Photo/Zheng Yuhang (NBD)

On February 1, local time, U.S. stocks opened higher, with the three major indexes all closing higher. At the close, the Nasdaq rose 1.3%, the S&P 500 index rose 1.25%, and the Dow rose 0.97%, setting new historical closing highs.

Large-cap tech stocks rose across the board, with Amazon and Nvidia rising more than 2%, Meta, Apple, and Microsoft rising more than 1%, and Tesla, Google, and Netflix rising slightly. Ferrari rose more than 12%, hitting a record high, and its market value exceeded $70 billion, surpassing BMW. New York Community Bank fell more than 11%, after falling more than 37% yesterday.

After the close, Meta, Amazon, and Apple released their latest earnings reports.

Apple Q1 revenue beat expectations, but greater China revenue falls short

On February 1, local time, tech giant Apple released its first-quarter report for fiscal year 2024 (i.e., the fourth quarter of calendar year 2023).

Photo/Apple Fiscal Report

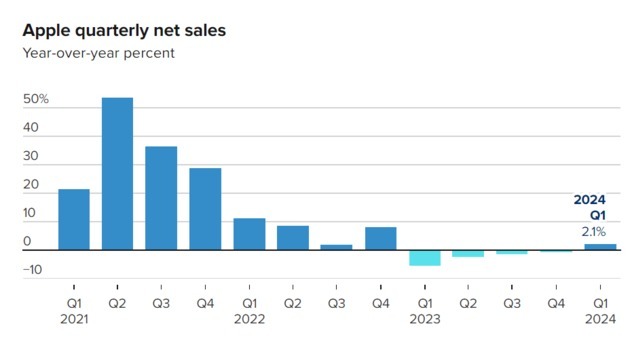

The report showed that Apple’s quarterly revenue was $119.58 billion, higher than analysts’ expectations of $117.97 billion, returning to year-over-year growth. First-quarter iPhone revenue came in at $69.7 billion, higher than the expected $68.55 billion.

Apple’s first-quarter service revenue was $23.12 billion (exstimation: $23.37 billion); earnings per share were $2.18 (analysts expected $2.11); Mac revenue was $7.78 billion (estimation: $7.9 billion); iPad revenue was $7.02 billion (estimation: $7.06 billion); wearable devices, home and accessories revenue was $11.95 billion (estimation: $12.02 billion).

Apple’s first-quarter Greater China revenue was $20.82 billion (estimation: $23.5 billion). Apple said that Apple achieved sales growth in all regions except Greater China, where sales fell nearly 13% year-over-year.

iPhone sales were slightly lower than Wall Street’s revised expectations, growing nearly 6% to $69.7 billion, a positive sign for the iPhone 15 models released in September. This was Apple’s first full quarter to include iPhone 15 revenue.

Apple’s profitable service business grew 11% in the quarter, with revenue of $23.11 billion, but still slightly below expectations. Investors have been closely watching the growth of Apple’s service business, which includes subscription services such as Apple Music, warranties, search licensing revenue, and payment revenue from Apple Pay and Apple ads.

Apple said that there are currently 2.2 billion active devices in use, and many analysts believe that this indicator provides important information for predicting Apple’s service growth. Compared with 2 billion active devices in the same period last year, this number has increased.

Apple CEO Cook said that Apple will announce new artificial intelligence features this year.

As of the close on February 1, local time, Apple reported $186.86, up 1.33%, with a market value of $2.9 trillion. After the earnings report, Apple fell more than 2% after hours.

Meta announces $50 billion buyback and first dividend, up 14% after hours

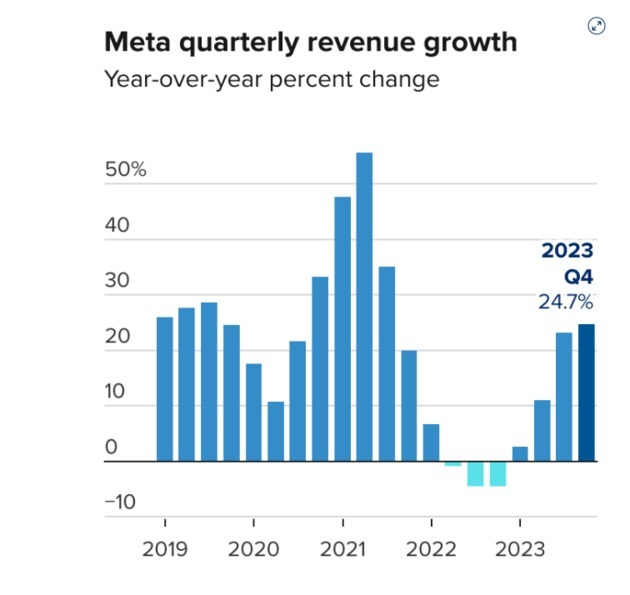

Facebook’s parent company Meta Platforms announced its earnings report after the close on February 1, local time, showing that the company’s fourth-quarter results and first-quarter guidance were largely better than expected, especially the fourth-quarter active user numbers exceeded expectations.

The report showed that Meta’s fourth-quarter revenue was $40.11 billion, higher than analysts’ expectations of $39.01 billion. Among them, advertising revenue was $38.71 billion, higher than analysts’ expectations of $37.81 billion; APP family revenue was $49.04 billion, higher than analysts’ expectations of $38.16 billion; Reality Labs revenue was $1.07 billion, higher than analysts’ expectations of $812.6 million.

At the same time, Meta’s fourth-quarter daily active users were 2.11 billion, higher than analysts’ expectations of 2.07 billion; fourth-quarter monthly active users were 3.07 billion, higher than analysts’ expectations of 3.06 billion.

Meta said that by December 31, 2023, the company had completed the layoff plan launched in 2022, and as of December 31, 2023, Meta said its number of employees was 67,317, down 22% year-over-year after the layoffs.

Meta has been investing record amounts of money in developing artificial intelligence technology, including expanding its core advertising business by improving ad targeting and artificial intelligence-recommended content and running the infrastructure required. At the same time, it has not given up on building a virtual reality metaverse. Zuckerberg attributed the accelerated growth of the advertising business to advances in artificial intelligence.

Meta also made its first dividend payment in company history, paying a cash dividend of $0.50 per share. The company announced an increase of $50 billion in stock buybacks.

Meta CFO Susan Lee said that the sharp increase in fourth-quarter revenue was due to high spending by Chinese advertisers and artificial intelligence-recommended video content, with the company’s apps’ average daily viewing time increasing 25% year-over-year. In the earnings call, Susan Lee said that in 2023, revenue from Chinese advertisers accounted for 10% of Meta’s total revenue, contributing 5 percentage points to global total revenue growth.

In a previous earnings report, Susan Lee also emphasized the importance of the business from China, although she did not name specific companies, but fast-growing emerging companies from China, Temu and Shein, have been pouring a lot of advertising money into Facebook and Instagram.

As of the close on February 1, local time, Meta reported $394.78, up 1.19%, with a market value of $1 trillion. After the earnings report, Meta rose more than 14% after hours.

Amazon’s Q4 results and Q1 guidance better than expected, up nearly 8% after hours

Amazon announced its fourth-quarter earnings report after the close on February 1, local time, showing that its fourth-quarter results and first-quarter guidance were generally better than expected.

The report showed that Amazon’s fourth-quarter net revenue was $169.96 billion, up 14% year-over-year, higher than analysts’ expectations of $166.21 billion; operating profit was $13.21 billion, higher than analysts’ expectations of $10.49 billion. Earnings per share were $1.00, higher than analysts’ expectations of $0.78.

For the first quarter, Amazon expects net revenue of $138 billion to $143.5 billion, analysts expect $142.01 billion. It expects first-quarter operating profit of $8 billion to $12 billion, analysts expect $9.12 billion.

Amazon laid off 27,000 people between the end of 2022 and mid-2023, and Amazon has been looking for ways to cut costs in other areas, such as its fulfillment business. In January, the company announced layoffs for Prime Video, MGM Studios, and Twitch. Amazon CFO Brian Olsavsky said the company will continue to be cautious about new investments, but does not think 2024 is “a year of pursuing efficiency.”

Olsavsky said: “We will continue to invest in new things, new areas, and things that resonate with customers. Where we can improve efficiency and spend less and do more, we will do that.”

Fourth-quarter revenue jumped 14% to $170 billion. This period reflected the holiday shopping season and Amazon’s Prime Day event in October, both of which Amazon said exceeded expectations.

As of the close on February 1, local time, Amazon reported $159.28, up 2.63%, with a market value of $1.6 trillion, and Amazon’s U.S. stock rose nearly 8% after hours.

Disclaimer: The content and data of this article are for reference only and do not constitute investment advice. Please verify before using.

川公网安备 51019002001991号

川公网安备 51019002001991号