Photo/Hao Shuai (NBD)

On April 26, the Bank of Japan decided to maintain its current monetary policy unchanged, keeping the policy rate target between 0 and 0.1%. This was in line with economists’ expectations, but the statement removed the wording about purchasing the same amount of bonds as before. The Bank of Japan expects the current loose financial environment to continue.

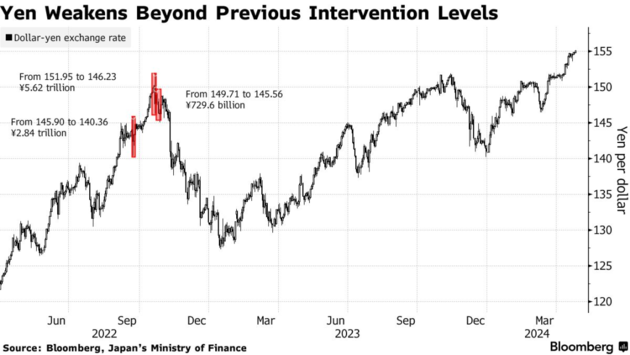

After the announcement, the yen fell below 156 yen to the dollar, marking a new low since May 1990. Just the day before, the yen had historically broken through the key threshold of 155. As of press time, the exchange rate stands at 158.35 yen to the dollar.

Photo/Investing.com

Analysts believe that the core reason for the pressure on Asian currencies is the market expectation that the Federal Reserve may delay interest rate cuts, leading to a stronger dollar. Not only the yen, but also other Asian currencies like the Indonesian rupiah and the Korean won have faced a new round of selling pressure.

Especially, the cautious stance of the Bank of Japan contrasts sharply with the hawkish stance of the Federal Reserve, leading to market expectations of an ever-widening Japan-US interest rate differential, which in turn has intensified the selling pressure on the yen. Since the beginning of the year, the yen has fallen by more than 10%. The depreciation of the yen has, in turn, increased the operational pressure on businesses. Data shows that since July 2022, there have been 20 consecutive months of business closures due to the depreciation of the yen.

As the yen continues to weaken, the Bank of Japan’s response strategy has become a focal point of market attention. Will the Bank of Japan take action next? Has the yen’s decline reached its peak?

What Drives Japanese yen to 34-year low?

Due to the market’s anticipation of quantitative tightening not being mentioned at the latest monetary policy meeting, the foreign exchange market has intensified the sell-off of the Japanese yen. As of the time of reporting, the yen has fallen to 158.35 yen per US dollar, marking the lowest level since May 1990.

In March of this year, the Bank of Japan announced the end of its negative interest rate policy that had been in place for 8 years. However, because the degree of tightening was less than market expectations, it actually exacerbated the depreciation of the yen. Since the beginning of the year, the yen has depreciated by more than 10%, making it the worst-performing currency among the G10 countries.

Photo/Google Finance

Bloomberg cited data from the Depository Trust & Clearing Corporation indicating that the demand for selling contracts for the Japanese yen against the US dollar and the euro has risen, driving the yen to new lows this week. On April 24th, the total amount of options sold, including those priced at 156 yen to 1 US dollar, reached 300 million US dollars, putting pressure on the spot market for the yen.

Professor Huang Jinrong from the Business and Finance Faculty of Universiti Tunku Abdul Rahman in Malaysia stated, “You can borrow yen in Japan at nearly zero interest rates, then sell the yen and buy US dollar assets to earn an interest differential of 5.25%. As a result, the yen is under significant selling pressure.”

Regarding the more fundamental and core reasons for the yen’s continued decline, analysts believe it stems from the significant differences in monetary policy between Japan and the United States.

The Bank of Japan ended its negative interest rate policy last month but only raised the interest rate to a range of 0 to 0.1%, which had limited impact on the market. Recently, Wall Street’s expectations for the Federal Reserve to cut interest rates within the year have weakened, in stark contrast to the beginning of the year. Previously, officials including the Chairman of the Federal Reserve and the President of the New York Federal Reserve, Williams, expressed hawkish views, suggesting that “it may be appropriate to let high interest rate policies work for a longer period.” Based on this, the interest rate differential between Japan and the US may continue to be maintained at a higher level, causing the yen exchange rate to fall upon hearing the news.

On the other hand, Japan has a trade deficit and domestic demand is sluggish, resulting in a lack of momentum for the repatriation of overseas investment earnings by Japanese companies. These structural issues are also factors driving the depreciation of the yen.

It is worth noting that the strong US dollar has also triggered a wave of depreciation in the currencies of Asian countries other than the yen, with the Indian rupee, Korean won, Indonesian rupiah, Vietnamese dong, and Philippine peso all experiencing a new round of selling pressure.

Goldman Sachs pointed out in a recent report that the trend of the US dollar is dominating Asian currencies. The economic growth rate in Asia has rebounded in recent months, inflation has slowed, and macroeconomic policies have tightened, which should further support local currencies. However, the dominant theme in the macro market is the policy path of the Federal Reserve and its impact on the US benchmark interest rate and the US dollar.

When Will the Bank of Japan intervene?

Among the Asian currencies that have recently depreciated, the Japanese yen has seen the largest decline, and its impact on the national economy is the most direct.

Due to Japan’s high dependence on foreign energy and raw materials, the depreciation of the yen has led to increased business costs. Some businesses that cannot pass on the cost increases have struggled to cope with the impact of the yen’s depreciation. According to data from the Japan Chamber of Commerce and Industry, there have been businesses closing down for 20 consecutive months since July 2022 due to the depreciation of the yen.

Furthermore, the rising cost of imports is also stimulating cost-push inflation, putting pressure on consumers. In February of this year, household spending in Japan declined for the 12th consecutive month.

Although some analysts believe that the fall of the yen is beneficial to Japan’s export-oriented industries such as automobiles and semiconductors, according to Hideto Kumanoya, Chief Economist at Dai-ichi Life Research Institute, “In reality, almost no one thinks that such a depreciation of the yen is beneficial for export businesses. For consumers, the depreciation of the yen means that the prices of imports will rise, and the prices of food and energy sources like gasoline, which had finally stabilized, will further increase. For them, the depreciation of the yen has obvious disadvantages.”

Additionally, Bloomberg believes that the current predicament faced by the depreciating yen includes the risk of escalating tensions in the Middle East, which could push up oil and natural gas prices, potentially further damaging Japan’s trade balance.

Faced with the sharp fall of the yen, Japanese foreign exchange officials have intensified their warnings about the excessive weakness of the yen, and business leaders have also amplified their concerns, implicitly pressuring the Bank of Japan not to further exacerbate the decline of the yen. However, the Bank of Japan has only intervened verbally in recent times and has not taken any actual action.

NBD noted that the last time Japanese authorities intervened in the foreign exchange market was in 2022 when the yen exchange rate once plummeted to 151.95 yen per US dollar, and the Japanese Ministry of Finance spent approximately 9.2 trillion yen to support the yen three times. The intervention was immediately effective, and in the last two months of 2022, the exchange rate of the US dollar against the yen fell from 151 yen per dollar to around 127 yen per dollar.

Photo/Bloomberg

Marc Chandler, a strategist at Bannockburn Global Forex, believes that the intervention in 2022 was successful because it coincided with the peak of US interest rates, but now Bank of Japan officials cannot be so confident.

Piotr Matys, a foreign exchange analyst at InTouch Capital Markets Ltd, believes that raising interest rates now makes more sense than foreign exchange intervention. Although he thinks the likelihood of this happening is small, he says, “The most effective way to stabilize a currency that has been severely hit is to surprise the market with a rate hike.”

As the yen continues to fall, Kazuo Ueda, the Governor of the Bank of Japan, has stated that if the situation develops to the point where the impact of the yen’s decline on prices cannot be ignored, then he will consider raising interest rates again.

Bloomberg cites analysis suggesting that Japan’s economic foundation is not stable. After barely maintaining growth in the previous quarter to avoid a technical recession, Japan’s economy contracted in the first quarter. Therefore, some analysts believe that slowing down the pace of bond purchases—or indicating an intention to do so—could also be a way to support the yen.

However, NBD noted that the Bank of Japan stated in March that it would purchase roughly the same amount of bonds as before and announced that it had been purchasing about 6 trillion yen of bonds each month. However, in the policy decision on April 26, the phrase “purchase the same amount of bonds as before” was removed from the statement, but the purchase of Japanese government bonds and corporate bonds will proceed as decided in March.

Next week, the Federal Reserve will hold a monetary policy meeting, which will determine the next move for the yen. Goldman Sachs believes that the current weakening expectations for the Fed to cut interest rates also open up space for the US dollar to rise further. This means that the depreciation of the yen may continue.

Takao Ochi, Secretary-General of the Liberal Democratic Party’s Financial and Banking System Research Committee, said this week that although there is not yet a broad consensus, if the yen further slides to 160 or 170, it may be considered an excessive decline, prompting policymakers to consider taking action.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice.

川公网安备 51019002001991号

川公网安备 51019002001991号