Photo/Zhang Jian (NBD)

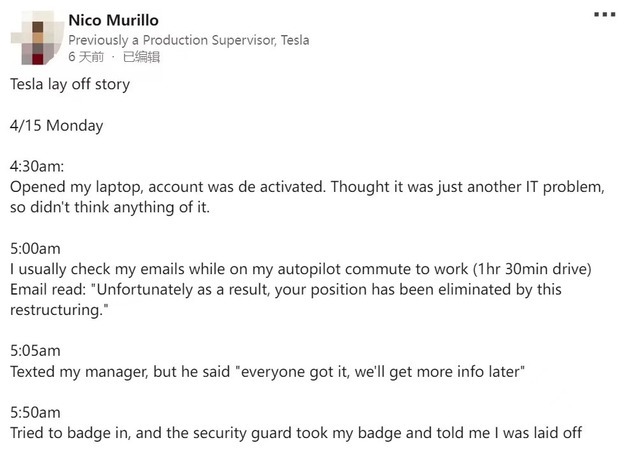

Nico Murillo was wearing his badge and trying to enter the Tesla factory where he worked. However, the factory security guard took away his badge and told Murillo that he had been fired. The scene happened on April 15, 2024, and the harsh reality was hard for Murillo to accept. He had been a production supervisor at Tesla for nearly 5 years.

"In 2023, I used to sleep in my car in the parking lot during the week to avoid commuting, take showers at the factory, and heat up my dinner in the microwave in the break room," Murillo said in a post reviewing his experience of being laid off, unable to hide his frustration.

Photo/LinkedIn screenshot

In fact, Murillo is just a microcosm of Tesla's recent largest layoffs. Tesla is currently facing growth bottleneck. The latest financial report shows that Tesla's revenue in the first quarter of 2024 decreased by 9% year-on-year to 21.3 billion US dollars, the largest year-on-year decline since 2012.

Now, Tesla is hoping to get out of the trough with more affordable models, a fully autonomous driving system (referred to as FSD), and a Robotaxi.

However, Sam Fiorani is the current Vice President of Global Vehicle Forecasting at AutoForecast Solutions, told NBD that Robotaxi is expected to be difficult to market in the short term. " The automaker has a history of announcing new products and taking years to bring them to market, and the announced “robotaxi” is definitely going to need years before it is ready for public consumption."

Wind data shows that as of the close of April 23, Tesla's market value has fallen from its peak of $1.3 trillion in November 2021 to $460.8 billion, a shrinkage of about $840 billion. This shrinkage alone is far more than the current market value of TSMC ($6920 billion). The sell-off by institutional investors makes it feel like Musk's "Tesla" stock has entered an "autonomous driving" state.

Tesla saw 840 bln yuan market value evaporated after historical massive layoff

Tesla, long considered the poster child of the electric vehicle industry, is now facing a harsh reality check. After a period of rapid growth, the company that once had Wall Street swooning has now resorted to layoffs, a move that has sent shockwaves through the industry.

In mid-April, Tesla announced that it would be cutting its global workforce by over 10%, affecting more than 14,000 employees. This decision has been dubbed Tesla's "largest-ever layoff" by the media.

The grim reality behind the mass layoffs is that Tesla is teetering on the brink. According to its Q1 2024 earnings report released on April 23rd, Tesla's revenue fell 9% year-on-year to $213 billion, missing market expectations of $223 billion. This marks not only the first year-on-year decline in nearly four years but also the largest drop since 2012. Sequentially, the decline is even more alarming, exceeding 15%. Furthermore, the company's operating profit margin for Q1 2024 plummeted from 19.2% two years ago to a mere 5.5%.

Data released earlier this month also showed that due to its failure to stimulate demand through price cuts, Tesla's global auto deliveries in the first quarter of this year experienced its first year-on-year decline in nearly four years.

In the capital market, Tesla's performance has also been on a downward spiral, faring much worse than established automakers like Toyota and General Motors.

In November 2021, Tesla reached its peak market capitalization of $1.3 trillion, dominating the entire electric vehicle market. However, as of the close of April 23rd, Tesla's market value had shrunk to $460.8 billion, evaporating nearly $8400 billion from its $1.3 trillion peak, a cumulative decline of nearly 65%. Since the beginning of the year, among the "magnificent seven" of US stocks, only Tesla and Apple have shown a downward trend. Tesla's stock price has tumbled 41.79%, more than three times the decline of Apple (10.14%), and its market value has evaporated nearly $330.6 billion.

Tesla Faces Tough Competition and Price War in China

Tesla is not only facing sluggish demand in its home market of the United States, but also increasingly fierce competition from automakers in China. This could be a cause for greater concern for the company.

Some believe that Tesla's global delivery decline in the first quarter of this year is partly due to its poor performance in the Chinese market during the same period. Data shows that Tesla's retail sales in China totaled approximately 132,000 units from January to March, down 3.6% year-on-year. Of that, March retail sales were around 62,400 units, a year-on-year decline of 18.61%. However, Cui Dongshu, secretary-general of the China Passenger Car Association, said that "Tesla's China production capacity has reached its peak, and sales are fluctuating, making it easy to see negative growth."

Tesla's sharp sales decline in China is mainly due to the increasing number of mid-to-high-end electric vehicles entering the market, squeezing its market. Cui Dongshu also admitted that part of the reason for Tesla's sales decline in China is the impact of the launch of the Xiaomi SU7.

In addition to the Xiaomi SU7, in the 200,000 to 300,000 yuan price range segment, Tesla's main model, the Model 3, also faces competition from the Geely 007, Lynk & Co 001, XPeng P7i, BYD Han, XPeng P7, Leapmotor S7, and others.

In addition to the already launched XPeng G6, more and more Chinese automakers are launching models that directly compete with Tesla's Model Y. Recently, BYD released its new Denza N7 at a lower price than the Model Y. NIO's new sub-brand, LeapMotor, also unveiled its first model, the LeapMotor L60, which directly benchmarks the Model Y and is expected to be released in the third quarter of this year and begin mass delivery in the fourth quarter. The L60's cost is about 10% lower than the Model Y.

"The sales of major electric vehicle companies also declined in the first quarter of this year, which to a certain extent means that Tesla's troubles have just begun," said Gong Huiwei, an analyst at Haitong Securities. "In addition to developed markets, competition in emerging markets is becoming increasingly fierce. The rise of Chinese electric vehicle companies, including high-tech companies such as Huawei and Xiaomi, has added uncertainty to the already 'involuted' electric vehicle competition. Price cuts and the dilution of the market share of the leader are inevitable."

In response to the intensifying competition, Tesla cut prices across the board for its Model 3, Model Y, Model S, and Model X by 14,000 yuan less than a month after announcing a price increase. After the price cuts, the price difference between the Model 3 and the Xiaomi SU7 narrowed to 16,000 yuan, and the price difference between the Model Y and the new Denza is less than 10,000 yuan.

As for whether Tesla will further reduce prices to maintain sales in the future, Sam Fiorani is the current Vice President of Global Vehicle Forecasting at AutoForecast Solutions, told NBD that "The market acceptance of electric vehicles was always expected to be in waves. The first wave includes “tech savvy” and influencers who need to be in on the early push for new products as well as buyers wanting to help clean up the environment at any cost. After that group has been satisfied, shifting the focus to “regular” vehicle buyers is much more difficult as they are wary of change and are unwilling to spend extra on a product that is different or comes with shortcomings. "

Elon Musk's Big Bets: FSD and Robotaxi

Facing a number of challenges, Tesla has shifted the focus of its "breakout" strategy to more affordable and economical models, FSD, and Robotaxi, a self-driving taxi equipped with FSD capabilities.

After the release of the latest quarterly report, Musk said in a conference call with analysts that Tesla's low-price models will begin production in early 2025, even if not later this year. As soon as the news was announced, Tesla's stock price soared more than 10% after hours.

Musk acknowledged that the demand for electric vehicles is facing pressure and that other automakers are turning to hybrids, but Tesla will not do so. He pointed out that Tesla is accelerating the launch of new models, including a cheaper car. These vehicles will use existing and new platforms and will be produced on the company's existing production lines.

A few days before that, Tesla had significantly reduced the price of its FSD software in the United States from $12,000 to $8,000, and the monthly subscription fee also dropped from $199 to $99. In the absence of new models in the short term, the continuously updated FSD will become Tesla's "sharp weapon" to conquer the global market.

As for the revenue-generating capabilities of FSD, a report by Goldman Sachs analyst Mark Delaney's team in November last year stated that although FSD is still in the testing stage, its annual revenue has reached 1-3 billion US dollars.

The team believes that on the positive side, with the growth of Tesla electric vehicles worldwide, "we believe that Tesla's software-related revenue will reach hundreds of billions of dollars annually (mainly from FSD) by 2030."

Despite the optimistic revenue expectations given in the report, FSD still has a long way to go before it can be commercially available on a large scale. Experts in autonomous vehicles and regulation say it may take Tesla several years to release a fully autonomous vehicle approved by regulators.

"Driving assistance systems like FSD work very well in limited situations, but they also have shortcomings. When the system is in chaos, the driver needs to intervene. In addition, technology and regulations have not yet developed to the point where autonomous vehicles are safer and more reliable than human drivers. I think commercial autonomous vehicles won't come until sometime in the 2030s or even later," Sam Fiorani told reporters.

As another "sharp weapon" planned by Tesla, the Robotaxi project will be launched in August this year. However, Fiorani pointed out to reporters that Robotaxi is expected to be difficult to market in the short term.

"Tesla has always announced new products first and then spent years bringing them to market. It takes time to improve batteries or FSD software. If Robotaxi is fully autonomous as Musk says, I don't think it will be possible at least until next year. Nevertheless, the promise of having the technology needed to produce self-driving cars could still excite investors for years to come," he explained.

"The specific implementation and penetration of autonomous driving is closely related to government regulation," Gong Huiwei summarized to reporters. "Musk's depiction of electric vehicle technology disrupting traditional cars has been achieved to some extent, but to some extent it is just a beginning. Moreover, traditional giants such as Toyota, Volkswagen, General Motors and Ford will do whatever they can to delay the popularization of electric vehicles in order to buy time for product innovation.

川公网安备 51019002001991号

川公网安备 51019002001991号