On Monday, several U.S. stocks experienced unusual market activity, with significant drops in shares of companies like Berkshire Hathaway, Bank of Montreal, and Barrick Gold. Notably, Warren Buffett’s investment firm, Berkshire Hathaway, saw its stock plummet from a previous closing price of $620,000 per share to $185.10 per share, a staggering 99.97% drop.

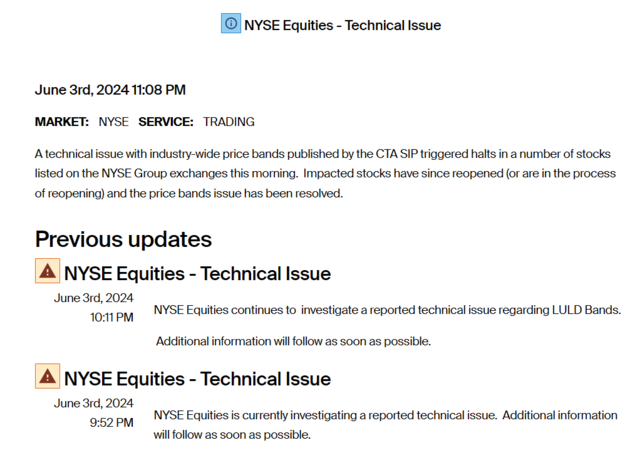

Subsequently, the New York Stock Exchange (NYSE) attributed the abnormal stock quotes to a technical issue with price ranges, which has since been resolved.

According to reports, market observer Lin Yi also noticed this super bug. At the price of $185.10, 51 shares were traded, with the largest single transaction being 8 shares. “We are all curious about who sold the shares and who the lucky buyer was at the price of $185.10,” said Lin Yi. He believes that the stock price bug may have prompted quantitative funds to sell directly, as normal investors would not sell at such a low price.

In the comments section of NBD's WeChat article, many netizens expressed that if someone had bought $1 million worth of shares at that price, they would have become wealthy once the price corrected.

So far, the regulator has announced the tradings during the technical error period invalid.

川公网安备 51019002001991号

川公网安备 51019002001991号