Photo/VCG

In the early months of 2025, China's tech sector has witnessed a remarkable surge, driven by the rising influence of DeepSeek, an AI technology that has captured global attention.

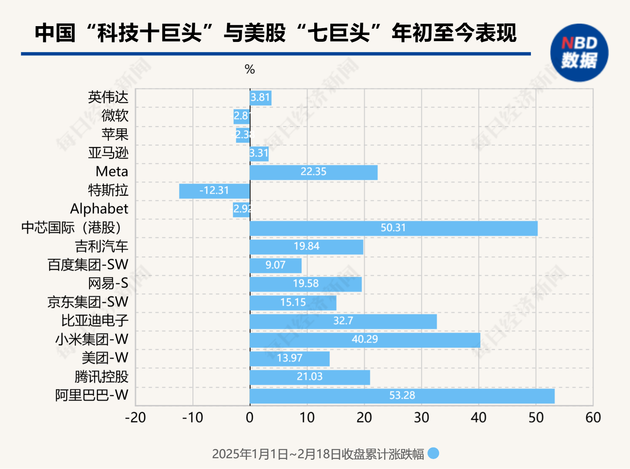

National Business Daily (NBD) noticed that China's "Terrific Ten" tech stocks have outperformed their US counterparts by a significant margin, with an average increase of 27.5% since the beginning of the year. This trend underscores a broader shift in the global tech landscape, as investors re-evaluate the potential of Chinese tech companies.

The "Terrific Ten" refers to a group of leading Chinese tech firms, including Alibaba, Tencent, Meituan, Xiaomi, BYD, JD.com, NetEase, Baidu, Geely, and SMIC. Notably, Alibaba has led the charge, with a staggering 53.28% increase in its stock price since the start of the year, followed by SMIC with a 50.31% rise.

These companies have collectively outperformed the US "Magnificent 7" tech giants—Apple, Microsoft, Alphabet, Tesla, Meta, NVIDIA, and Amazon—which have seen an average increase of just 1.3% over the same period.

This outperformance is not just a short-term phenomenon. From December 31, 2023, to February 12, 2025, the "Terrific Ten" achieved a cumulative increase of 77.4%, compared to a 76.6% rise for the US "Magnificent 7."

Photo/NBD

The driving force behind this surge is DeepSeek, an AI technology that has garnered significant attention for its efficiency and cost-effectiveness.

According to UBS Securities analyst Meng Lei, DeepSeek has brought Chinese innovation back into the global investors' spotlight by achieving world-class capabilities at a lower cost. This has led to a re-evaluation of Chinese tech companies' potential, especially in AI and cloud computing.

Meng said to NBD that sectors closely related to AI, such as computing, automotive, and electronics, have seen a significant uplift in valuation since the Chinese New Year. This trend is expected to continue as more AI applications are realized and fundamental benefits are delivered. UBS predicts that the AI theme will experience a "pulse-like" upward trend in the medium term, driven by continuous advancements and market confidence.

The market's optimism is also reflected in the upcoming earnings season. Analysts expect that comments from management on AI model progress and cloud service demand will provide new catalysts for the sector. The economic stimulus policies introduced in September 2024 have further bolstered the confidence of these tech giants, with companies like Xiaomi, JD.com, and Meituan raising their profit forecasts.

DeepSeek's impact extends beyond the tech sector. According to Goldman Sachs, the widespread application of AI could increase Chinese companies' earnings per share by 2.5% annually over the next decade.

As China's tech sector continues to gain momentum, investors are increasingly recognizing the potential of Chinese tech stocks. With DeepSeek at the forefront, the global narrative around Chinese innovation is shifting, and the "Terrific Ten" are leading the charge.

川公网安备 51019002001991号

川公网安备 51019002001991号