Photo/VCG

On August 23 (Wednesday) after the market closed in the US, an “explosive” earnings report attracted the attention of almost everyone in the capital market.

In the second quarter of the fiscal year (ending July 30), “AI leader” Nvidia’s net profit reached a record $6.188 billion, up 843% year-on-year; revenue also surged 101% year-on-year to $13.5 billion, beating the expected $11.22 billion. The stock price rose 6.6% after hours on Wednesday, crossing the $500 mark.

During the reporting period, Nvidia’s gross margin increased by more than 25 percentage points to 71.2%. For a technology giant that mainly produces hardware products, such a gross margin can be said to be extremely rare.In addition, Nvidia expects revenue of about $16 billion for the third quarter ending in October, which is also much higher than analysts’ expectations of $12.6 billion.

Daniel Ives, managing director and senior stock analyst at US brokerage Wedbush, said in an email to National Business Daily that Nvidia’s second-quarter results and third-quarter guidance are a historic moment for the technology industry, which will have a chain reaction in the technology field for the rest of the year and also heralds a wave of artificial intelligence spending in the next few years.

Nvidia's GPU dominance continues to grow, widening gap with AMD and Intel

In the second quarter, Nvidia's data center business, which is its fastest-growing segment, saw revenue surge 141% to $10.3 billion, accounting for more than 76% of total revenue.

The growth in Nvidia's data center business was driven by sales of its "computing" or artificial intelligence (AI) chips, which grew 195% in the quarter, outpacing the overall 171% growth.

Photo/Nvidia

Nvidia CEO Jensen Huang said, "The world has installed a trillion dollars worth of data centers, including the cloud. These data centers are moving to accelerated computing and generative AI capabilities. Companies around the world are moving to accelerated computing and generative AI."

According to CNBC, the strong earnings report shows that Nvidia's lead in the GPU market is further expanding, while its main rival AMD is lagging behind, and chip giant Intel is continuing to miss out on the hottest tech trends. After Nvidia reported earnings, AMD and Intel shares fell 7% and 4%, respectively.

The report says that Nvidia's strong performance in the second quarter also marks a shift in the data center chip market: the most important and expensive part of data center construction will no longer be the CPUs manufactured by AMD or Intel, but the GPUs that are being snapped up by large cloud computing companies. For example, Alphabet, Amazon, Meta, and Microsoft are all buying up Nvidia's next-generation processors.

Nvidia's second-quarter data center revenue came in at $10.3 billion. Compared to FactSet's estimatimation of $4 billion for Intel's business in the same period, and $1.64 billion for AMD, Nvidia's data center revenue is almost twice that of Intel and AMD combined.

Intel CEO Pat Gelsinger said on the company's earnings call in July that he expects all of its businesses to remain "under pressure" through the end of the year, and that cloud computing companies will be focused on GPUs that enable AI, rather than Intel's CPUs.

Like Intel, AMD is facing a major challenge. Earlier this year, AMD released a new flagship AI chip, MI300, but it is still only shipping in limited quantities and will not be officially launched until next year. Raj Joshi, senior vice president at Moody's Investor Service, believes that Nvidia's high-performance GPUs will not face real competition until AMD begins shipping significant quantities of its new GPUs in early 2024.

Nvidia itself expects that the strong demand for AI GPUs will continue at least through next year, and says it has secured additional supply to increase chip shipments in the coming months.

NVIDIA's Earnings Could "Spark" Tech Stock Rally

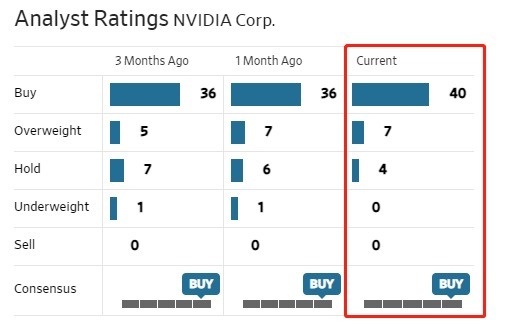

Analysts are overwhelmingly bullish on the chipmaker, with 40 of 51 rating it a buy.

As the global tech industry and market waited for NVIDIA's second-quarter earnings, expectations were already high for a "blockbuster" report.

Data from the Chicago Board Options Exchange (Cboe) showed that as of mid-August, bets on NVIDIA options exceeded $1 trillion, with call options accounting for about 60%. The number of unexercised NVIDIA call options in August also hit a record high.

Data from Nomura Securities showed that ultra-short-dated options expiring within a few days of the earnings report were the most popular trading products, suggesting that many option investors were hoping to make a quick buck from NVIDIA's earnings release.

Daniel Ives, an analyst at Wedbush Securities, told NBD that the entire tech industry and market were watching NVIDIA's earnings because they are the purest and best barometer of global AI demand.

After NVIDIA released its earnings, major investment banks raised their price targets for the company. Chaim Siegel, an analyst at Elazar Advisors, raised his target price to $1,600.

In a report, Siegel wrote, "I still believe my estimates are too conservative." He said that $1,600 is equivalent to 13 times NVIDIA's 2024 earnings per share.

According to The Wall Street Journal, of the 51 analysts covering NVIDIA on Wall Street, 40 rate it a "buy," 7 rate it a "strong buy," and 4 rate it a "hold." According to Nasdaq, analysts' target prices for NVIDIA over the next 12 months range from $1,100 to $475, with an average target price of $628.06.

Analysts believe that NVIDIA's earnings are a direct validation of the unprecedented demand they are seeing in the AI gold rush. The company's forecast of $16 billion in revenue for the third quarter is well above analysts' expectations of $12.6 billion, and could be a catalyst for a tech stock rally.

Photo/WSJ

Analysts believe that NVIDIA's biggest challenge is whether its supply chain can meet the surge in demand.

Jacob Bourne, a senior analyst at research firm Insider Intelligence, said that NVIDIA's second-quarter results highlight its leadership in leveraging the momentum of AI. However, as global demand for the company's chips continues to grow, it will be critical to overcome supply chain challenges to increase production.

川公网安备 51019002001991号

川公网安备 51019002001991号