Photo/Hao Shuai (NBD)

In 2023, driven by factors such as the rebound of large tech stocks and the popularity of AI-related concepts, the Nasdaq soared by 43.42% for the entire year. Following closely behind was the Nikkei 225 Index, which achieved a remarkable 28.24% annual gain, marking its largest yearly increase in nearly a decade.

Since the start of 2024, the Japanese stock market has been on a wild ride, repeatedly surpassing its 1989 peak and currently sitting above 39,000 points.

However, the upward trend in Japan’s stock market didn’t begin just in the past couple of years; it traces back to 2013. After the burst of Japan’s economic bubble in the early 1990s, the stock market experienced a prolonged decline, with losses exceeding 80% at one point. The return to power of Prime Minister Shinzo Abe and his “three arrows” aimed at stimulating Japan’s economic growth played a pivotal role in reversing this trend. Over the 11-year period from 2013 to 2023, the Japanese stock market saw declines in only two years.

Beyond macroeconomic policies, robust corporate profits, governance reforms among listed companies, and the depreciation of the yen have all contributed to the growth of Japan’s stock market. Satoru Aoyama, Senior Managing Director at Fitch Ratings (Japan), said in an email to NBD that the impact of the post-pandemic opening and recovery and the easing of supply-chain constraints in Japan and internationally, and the yen’s depreciation contributed to the strong aggregate revenue growth of the Fitch TSE portfolio.

Despite reaching its highest point in 34 years, the Japanese stock market maintains relatively low valuations. Additionally, with strong fundamentals among Japanese companies, foreign investors—led by the likes of “stock guru” Warren Buffett—have significantly increased their presence in the market. Interestingly, while foreign capital flows in, local retail investors have been selling off their holdings, making their future investment decisions a critical factor in shaping the trajectory of Japan’s stock market.

Another noteworthy aspect is Japan’s central bank, which has maintained loose monetary policies for several years. Market expectations suggest that as inflation continues to rise, the Bank of Japan may end its negative interest rate policy in the first half of the year. The implications of this move on Japan’s stock market remain to be seen.

Nikkei 225has risen 300% in past 11 years, outperforming other major global indexes

In 2023, the Nikkei 225 index rose 28% cumulatively, the highest in Asia and the largest annual increase in the past ten years. As of press time, the Nikkei 225 index reached 39,239.52 points, hitting a record high since 1989, and has risen by about 18% year-to-date.

Photo/google finance

In fact, the Japanese stock market has not only risen recently and this rising trend has lasted for nearly 10 years.

After the Japanese bubble economy burst in the early 1990s, the Japanese stock market fell all the way from its high in 1989, with a maximum drop of more than 80%. At the end of 2012, Shinzo Abe was re-elected as Prime Minister of Japan. He then launched a series of economic stimulus policies aimed at getting rid of deflation, achieving an inflation target of 2%, and boosting the Japanese economy. Japanese media and scholars call it "Abenomics". Specifically includes: aggressive monetary easing, flexible fiscal policy, and growth-promoting structural reforms.

First, the Abe government implemented a large-scale quantitative easing and negative interest rate policy, which caused the depreciation of the yen and increased the international competitiveness and profitability of Japanese export enterprises, thus boosting the Japanese stock market. Second, by lowering the corporate tax rate, relaxing regulations, encouraging female employment and other measures, the Abe government promoted the corporate governance reform of Japanese enterprises, improved their efficiency and innovation ability, and enhanced the attractiveness of the Japanese stock market. Finally, by expanding the investment ratio of the Japanese government pension fund (GPIF) in Japanese stocks, the Abe government increased the stability and liquidity of the Japanese stock market, providing strong support for it.

Under the influence of “Abenomics”, the Japanese stock market has been in a moderate upward trend. Data shows that from 2013 to 2023, the Nikkei 225 index rose by 295.78% cumulatively, while the S&P 500 index rose by 278.9%, the Dow Jones index rose by 208.4%, and the German DAX rose by 117.85% in the same period.

In these 11 years, the Nikkei 225 index only fell in 2018 and 2022, reversing the previous downtrend and sideways trend for more than 20 years.

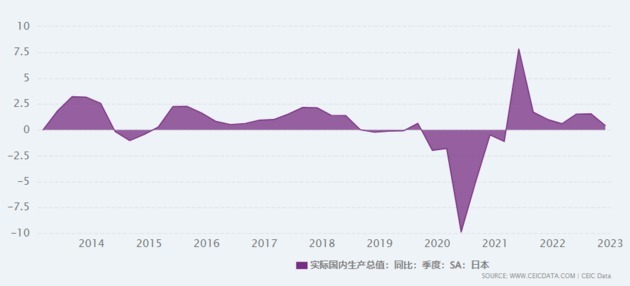

However, NBD noticed that in the more than ten years since Shinzo Abe became prime minister, Japan’s GDP growth and the rise of the Japanese stock market were not proportional. As shown in the figure below, Japan’s quarterly GDP mostly hovered in the 0-3% range in the past decade, and even shrank sharply in the second quarter of 2020. However, even though GDP fluctuated greatly during this year, it was not reflected in the stock market. As shown in the figure above, the Nikkei 225 index rose by 16.01% and 4.91% in 2020 and 2021 respectively.

Photo/CEIC data base

Growth driver: Strong export supports corporate earnings

Morgan Stanley’s strategists wrote in a research report on February 22 that “investors recognize that Japan’s bull market has lasted for a while and is likely to have even bigger gains.” The strategists believe that one of the main reasons for optimism is the strong earnings of Japanese companies.

According to the earnings forecasts of SMBC Nikko Securities for about 1,400 listed companies on the Tokyo Stock Exchange, the net profit of Japan’s major listed companies is expected to grow by about 13% by March 2024, setting a record for the third consecutive year. Goldman Sachs’ expectations are more optimistic - the bank expects the earnings of Japan’s large enterprises to increase by more than 40% in the latest quarter.

The performance of exporters such as Toyota Motor was supported by a strong dollar. The dollar-yen exchange rate has remained strong since it rose to a 32-year high in 2022, and the depreciation of the yen has increased the income of multinational companies such as Toyota in overseas markets and enhanced the price competitiveness of Japanese-made products in overseas sales. Driven by better-than-expected performance, Toyota Motor’s market value reached 48.7 trillion yen (about 328.8 billion US dollars) at the close of the Tokyo stock market on January 23, surpassing the record set by the telecommunications group NTT in 1987 (bubble economy period).

Satoru Aoyama, senior executive of Fitch Ratings (Japan) Corporation, said in an email to NBD that The impact of the post-pandemic opening and recovery and the easing of supply-chain constraints in Japan and internationally, and the yen’s depreciation contributed to the strong aggregate revenue growth of the Fitch TSE portfolio.

Aoyama believes that Japanese yen interest rates, which are at absolute low levels, are highly likely to rise. This would have a limited but negative impact on Japanese companies’ free cash flow and financial flexibility. "Fitch expects Japanese companies to continue to expand overseas, driven by Japan's low economic growth and saturated domestic markets. Companies with accumulated cash are likely to increase investment if overseas interest rates fall and exchange rates stabilise. This could raise their currently low leverage.”

Toshikazu Horiuchi, a stock strategist at IwaiCosmo Securities, pointed out that the decisive difference now is that companies aren't overvalued like they were in the bubble (era). The market could see another run-up after reaching the all-time high, "so long as companies post strong earnings in the next reporting season," said Horiuchi, who has worked through both market highs.

At the same time, NBD noticed that the Japan Exchange Group had called on listed companies last year to pay more attention to improving stock prices and capital efficiency, to increase their attractiveness to investors. Under this call, more Japanese listed companies began to buy back shares and increase dividends to investors. Such measures also achieved immediate results. For example, Mitsubishi Corporation announced a 10% buyback of its outstanding shares at the beginning of this month, and the company’s stock price hit a record high the next day.

Composition changes: Tech stocks gain weight

Looking at the index composition, the Nikkei 225 index has changed a lot in the past 30 years. The index was established in 1950 and is updated twice a year, adding or removing stocks based on the size and liquidity of the companies.

In the bubble economy period of 1989, banks and utilities were the largest companies by market value in Japanese stocks, so they also had a larger weight in the Nikkei index. By early 2024, about 50% of the Nikkei index was tech companies, followed by consumer goods (23%).

After Nvidia released better-than-expected earnings, the strong growth of Japanese tech stocks and the semiconductor sector boosted the Nikkei 225 index. Analysts said that due to the artificial intelligence wave triggering speculation on the rise of long-term demand, investors bought chip-related companies such as Advantest and Tokyo Electron.

However, it should be pointed out that the current compilation method of the Nikkei index is different from other major stock indexes. The index measures the average price of stocks, so stocks with higher prices have more influence on the overall trend of the index than stocks with lower prices. The Wall Street Journal reported that this index compilation method is actually unreasonable, because the price of a stock is the arbitrary result of how many shares the constituent company chooses to issue.

Currently, the largest constituent stock of the Nikkei 225 index is Fast Retailing, the parent company of Uniqlo (market value of 92 billion US dollars), with a weight of 11%, while Toyota Motor, the highest market value in Japan (387.345 billion US dollars), accounts for only 1.4%. But if compiled by market value, Fast Retailing’s weight in the Nikkei 225 index will be less than 2%, ranking seventh in the index.

Analysts believe that although the trading volume of futures contracts based on the Nikkei 225 index far exceeds that of contracts based on the Topix index, the Topix index may be a more suitable measure. If the Topix index is used to measure, the price of Japanese stocks is still more than 8% lower than the high point in December 1989.

Valuation: Japanese stocks within reach of record highs, and yet inexpensive

According to a Reuters report, despite reaching a 34-year high, the current valuation of the Japanese stocks remains inexpensive.

Yet, on a popular price-to-earnings ratio metric, the MSCI Japan index's 12-month forward ratio stands at 14.1, below the MSCI World index's 17.4 and the MSCI United States index's 20.1. MSCI Japan's price-to-book ratio is 1.37, much lower than 4.72 recorded in 1989, when the market last hit these highs during Japan's asset price bubble.

LSEG data showed approximately one-third of companies in Japan's Nikkei 225 index still trade below book value, compared to a mere 3% ratio for the S&P 500 index.

"From a historical perspective, Japanese stocks at a forward price-to-earnings ratio of 15x do not look expensive versus other markets, especially at current interest rate levels," said Miyuki Kashima, head of Japan investments at Fidelity International.

More importantly, Japanese stocks trade at a low price-to-book value, meaning the shares are underpriced relative to the value of assets on companies' balance sheets.

Who is buying: Foreign investors flock in

As the yen continues to depreciate, foreign capital also continues to flow into the Japanese stock market. According to Bloomberg, from the beginning of this year to February 22, these funds accounted for about two-thirds of the trading volume on the Tokyo Stock Exchange. In January alone, foreign investors net bought $13.8 billion of Japanese stocks, the seventh-largest monthly purchase amount since 1982.

Among them, the most attractive is Buffett's favor for Japanese stocks. He built positions in the stocks of Japan’s five major trading companies (Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo) in 2020 and further increased his holdings in 2023. In a recent shareholder letter, Buffett revealed that diversified businesses, high dividends, high free cash flow, and prudent issuance of new shares are the important reasons for his favor of these five trading companies. He also said that Berkshire will continue to increase its investment in these five companies.

As for the outlook for the Japanese stock market, CICC pointed out in a report that there is a possibility of breaking the 40,000-point integer mark in the Nikkei index within 2024.

On the one hand, according to Nikkei, “Cumulative net buying by overseas investors remains well below the 2015 peak and global active funds remain net underweight in Japan, which means that there is still a lot of incremental capital on the way.

On the other hand, whether the funds of Japanese retail investors will continue to flow in or become one of the key factors for the trend of the Japanese stock market.

Future: What impact will ending negative interest rates bring?

As part of “Abenomics”, the Bank of Japan’s loose monetary policy has been in place for years, setting the tone for the rise of the Japanese stock market. Changes in monetary policy may bring some changes to the stock market.

Jeffrey Young, former head of foreign exchange strategy at Citigroup and co-founder and CEO of DeepMacro, just finished his weeks-long investigation of Japan. He told NBD that “The market currently expects the Bank to end its negative interest rate policy (with a -0.10% rate on some bank deposits at the BoJ) on April 26 (according to surveys) or June 14 (according to market pricing). We would expect a move to 0% more on the later side of this range, either in June or possibly even July. "

The International Monetary Fund (IMF) pointed out that once the negative interest rate policy ends, the Bank of Japan may gradually raise interest rates, tighten monetary policy, which may lead to a decline in domestic liquidity, an increase in borrowing costs, a slowdown in economic growth, and a easing of inflationary pressure. These factors may weaken the profit expectations and valuation levels of the Japanese stock market, trigger investors’ risk aversion sentiment, and cause market adjustments and fluctuations.

川公网安备 51019002001991号

川公网安备 51019002001991号