In 2024, the Chinese tourism market is full of vitality, and people's enthusiasm for travel is high. The National Day holiday has witnessed the surge of outbound tourism of residents from the third- and fourth-tier small cities. The younger generation now prefers hotels rich in historical heritage and unique characteristics. Under this trend, international big hotels are focusing on the young people market, and the accommodation experience of history and modernity is becoming a new favorite.

Among the only seven century-old hotel brands in the world, four are operated by Accor Group (hereinafter referred to as Accor). They are Pullman, Orient Express, Raffles and Fairmont, and have more than 5,700 hotels and 10,000 restaurants in 110 countries around the world.

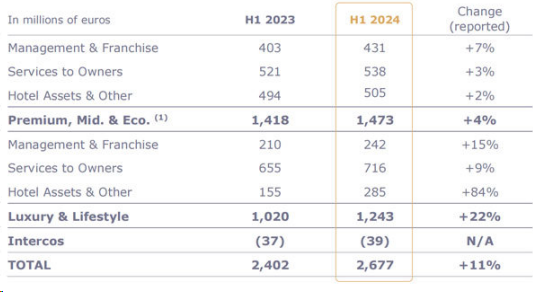

In the first half of 2024, Accor's global revenue increased by 11% year on year to 2.677 billion euros, and the net profit was 253 million euros.

Raffles at Galaxy Macau (Photo provided by the interviewee)

From the Peace Hotel on Shanghai's Bund to the Raffles at Galaxy Macau, in the six years since Gary Rosen took the helm as the CEO of Accor Greater China, he has accelerated and deepened his commitment to the Chinese market, with the hotel portfolio now expanding to over 700 properties. Competing against international hotel chains such as Marriott, Hilton, and InterContinental, what strategies does Rosen have, and how does he "envision" the future of hotels and the industry?

In 2024, as National Business Daily celebrates its vibrant 20th year, it has launched the "Envisioning the Future - Global Elite Interview Series", inviting industry leaders to discuss the future. Against this backdrop, Rosen sat down with NBD for an exclusive interview. Rosen has observed significant changes in the travel demands of Chinese consumers. He also admitted that room prices are under pressure. However, Rosen sees the opportunities behind the challenges and the immense potential hidden in the Chinese market.

Rosen has served as an executive in multiple international giants such as Walt Disney and McDonald's. Now, what he thinks about the most is how to capture the hearts of young Chinese consumers in the new trends of the hotel industry, thereby increasing Accor's market share.

Gary Rosen, CEO of Accor Greater China (Photo provided by the interviewee)

Accor has opened over 700 hotels in Greater China, beating expectations, but room rates are under pressure

Founded in 1967, Accor owns more than 45 luxury, high-end, mid-range and budget hotel brands, including Raffles, Fairmont, Pullman, Mercure, and Ibis. In 2023, its revenue rose 20% year on year to 5.506 billion euros, while its net profit rose to 633 million euros from 402 million euros in 2022. In the first half of this year, Accor's revenue and net profit both rose continually.

Accor's first-half year of 2024 financial results

Since consumers pay more attention to cost-effectiveness in hotel consumption. This has put a lot of overseas hotel brands under pressure. This means that Gary Rosen has to find a way out in the changing market.

NBD: Accor has been in the Chinese market for nearly 40 years. What's your take on the current development? Did it meet Accors expectations?

Gary Rosen: We have opened more than 700 hotels here, exceeding our previous expectations. Among them, high-end brands such as Pullman, and mid-end brands such as Novotel and Mercure show a strong momentum of growth and are our "backbone". Pullman and Novotel each have more than 50 hotels in Greater China, and the figure will double in the next few years. More than a third of hotels under Grand Mercure are located in Greater China, and seven more will open by the end of 2024. For luxury brands like Raffles and Fairmont, we will focus on cities with high-end luxury lifestyle customers. Our strategy is to work with the right brand in the right city and the right owners.

NBD: How has Accor performed in terms of new hotel openings over the past year?

Gary Rosen: In 2023, we signed more than 125 projects, and we expect the scale of signings in 2024 to maintain or exceed this level.

NBD: This year, many international hotels have suffered frustrations in the Chinese market, including Accor. What is your perspective on this?

Gary Rosen: Undoubtedly, our room rates are under pressure. In 2023, our room rates actually reached the highest level in history, and this year they have fallen back, facing a situation where challenges and opportunities coexist. Therefore, there is pressure on room rates, especially in the luxury brand market.

NBD: What is Accor's positioning for itself in the Chinese market?

Gary Rosen: We have 45 hotel brands globally, and 17 of them are present in China. Our positioning is to cover the entire spectrum.

Chinese consumers are enthusiastic about traveling, but demands have changed significantly

Meishan San Su Shrine Museum (Photo/NBD reporter Du Wei)

NBD: How do you view the purchasing power of Chinese consumers in hotels?

Gary Rosen: Compared to 2019, the number of tourists departing from China and choosing Accor hotels for overseas travel is growing rapidly.

NBD: You have worked and lived in China for 15 years. What changes have you observed in consumer behavior? Has it affected the travel industry?

Gary Rosen: I have noticed that young people in China tend to choose places that are not popular but rich in cultural and historical heritage for travel. For example, they are more willing to go to third-and fourth-tier cities, which, although smaller in scale and varying in economic development, are rich in cultural and historical resources.

NBD: You just talked about some changes in the tourism market. What opportunities and challenges does the hotel industry face?

Gary Rosen: In the area of growth, we see many exciting opportunities, which include not only the creation of new hotel brands and the advancement of new projects but also many opportunities for rejuvenation.

Accor will focus on expansion with the "matching" philosophy in mind

Mondrian Hong Kong jointly built by Accor Group and Ennismore (Photo provided by the interviewee)

NBD: You have held key positions in several international giants. How has this cross-industry experience influenced your work at Accor?

Gary Rosen: In my past career, I have been fortunate to work in several well-known enterprises. In different positions in these companies, I gradually realized that being a good leader is crucial, no matter which field you are in. Looking back on my career, I know that the knowledge and experience I have learned are hard-won. Now, I am willing to share these valuable experiences with the younger generation to help them better plan their careers.

NBD: Does Accor have a clear expansion plan for the future, and which cities in China will be the focus?

Gary Rosen: We pay particular attention to opportunities in different market segments. Accor has a range of brands covering all product lines. When choosing brands, we consider suitability or matching, that is, selecting the right brands based on the positioning and characteristics of Chinese cities themselves.

NBD: Faced with increasingly fierce competition in China's hotel industry, how will Accor leverage its strengths and differentiate itself?

Gary Rosen: In the Chinese market, we do not want to be limited to promoting our own hotel brands, but rather hope to expand and deepen cooperation with other brands in areas such as ESG (Environmental, Social, and Governance) and carbon neutrality.

NBD: What are your expectations for Accor's development in the next few years, and how do you view the trend of the hotel industry in the Chinese market?

Gary Rosen: In the short term, we face some economic challenges, but we maintain a long-term perspective. In the long run, we are confident that the economy will return to a healthy and reasonable growth trajectory.

Over the next decade, China will become the world's largest travel and tourism market. We firmly believe that Chinese consumers will continue to play a significant role in promoting healthy and long-term sustainable economic growth in China.

川公网安备 51019002001991号

川公网安备 51019002001991号