Photo/Hao Shuai

Data released on February 15 showed that Japan’s GDP unexpectedly dipped in the fourth quarter of 2023, entering a technical recession after two consecutive quarters of decline. For the whole year of 2023, Japan’s nominal GDP grew by 5.7%, but its economic size was lower than Germany’s, losing its position as the world’s third-largest economy.

Japan’s rapid rise after World War II created an economic miracle. From 1968 to 2009, Japan was the world’s second-largest economy after the United States, until it was overtaken by China in 2010. This time, Japan’s GDP was surpassed by Germany again, which will undoubtedly cause some psychological impact on Japanese society. Tetsuji Okazaki, a professor of economics at the University of Tokyo, believes that Japan’s activity on the international stage may decline.

The technical recession, along with the three consecutive quarters of decline in domestic consumption and business investment, made it difficult for the Bank of Japan to normalize its monetary policy. In this regard, Norio Yamaguchi, Senior Economist at Oxford Economics, told NBD that GDP stats represents a history rather than the outlook. If the actual income of the Japanese people improves, the Bank of Japan will still most likely end the negative interest rate in April.

Japan, no longer the third largest economy in the world

On February 15 local time, the preliminary statistics released by the Japanese Cabinet Office showed that Japan’s nominal gross domestic product (GDP) for 2023 was 591.482 trillion yen (about 4210.6 billion US dollars), lower than Germany’s 4456.1 billion US dollars, falling to the fourth place in the world, and being overtaken by Germany.

The results also showed that Japan’s nominal GDP grew by 5.7% in 2023, and its real GDP increased by 1.9% year-on-year. Nominal GDP is the value of all products and services produced in a year at the market prices of that year. Compared with real GDP, nominal GDP is more susceptible to market price fluctuations. Although Germany’s GDP shrank by 0.3% in 2023, due to the rise in prices and the appreciation of the euro against the US dollar, Germany’s GDP still surpassed Japan.

In 2023, the yen depreciated sharply against the US dollar. This week, the yen touched the level of 150.5 to 150.9 yen per US dollar, the lowest in about three months. In addition to the yen’s depreciation, Japan’s population decline and aging problem, as well as the stagnation of productivity and competitiveness, were regarded by economists as structural factors for its fall from the third-largest economy. “A few years ago, Japan was proud of its strong industries such as automobiles. But with the advent of the electric car era, this advantage was also shaken. Looking ahead to the next few decades, Japan’s prospects are rather bleak.” Okazaki told the Associated Press.

In fact, the International Monetary Fund had predicted in October 2023 that Japan would lose its third place in the world, and by 2026, Japan’s economic size would also be overtaken by India.

The data released by the Japanese Cabinet Office also showed that Japan’s real GDP fell by 0.1% quarter-on-quarter in the fourth quarter of 2023, translating into an annualized decline of 0.4%. According to the market information company Nikkei QUICK, the median of private forecasts was an annualized growth of 1.0%. Coupled with the revised 3.3% decline in GDP in the third quarter of 2023, Japan’s economy has been negative for two consecutive quarters, meeting the criteria for a technical recession.

Norio Yamaguchi, Senior Economist at Oxford Economics, told NBD that the main reason for Japan’s economic downturn was weak domestic demand, which shrank by 0.3 percentage points in the fourth quarter of last year, while net exports increased by 0.2 percentage points. “The largest drag was from consumption which dipped for three consecutive quarters. Although goods purchased improved (+0.8%, from-1.3%), service consumption (-0.6%, from +0.3%) dipped for the first time since 2022Q1, suggesting that the pent-up demand is diminishing.”

Yamaguchi pointed out that in addition to consumption, business investment was also declining. Japan’s equipment investment fell by 0.1% in the fourth quarter of 2023, also the third consecutive quarter of decline, mainly due to high raw material prices and severe labor shortages that hampered the implementation of corporate investment plans. But in fact, Japanese companies have a strong investment appetite, and large companies expect to increase their capital expenditure by 13.5% in the fiscal year ending in March.

“Overall, the weak GDP data in the fourth quarter of 2023 supported our forecast of 0.6% growth for Japan’s economy in 2024, which is lower than the consensus.” Yamaguchi said.

Experts: GDP represents history, negative interest rates may end in April

The weak economic data made Japan’s monetary policy normalization road face challenges.

Previously, the market generally predicted that the Bank of Japan was likely to start exiting the negative interest rate policy that has been implemented for many years at the policy meeting in April. On the one hand, the inflation rate has exceeded the Bank of Japan’s 2% target for more than a year, which is one of the key factors that suppress domestic consumption, and the interest rate difference between Japan and the United States also causes the yen to continue to depreciate. On the other hand, Japan’s weak economy still needs the stimulus of ultra-loose monetary policy. Kazuo Ueda, who took office as the governor of the Bank of Japan last year, faced a severe test.

“I also expect the BoJ to eliminate its negative rate policy in April. As is the always the case, GDP stats represents a history rather than the outlook. Given that consumers’ confidence is improving with the real income recovering gradually, I think the BoJ will maintain their outlook of “Japan's economy is likely to continue recovering moderately,” and thus the Q4 growth outturn is not likely to affect their decision making significantly.” Yamaguchi told NBD.

Yamaguchi’s analysis was also confirmed by news reports. Reuters reported on February 16 that informed sources revealed that GDP is only one of the many data that the Bank of Japan pays attention to, and the important thing is the overall trend and outlook of the economy, so the Bank of Japan will still end the negative interest rate in the next few months. The annual wage negotiations in the spring of 2024 will be an important indicator of whether the wage income level will increase. Due to labor shortages, many companies have signaled that they will significantly increase wages. The Bank of Japan hopes that wage increases and easing price pressures will create space for monetary policy normalization.

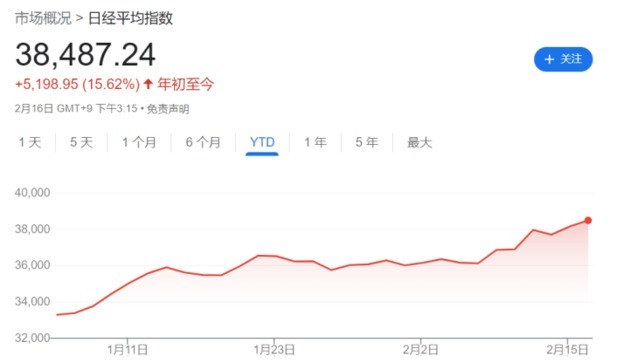

In contrast to the economic data, the Japanese stock market is hot. On February 16, the Nikkei 225 index of the Tokyo Stock Exchange continued to rise, closing at 38,487.24 points, and at one point it was only 50 points away from the historical high (38,915.87 points) set at the end of December 1989. Since the beginning of the year, the Nikkei 225 index has risen by 15%.

Photo/ Google Finance

The Nikkei Economic News reported that the driving force behind the rise of the Japanese stock market came from the overseas profitability of Japanese companies. On February 15, the stock prices of Shin-Etsu Chemical and Fuji Electric both hit new highs since listing, and their overseas sales accounted for 80% and 30% respectively. The yen’s depreciation increased the profits of Japanese companies’ overseas subsidiaries, driving up stock prices. In addition, with the boom of AI technology, Japanese semiconductor stocks were also sought after by investors.

Yamaguchi explained to NBD, “I don’t think it will deteriorate the market’s confidence. Yes the real GDP dipped, but the nominal GDP which has more implication on the corporate earnings indeed grew positively in Q4. Moreover, continued yen weakness and a positive turn in the IT cycle means that earnings are likely to stay firm, especially for those manufacturers operates globally. Weak yen also means that the number of inbound tourists and their expenditure is likely to stay robust ahead.”

Disclaimer: The content and data of this article are for reference only and do not constitute investment advice. Please verify before using.

川公网安备 51019002001991号

川公网安备 51019002001991号