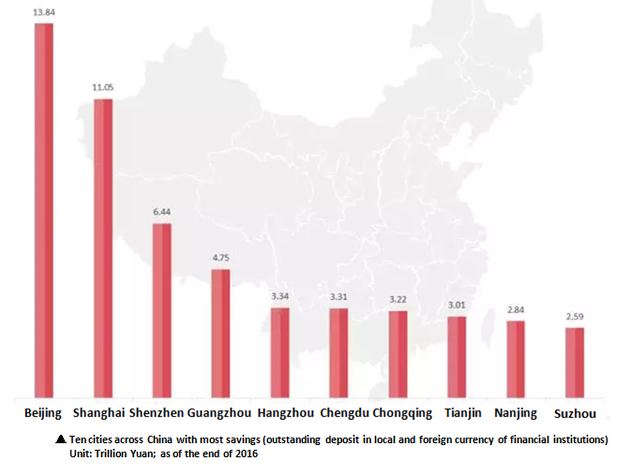

What will the ranking list of Chinese main cities be if the amount of savings (outstanding deposit in local and foreign currency of financial institutions) is considered for judging?

Beijing, instead of Shanghai with highest GDP in China, ranks 1st. The headquarters of major banks, central authorities and headquarters of central enterprises are concentrated in Beijing and the deposit of 13.8 trillion yuan makes the city the wealthiest across China.

Shanghai, China's finance center and the most economically powerful city, ranks 2nd with the deposit of 11.1 trillion yuan.

Shenzhen, known as china's innovation and entrepreneurship center, ranks 3rd with the deposit of 6.4 trillion yuan. Shenzhen Stock Exchange, technology companies and venture capital firms are all located in this city.

Guangzhou, ranking 4th for the deposit of 4.8 trillion yuan, is a historic opening port and the center of Guangdong province.

No doubt, Beijing, Shanghai, Guangzhou and Shenzhen are the top 4 cities by savings. But, how about the remaining ones, who's gonna take the crown?

Will it be Wuhan? Or Zhengzhou, the center of ancient China? Or Nanjing, the heartland of the lower Yangtze River region?

In fact, it is Hangzhou that tops the non-first-tier cities with savings amounting to 3.3 trillion yuan While in western China, Chengdu's savings is very close to Hangzhou.

Hangzhou is the capital of Zhejiang province and owns the most dynamic private sector in China, which explains its large amount of savings. Chengdu, sitting in western China, how can it be so attractive for outer capitals?

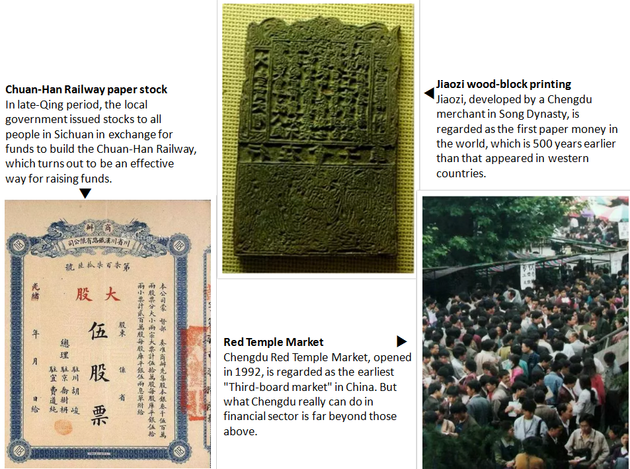

Chengdu's financial position is not born, but built on an innovation that dated back to 1000 years ago.

Chengdu's financial innovation goes beyond that.

It was China's first city approved after the 18th CPC National Congress to conduct comprehensive pilot reform of rural financial services, providing reference to the country's rural finance development.

It is home to WinPower, China's first technology and finance service platform with significant influence across the country.

It is where China's first IEFI financial index was launched and China's first financial makerspace, Financial Dreamworks Chengdu, was founded.

It is the location of China's only trans-provincial equity trade center, Tianfu (Sichuan) United Equity Exchange Corp., Ltd., which is now a "capital reservoir" that covers Sichuan province and Tibet Autonomous Region and serves the whole West China.

Thanks to the profound historical accumulation and unremitting pursuit of financial innovation, Chengdu has built up strong financial strength in Central and West China,. It ranked top in West China in terms of the value added of the financial industry, financed amount of the capital market, premium income, and volume of securities trading.

The southwestern city, meanwhile, has the largest number and most types of financial institutions in Central and West China. As of the end of June 2017, 1,950 financial institutions and financial intermediary service agencies has been registered there.

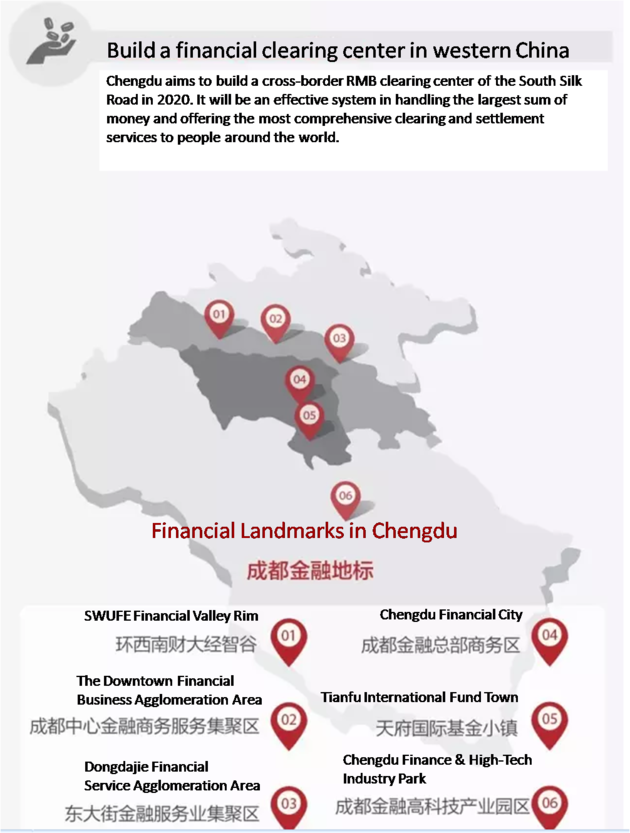

Chengdu never ceases its financial expansion. After taking the lead in central-western China, Chengdu eyes global market.

On 3pm., August 22nd, the Promotion Conference of Chengdu, Buliding a National Finance Center in western China, as part of the Sichuan-Hong Kong-Macao Cooperation Week, is also held in Hong Kong. Fan Ruiping, Member of the Standing Committee of Sichuan Provincial Party Committee and Secretary of Chengdu Municipal Party Committee, delivered an important speech at the event.

Fan Ruiping's introduction and promotion of Chengdu were applauded by the financial community in Hong Kong. Wisely managed capital would not miss the opportunities created in the midst of Chengdu's efforts of building a national central city and China's course of "opening to the West".

In this conference, Chengdu's government and Hong Kong Trade Development Council signed the Memorandum of Economic and Trade cooperation between Chengdu and Hong Kong. 16 Projects worth 15.739 billion U.S. dollars in total were signed in the conference, including:

6 strategic cooperation projects, worth 2.941 billion U.S. dollars;

3 financial cooperation projects, worth 900 million U.S. dollars;

3 One Belt and One Road projects, worth 6.736 billion U.S. dollars;

4 service entity economy projects, worth 5.162 billion U.S. dollars.

Today, Chengdu's plan of building a western financial center was also announced in Hong Kong.

"In 2022, the financial added value is expected to account for 15% of the total GDP of Chengdu, with a year on year growth of 22%; Chengdu's total amount of RMB and foreign currency deposit will reach 3.7 trillion yuan and that of RMB and foreign currency loan will go up to 3.3 trillion yuan; social financial amount will reach 650 billion yuan, the economic securitization rate reaching 22% and the proportion of direct financing reaching 60%." said Liang Qizhou, Director of Chengdu Financial Office.

So how does Chengdu build the western financial center? Liang listed 6 specific ways of building the western financial center: developing the financial organization system, building the multi-level capital market, setting up the western venture investment base, developing financial and technology incubation, conducting financial service supply front reform and promoting inclusive finance.

Leaders in the financial and academic circles highly appraised Chengdu's ambition to build a financial center in western China.

Chengdu offers abundant opportunities. We have lots of projects in Chengdu. If business activities in Chengdu are often held, we will possibly set up a branch in Chengdu. Besides, we will take a broad view at Southwest China via Chengdu.

--- Chen Jianhao, Managing Director of Morgan Stanley Asia Limited

Under the "Belt and Road Initiative", Chengdu's regional advantages begin to unveil and create great development potentials. China Taiping Insurance Group Ltd has already made several investments in Chengdu. Meanwhile, financial institutions in Hong Kong show much interests in investing in Chengdu.

--- Wang Tingke, Executive Director of China Taiping Insurance Group Ltd

Over 1000 years ago, intelligent Chengdu people invented "Jiaozi" which is regarded as the first paper money in the history of finance. With this regard, Chengdu and Hong Kong share the urban characteristics of flexibly adapting to changes and seizing the opportunities when they come.

--- Ba Shusong, Chief China Economist for the Hong Kong Stock Exchange

Chengdu ranks first among sub-provincial cities in central-western China in terms of GDP and added value of the financial industry. As an important economic center in western China, Chengdu provides a good business environment and a broad growth space for companies which choose to develop in here in Chengdu.

--- Yan Xiaoying, Managing Partner and CEO of Winsome Capital

Email: gaohan@nbd.com.cn

川公网安备 51019002001991号

川公网安备 51019002001991号