As the "heart" of the automotive industry, powertrain systems have become the core battleground for global automotive transformation. Driven by the dual-carbon strategy and intelligent transformation, the strategic importance of powertrain technology has evolved from traditional performance assurance to a decisive factor in industrial competitiveness.

In 2024, the growth rate of pure electric vehicles (BEVs) gradually slowed, while the penetration of plug-in hybrid (PHEV) models accelerated rapidly. In key markets like China, the coexistence of traditional internal combustion engine vehicles (ICE), PHEVs, and BEVs has become an industry consensus.

Meanwhile, continuous advancements in ICE technology, breakthroughs in automatic transmission systems, and global exploration of green pathways have positioned zero-carbon technologies—such as hydrogen internal combustion engines and hydrogen-ammonia fusion—as innovation hotspots.

Chinese automakers and technologies are playing an increasingly pivotal role in the global automotive transition, with China's automotive supply chain now embarking on large-scale technology export.

On May 31, 2024, Geely Holding Group and Renault Group officially established HORSE Powertrain Limited (HP), headquartered in London. The joint venture leverages cutting-edge technologies to design, develop, produce, and sell industry-leading hybrid and ICE powertrain components, including engines, transmissions, hybrid systems, and batteries.

Under its governance structure, Geely Holding CEO Daniel Li serves as Chairman, while Matias Giannini acts as CEO. Lee Ma holds the CFO role, and Juan Ferrera is the Chief Human Resources Officer.

Approaching its first anniversary, HORSE Powertrain has maintained a low profile regarding operational updates. During an exclusive interview with National Business Daily in Shanghai, CEO Matias Giannini addressed the company's progress and strategic vision for navigating powertrain industry disruptions.

HORSE Powertrain CEO Matias Photo/Cong Sen (NBD)

China operations account for approximately 50% of the business and potential IPO plans under consideration

HORSE Powertrain comprises two subsidiary divisions: Aurobay (originating from Geely) and HORSE (originating from Renault). Horse Powertrain was established with 17 ICE and Hybrid manufacturing plants and 5 R&D centers.

In December 2024, Saudi Aramco announced the completion of its €740 million acquisition of a 10% stake in HORSE Powertrain. Post-transaction, shareholdings stand at 45% for Geely, 45% for Renault, and 10% for Saudi Aramco. The joint venture’s board seats expanded to seven following the appointment of Saudi Aramco’s representative. Based on the transaction valuation, HORSE Powertrain’s market capitalization reached €7.4 billion as of December 2, 2024.

NBD: As the first powertrain company which is independent from the global OEMs, what is the vision and target of HORSE Powertrain. Could you provide a brief overview of the company's future development plans and key focus areas?

HP: We think that our vision is to be the number one, developer and manufacturer of powertrains in the world.

We believe that we can support OEMs by developing highly efficient powertrain engines and transmissions for everything that is not battery, so that they can focus on their transition towards BEVs. Our goal is to support everybody everywhere and thus achieve our mission of becoming the number one powertrain company in the world.

China is and will continue to be one of our key focus markets. Today is nearly half of our business with the existing operations and as I mentioned with the more and more increase of Plug-in Hybrids and range extenders happening in China. As well, it's a great market and a great fit for a company, so we will continue to be a very strong focus for us in the future.

NBD: As a joint venture, what roles do the three shareholders—Geely, Renault, and Saudi Aramco—play respectively?

HP: Our shareholders, as you said, first and foremost, they are shareholders, they are the founders of the company. We're not a public listed company. So, from the standpoint of shareholders, their rolesare to ensure the support to the company, but also to ensure to monitor the progress in terms of the business and so on. But aside from that, the most important point is that HORSE Powertrain is an independent company. Not only to continue to support the business of the mother companies, but continue to expand and grow to support all the other OEMs in the world.

NBD: You previously stated that the company's products could cover 80% of the global hybrid and ICE (Internal Combustion Engine ) vehicle market demand. What's the core competitive advantage?

HP: A lot of times when you have companies coming together, you have major overlaps, you have to go through a lot of restructuring. That's not the case here.Here we have perfect complementarity of products from the different companies, not only in terms of the footprint you had with all the former Geely part, very strongly in China, very strong in smaller engines from 1.5liter, four-cylinder engines in a little bit of a higher power, more in the C-segment type.

And then you come with Renault side, which covers very well all the Europe region as well as south America with complementary products like 1.0Liter,3 cylinders, smaller engines, smaller power.

Then on top of that came the traditional products that we sell to volvo, 2.0engines higher power. So really when you put this all together, we have the perfect situation, as you said, where we have such a big range of products, such a big range of manufacturing locations plus R&D development locations in five different places that we can cover today, more than 80% of the needs and we continue now to develop more technologies.

So, the 80% is just a start.

NBD: Since your establishment in 2024, HORSE Powertrain Limited has been operational for nearly a year. Any investment plan in the capital market?

HP: Any successful company always has to be thinking about being so attractive that the external world, including investors would be interested in and jumping in. So, for us, that’s maybe something for the future.

For now, we're happy with the support from our mother companies. We focus on establishing the business which has a very solid foundation and now growing with additional OEMs. And then let's see, maybe in the future this becomes a reality.

HORSE Powertrain China Manufacturing Base Photo/provided to NBD

North America remains the only region without manufacturing presence and entry plans are under active evaluation

HORSE Powertrain operates 17 global factories with an annual production capacity of approximately 5 million powertrain units, serving eight major clients including Renault Group, Geely Auto, Volvo Cars, Proton, Nissan, and Mitsubishi Motors across 130 markets worldwide. The company employs around 19,000 staff across five R&D hubs and generates annual revenue of €15 billion.

NBD: You have anticipated annual revenue of €15 billion. Which key markets and customer segments do you consider critical to achieving this target?

HP: All the markets, all the customers really are. We're a very unique company. First and foremost, there’s nobody else doing what we're doing today.That's something that's very unique to us. And so the goal is really to be able to support all customers, whatever type of solutions that they might need.

And everywhere as a matter of fact. Because we believe that the needs of the customers will be different depending on the type of customer and the type of region. In some cases, it might be a highly efficient, low-cost ICE engine. In other cases, you might be a very powerful hybrid or a range extender. We have it all. We're here to support everybody.

NBD: Amid global competition, how does the company plan to expand its international presence? Which regions are emerging markets? And why?

HP: We are already present basically in all the regions in the world with strong presence in China, a strong presence in Europe and south America as well. I think if I were to point out one area where we don't have today manufacturing a presence, but we're actively looking in solutions to start that. That would be north America. But our focus, as I answered before, is global. So, we have a very strong focus on all the regions, supporting our customers where they need.

NBD: How do Geely and Renault subsidiaries collaborate across different overseas markets?

HP: This is precisely our core competitive strength. Chinese technologies—particularly in hybrid systems and high-efficiency engines—are globally leading. However, many domestic powertrain suppliers face limitations, as their products can only enter overseas markets tied to vehicle exports, restricting localization.

In contrast, our European facilities and R&D centers enable us to adapt Chinese technologies locally for European clients, bypassing geopolitical constraints. This dual-region integration represents our most significant strategic advantage.

NBD: Based on your observations, what are the current development trends in the global powertrain industry? How about China?

HP: So we all know that there is the continuous growth of battery electric vehicles and by the way, I'm a believer and supporter of the use of battery electric vehicles. HORSEPowertrain is not against thewholebattery strategy. We are complementing that our mission or our vision is that we really believe that the transition to a clean mobility, the transition to net zero, there's many ways, many roads to achieve that.

So, we believe in a multi energy solution. With that in mind, you already see what's happening in the market. Aside from the growth of EVS, you have a very significant portion, I personally believe will be more than 50% of the vehicles, even in more than 10 years from now, they will still have some type of engine. But the shift to answer a question, the trend that we see is more and more pure ICEs becoming hybrids. And particularly in China, I see that the increase of Plug-in Hybrids and also the use of a very, very exciting technology which is range extenders becomes bigger and bigger.

As a matter of fact, last year was the first year since the beginning of electrification where the growth in China of electrification was bigger in the segment of Plug-in Hybrids and range extenders than battery electric vehicles for the first time. So definitely you see that as a trend and this is where a company like HORSEPowertrain can really help.

Diverse alternative fuels will play an increasingly pivotal role in the powertrain sector

NBD: What is the outlook for traditional ICE powertrains and hybrid systems? Will ICE powertrains gradually phase out?

HP: We believe ICE engines will be required in some regions for many years to come.

We can look at Africa, we can look at Mideast Asia. We can look at even south America. There will be places where for questions of affordability, ICE, high efficient ICE, pure ICE will still be needed. This is part of what we do. We don't just focus on full hybridization and electrification. We focus on making all types of engines.

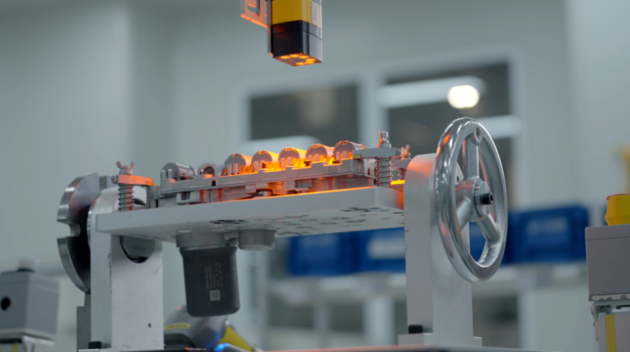

HORSE Powertrain Research and Development Process Photo/provided to NBD

NBD: What do you identify as the most significant challenges in technological innovation for the company, and how will they be addressed?

HP: I think that we touched a little bit on that when you asked about the technology trend so more and more move towards hybridization and especially Plug-in Hybrids. But for example, I touch on range extenders, which is a very interesting technology because it allows to put a very, very efficient compact engine in a battery electric vehicle (BEV) architecture to be able to increase the range of the vehicle, decrease the size of the battery, decrease the cost of the vehicle.

And with that you make the vehicle more cost effective for the OEMs. The OEMs can make more money. You increase range and reduce the anxiety for the consumers still having the EV fuel consumers appreciate, especially here in China. It's very efficient in terms of fuel consumption and emissions. And again, it's a great solution, but there could be many more. So, in terms of development of technology, I think that's one example, but we're working on other different solutions. Always with the focus of believing that more and more in the future vehicles will be built on BEV architecture. We have to have solutions, our own solutions that can easily fit into BEV architecture. As a matter of fact, we're going to show that trend in the upcoming shanghai auto show.

NBD: In your strategy, what is the projected revenue distribution among traditional ICE powertrains, hybrid systems, and other alternative solutions?

HP: Hard to say, because like I mentioned today, we see more and more hybrids growing, and hydrogen not playing a role in there yet. But likeI mentioned, we are constantly in contact with the OEMs and our business model is to understand where the OEMs need help and how we can help them. The direction that the OEMsgo in the future will determine. But like I said now and for the foreseeable future, I think hydrogen still has a somewhat of a small role.

NBD: How does the company assess the development prospects of hydrogen-powered vehicles? When do you anticipate a market inflection point?

HP: Hydrogen is very interesting, so we do have activities in hydrogen as well. We have innovation, advanced engineering activities where we look at hydrogen development. We have, as a matter of fact, we have a functioning prototype already on going in one of our R&D centers in Europe.

We look into hydrogen. We believe the hydrogen is one of the many possibilities of alternative fuels in the future. But there are concerns, there are constraints with the cost of manufacturing, with the infrastructure. I think it's still going to take a while for us to see hydrogen at a high volume and scale. The hydrogen, like I said, is one of the alternatives. We have a very, very special focus on other alternatives when we talk about alternative fuels. I think that will play a very important role in the future you look at.

For example, South America is a great example where they already use ethanol as an alternative fuel very widely used. Almost 100% of the vehicles today have the so called ‘flex fuel’, you can use both gasoline or ethanol and is used very effective. And ethanol is a clean fuel because it's made of sugar cane. So, I think more and more we will see alternatives coming into play in the role of powertrain not just hydrogen.

川公网安备 51019002001991号

川公网安备 51019002001991号