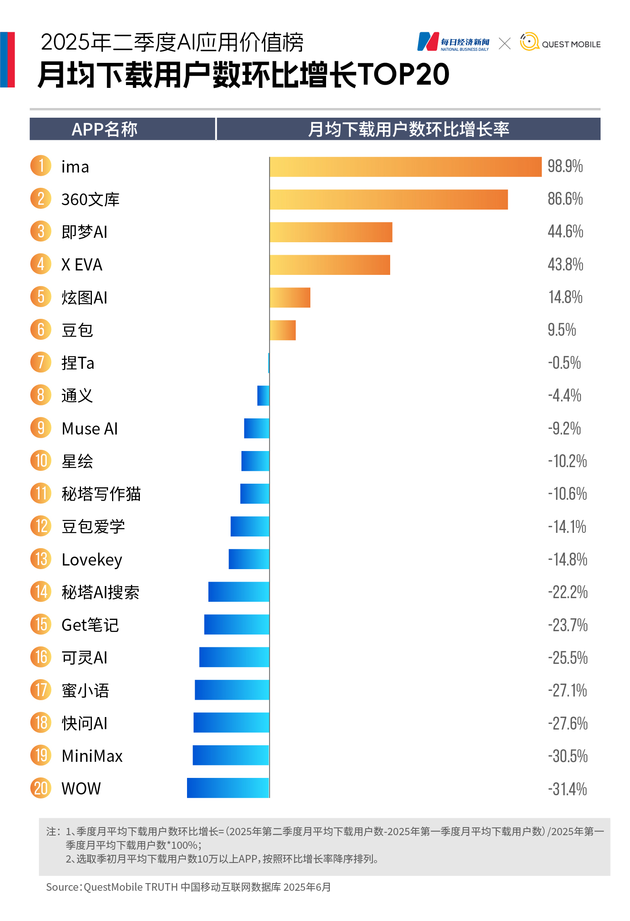

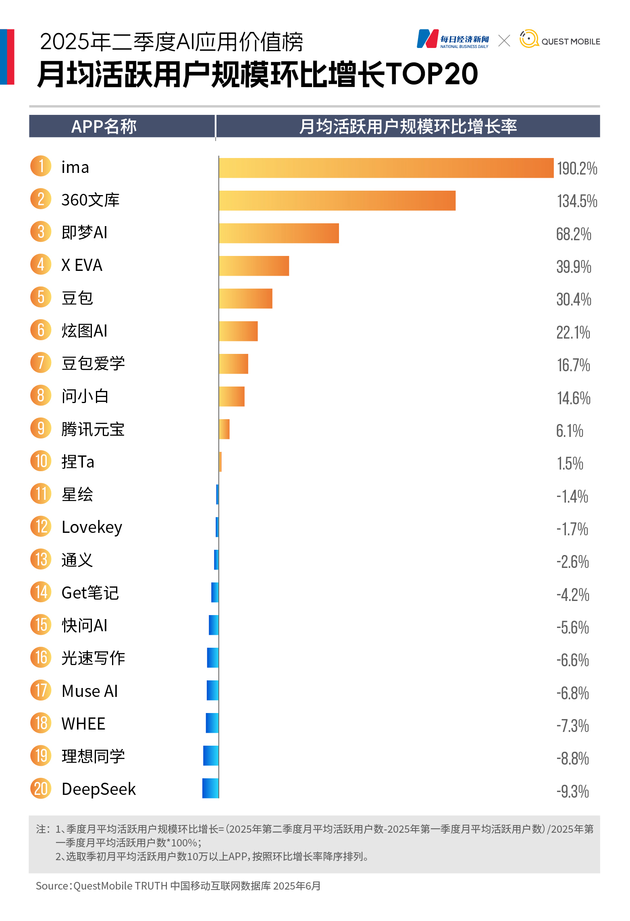

However, new vertical scenarios saw dark horses emerge: in "AI+Office," ima's MAU increased by 190.2% month-over-month, and 360 Wenku's MAU grew by 134.5% month-over-month. In "AI+Education," ByteDance's Doubao Aixue recorded an MAU of 7.562 million, while Zuoyebang's Kuaidui AI reached an even higher MAU of 10.444 million. A profound struggle centered on user retention, practical value, and monetization is now fully underway.

AI App Mid-Game: Many AI Assistants See Decline in MAUs, as "AI + Office" and "AI + Education" Rises

Doubao Overtakes DeepSeek with Nearly 30 Million Downloads, DeepSeek's Downloads Plunge by 72%

Q2 2025 saw a dramatic change in the leaderboard of the AI assistant category. Doubao, owned by ByteDance, replaced DeepSeek as the leader in monthly downloads, thanks to steady growth strategies and its powerful ecosystem integration. Doubao also narrowed the gap in MAU rankings, securing its position as the second-most active AI app.

Data Insights:

Doubao: In Q2, Doubao's average monthly downloads reached 29.813 million, a 9.5% increase from Q1. Its MAU surged 30.4% from 99.805 million in Q1 to 130 million in Q2, consolidating its position as the second-most popular app in the industry. The ratio of downloads to MAU has increased from around 3.7 times in Q1 to 4.4 times in Q2, reflecting growing user stickiness despite its large user base.

DeepSeek: The once-dominant DeepSeek saw a sharp decline in downloads, with its average monthly downloads dropping by a staggering 72.2%, from 81.113 million in Q1 to just 22.589 million in Q2. While its MAU of around 170 million still holds the top spot, it has fallen by 9.3% compared to Q1's nearly 187 million.

Analysis of Data:

Doubao's Ecological Advantage: Doubao's growth can be attributed to ByteDance's ecosystem and its focus on deepening its user engagement in vertical domains, such as education. For example, Doubao Aixue (Doubao Learning) saw an MAU of 7.562 million in Q2, contributing to high-frequency, essential use cases, which helped drive retention and user activity.

DeepSeek Loses Ground: DeepSeek's user loss can be attributed to multiple factors. On the one hand, its major updates have been few and far between. the DeepSeek-R2 model, which was scheduled for release in May, has still not materialized by mid-July, raising doubts about its ability to innovate. On the other hand, its "high cost-performance" advantage has been eroded as competitors like Alibaba, ByteDance, and Baidu launched similar models at lower prices.

According to QuestMobile's research director Chen Yan, DeepSeek's decline is primarily due to its user base being diverted by other apps that have integrated its AI models.

"Burning Cash" Aftereffects: Tencent Yuanbao and Kimi Face Growth Challenges

Tencent Yuanbao and Kimi, both of which employed aggressive "burning cash" strategies in Q1, have entered a "cooling-off period" in Q2, confirming the previous warning that the "burning cash" model is unsustainable.

Data Insights:

Tencent Yuanbao: While Tencent Yuanbao's MAU grew slightly by 6%, from 23.583 million to 25.025 million, its average monthly downloads plummeted by 54%, from 13.43 million in Q1 to just 6.175 million in Q2. This stark contrast indicates that the app's heavy reliance on user acquisition through high cash burn in Q1 is no longer sustainable. In Q2, its strategy shifted toward retaining users and improving user engagement, with a focus on precision marketing and ecosystem integration.

Kimi: Kimi's download volume and MAU both declined significantly in Q2. Its average monthly downloads dropped by 57.7%, to 3.529 million, while its MAU decreased by 35%, from 21.653 million to 14.072 million.

Kimi's struggles stem from the fact that, after scaling back its user acquisition efforts, it could not differentiate itself from the increasing number of competitive, higher-performance or lower-cost apps such as DeepSeek and Doubao. As a result, Kimi has failed to maintain its initial momentum.

"Dual Monopolies" Form as Most AI Assistants Lose Active Users

Q2's data reveals the accelerating market reshuffle, with most general AI assistants suffering from declines in active user numbers.

Data Insights:

The market concentration has reached an all-time high. According to the data, in Q2, DeepSeek (with 170 million MAU) and Doubao (with 130 million MAU) together captured 88.9% of the total active user base in the AI assistant category, creating a "duopoly" in the market. The remaining competitors must now fight for the remaining 10% of users.

Tencent Yuanbao maintained a modest growth of 6.1% in MAU, but the rest of the AI assistants have faced significant declines. Kimi's MAU dropped by 35%, Zhipu's MAU fell by 43%, Tiangong's MAU dropped by 39.2%, Wen Xiaoyan’s MAU decreased by 32.8%, and Tongyi saw a 2.6% decline.

Analysis of Data:

Product Homogenization and User Fatigue: As AI assistants become more similar in terms of core capabilities, such as basic conversation, Q&A, and knowledge retrieval, users are no longer motivated to download multiple apps that offer similar functions. Once the initial "novelty" fades, users are increasingly concentrating their activity on the apps that offer the best experience or the most relevant scenarios.

Ecosystem and Scene are Key: Doubao and Tencent Yuanbao stand out because they have transcended being merely tools and have embedded themselves into their respective ecosystems. Doubao’s strong growth is primarily driven by ByteDance’s ecosystem, which helps keep users engaged with high-frequency, essential-use cases. Tencent Yuanbao’s stable MAU growth is reflective of its successful retention strategy via its integration with the WeChat ecosystem.

"AI + Scene" Experiences Growth in Certain Areas: New Opportunities in "AI + Office" and "AI + Education"

Just as the general AI assistant market is undergoing a shift, the "AI + Scene" applications have also seen a two-sided trend, with some sectors growing strongly while others have cooled off.

Examples of Rising Trends:

AI + Education: AI-powered education apps are proving to be among the most successful verticals in terms of user scale and engagement. For instance, Doubao Aixue reached 7.562 million MAU, while Zuoyebang’s KuaiDui AI reached 10.444 million MAU, placing them among the top apps in terms of active users, surpassing even popular AIGC apps like Jimeng AI.

AI + Office: The "AI + Office" category has emerged as a new growth engine. Apps like ima and 360 Wenku saw impressive MAU growth of 190.2% and 134.5%, respectively, signaling a shift towards more productivity-oriented AI tools. These tools help users with document processing, data management, and knowledge management, providing tangible value to users and creating a promising commercial potential.

Future Outlook: AI Applications Enter "Stock War" Phase, Ecosystem and Scene Will Determine Winners

As AI applications enter a phase of "stock war," the focus has shifted from acquiring new users to retaining existing users. The key to success will lie in creating value through deep understanding of specific user scenarios, rather than just offering tools. The success of "AI + Office" and "AI + Education" applications suggests that the future will likely see more AI apps focused on vertical domains that offer tangible, long-term benefits to users.

川公网安备 51019002001991号

川公网安备 51019002001991号