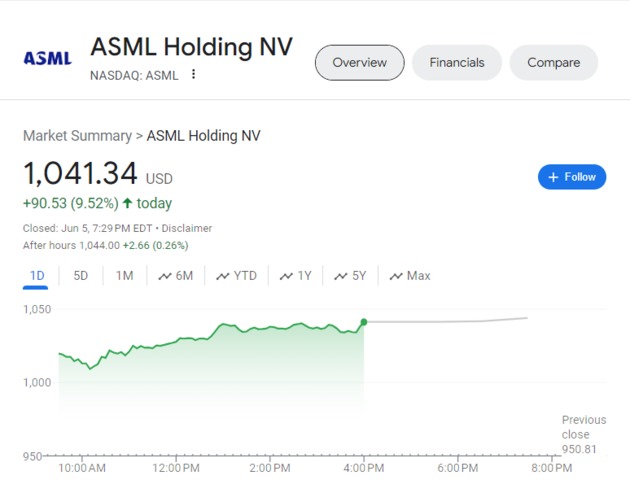

Photo/Google Finance

In a remarkable shift of market dynamics, ASML, the Dutch semiconductor equipment company renowned for its advanced lithography systems, has seen its stock surge by over 9% on the US stock market. This significant increase has propelled ASML's market capitalization to 409.7 bln, surpassing the luxury goods gaint LVMH. ASML now ranks as Europe's second-largest publicly traded company, just behind Denmark's Novo Nordisk.

The boost in ASML's share price comes on the heels of confirmation from the company's spokesperson that its most significant client, TSMC, will receive ASML's cutting-edge High-NA EUV lithography machine by the end of the year. The machine, priced at a staggering €350 million, is a testament to the growing demand for sophisticated technology in the semiconductor industry.

Analysts at Jefferies have expressed optimism about ASML's future, anticipating a flood of orders related to 2-nanometer technology in the upcoming quarters. ASML's own projections for 2025 sales target between €30 billion and €40 billion, fueled by robust demand for state-of-the-art logic chips used in smartphones and artificial intelligence applications.

Despite a reported 61% sequential drop in order volume for the first quarter of 2024, ASML remains confident, with CEO Peter Wennink stating that the company will continue to invest in capacity and technology to prepare for the market cycle's shift. The company predicts a continued decline in revenue for the second quarter, projecting sales between €5.7 billion and €6.2 billion.

This development underscores the evolving landscape where the manufacture of high-tech equipment like lithography machines is becoming increasingly more valuable than traditional luxury goods, reflecting the growing importance of the semiconductor industry in the global economy.

川公网安备 51019002001991号

川公网安备 51019002001991号