File photo/ Zheng Yuhang (NBD)

NVIDIA, the tech giant that recently overtook Microsoft to become the world's most valuable company, has experienced a significant market correction.

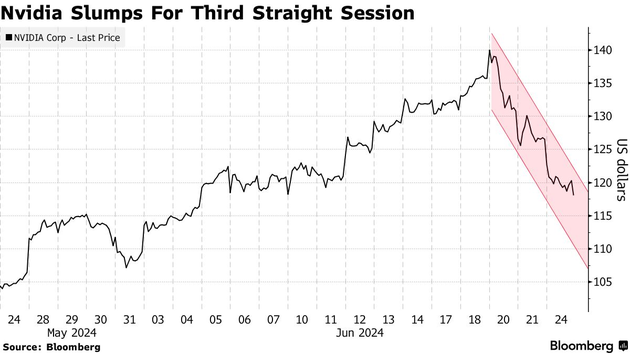

After a meteoric rise that saw its market capitalization peak globally, the company's stock has plummeted, with a 12.89% drop over three trading days from June 20 to 24, resulting in a staggering $430 billion loss in market value.

Photo/Bloomberg

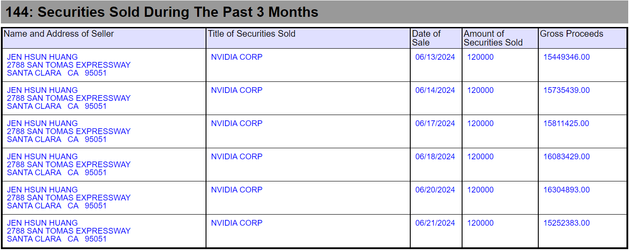

The downturn has been attributed to a combination of factors, including substantial share sales by executives, including CEO Jensen Huang. They has cashed out over $700 million through a series of sales. This, coupled with trading dynamics, has led to concerns about the company's valuation. Despite this, nearly 90% of analysts maintain a "buy" rating for NVIDIA, with an average target price that suggests a 12% increase from current levels.

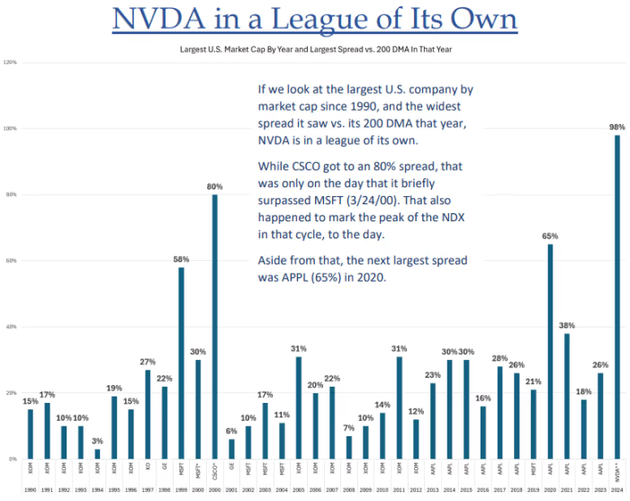

The situation has drawn comparisons to the tech bubble of the early 2000s, particularly with Cisco Systems, whose valuation also soared before the market crash. NVIDIA's current price-to-earnings ratio, based on projected sales for the next 12 months, stands at 21 times, the highest among all S&P 500 components, indicating either rapid growth or potential overvaluation.

Technical analysts are eyeing the $115 support level, a critical Fibonacci retracement level, as a potential indicator of where the stock might find stability. The company's stock price is also nearly 100% above its 200-day moving average, a deviation that has historically signaled overvaluation.

According to MarketWatch, Nvidia's stock recently traded around 100% above its 200-day moving average. Since 1990, the widest spread that any U.S. firm has ever traded above its 200-day moving average while being the largest company was 80%, achieved by Cisco in March 2000 (see chart below), according to Jonathan Krinsky, chief market technician at BTIG.

Despite the volatility, there is optimism in some quarters. Constellation Research forecasts a robust two-year growth trajectory for NVIDIA, predicting a rise to $200 per share, a 69% increase from current levels. Additionally, Oppenheimer's Ari Wald emphasizes the strength of NVIDIA's long-term trend, noting that its stock price remains well above key moving averages.

Jensen Huang's recent sales under a 10b5-1 trading plan have further fueled market speculation. Having sold 720,000 shares, he still has room to sell an additional 5.28 million shares under the plan, extending to March 2025. This, along with the lack of internal buying, raises questions about the company's future direction and the sustainability of demand for its products.

Photo/Edgar

As NVIDIA navigates these market dynamics, the company's strategic pivot towards software and cloud services, driven by Huang, may be pivotal in determining its long-term success. Investors are advised to consider these factors carefully, as the company's trajectory could significantly impact their portfolios.

川公网安备 51019002001991号

川公网安备 51019002001991号