Photo/Hao Shuai (NBD)

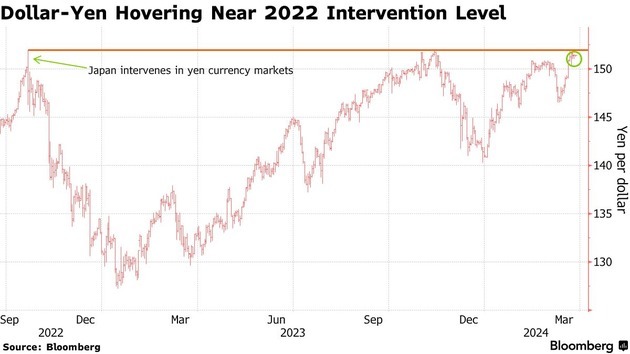

On the morning of March 27th, Beijing time, the Japanese yen briefly reached a new low against the US dollar, hitting 1 USD to 151.972 JPY for the first time since the collapse of Japan’s asset bubble in July 1990.

This has led to speculation about the Japanese authorities intensifying their intervention in the currency market. Previously, Naoki Tamura, a hawkish member of the Bank of Japan’s board, stated that the central bank must normalize its ultra-loose monetary policy slowly but steadily, suggesting that the financial market’s easy conditions may persist.

As the yen fell to a 34-year low, Japan’s Finance Minister, Shunichi Suzuki, issued a warning in the early hours of Wednesday, Tokyo time, indicating that the authorities might take “decisive steps.” Suzuki expressed that following the yen’s decline, the Japanese government is closely monitoring market trends with a high sense of urgency.

Themistoklis Fiotakis, the global head of FX and emerging market macro strategy at Barclays, pointed out in an email to NBD, “The BoJ ended its extraordinary easing, as expected, but USDJPY reached new YTD highs and is testing the 152 intervention “threathold.” In the absence of a deep US cutting cycle, only a steeper hiking cycle in Japan relative to current market pricing could afford lasting support to the yen. With yield differentials remaining wide, we expect USDJPY to remain within the 145-150 range throughout our forecast horizon.”

First Rate Increase in 14 Years,Yen Continental to Decline

The downward pressure persists even after the Bank of Japan raised interest rates earlier this week for the first time in 17 years. These include the persistently high-interest rate differential between the US and Japan, with the benchmark US Treasury yield about 3.5 percentage points higher than the benchmark Japanese government bond yield. This yield premium means that as long as the USD/JPY exchange rate remains above 146.1 yen, investing in US securities denominated in yen remains profitable.

Since then, the yen has continued its downward trend. Reuters reports that has reinforced the yen's use in carry trades, in which investors borrow in a currency with low-interest rates and invest the proceeds in a higher-yielding currency. Japanese investors can also get much stronger returns abroad, depriving the yen of support from repatriation flows. Since the Bank of Japan announced the end of negative interest rates last week, the yen has fallen more than 1% against the dollar. In the first quarter of this year, the yen has been the worst-performing major currency, depreciating 7.6% against the dollar.

Aninda Mitra, the head of Asian macro and investment strategy at BNY Mellon Investment Management, commented in an email to NBD: “The sell-off in the Yen, after the BOJ announcement, highlights how the funding properties of the Yen persists, but we would be more cautious about greater two-way risk and higher vol going forward. The end of explicit and large-scale policy accommodation is also a new regime for equities, but we still believe that the combination of strengthening nominal GDP and corporate reforms (including debt-buybacks and dividend payouts) warrants an overweight allocation in global portfolios..”

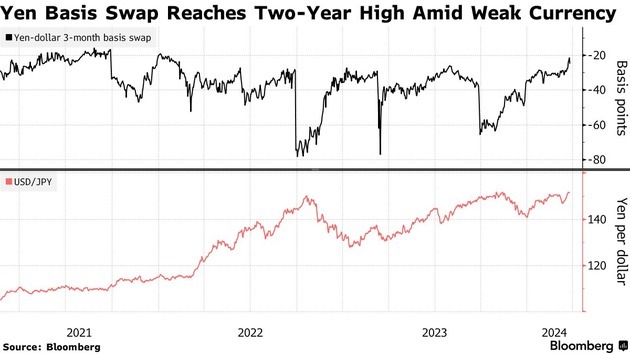

Worse for yen bulls, expectations of further weakening of the yen are becoming increasingly entrenched among investors. Last week, after the Bank of Japan raised interest rates while promising to maintain loose policies, the yen’s three-month basis swap reached a new high since January 2022 last week, indicating a decline in hedging demand and highlighting expectations of a softer yen.

Photo/Bloomberg

Japanese fund managers often use the yen’s three-month basis swap as a hedging tool to prevent the erosion of the value of overseas investments due to currency appreciation. In recent years, the yen has depreciated by nearly a quarter, making the purchase of overseas assets more expensive, and Japanese funds seeking high returns overseas have had a tough few years. As Japan maintained negative interest rates until this month, and some global central banks were eager to tighten policies to curb inflation, the cost of currency hedging soared. Signs of declining hedging demand suggest that local investors are less concerned about a significant rebound in the yen.

This morning, Naoki Tamura, a member of the Bank of Japan’s Policy Board, stated that managing monetary policy is crucial for achieving policy normalization and ending ultra-loose monetary policy slowly and steadily. Tamura, a former commercial bank executive seen as one of the hawkish members of the Bank of Japan, also noted that options traders are closely watching whether the USD/JPY will reach the key level of 152. Traders believe that breaking through this resistance level could exacerbate the yen’s decline, as investors holding reverse call options would need to cover a large number of short positions in USD/JPY.

Strategist: Only Aggressive Rate Hikes Can Bolster the Yen

As the Japanese yen hit a 34-year low, Japan’s Finance Minister Shunichi Suzuki expressed in Tokyo on Wednesday morning that the government is closely monitoring market trends with a heightened sense of urgency and may take “decisive steps.”

Earlier this week, Japan's top currency diplomat Masato Kanda also stated that it has not reflected fundamentals. On Monday (March 25), he told the media, “We will take appropriate measures to address the excessive depreciation of the yen, and we do not rule out any options.”

Kanda’s remarks are among the strongest warnings publicly issued by the authorities in recent years. Economists surveyed last week by Bloomberg still see monetary authorities holding off on intervention for now. In the meantime, a change in expectations over the timing of a rate cut by the Federal Reserve or another hike by the BOJ may shift the market dynamics. Meanwhile, any changes in expectations for a Federal Reserve rate cut or another rate hike by the Bank of Japan could also alter market dynamics.

Photo/Bloomberg

Furthermore, the Governor of the Bank of Japan, Kazuo Ueda, also stated that the bank will keep a close eye on exchange rate trends and their impact on Japan’s economy and price movements. In his speech to the Japanese parliament, he said, “The exchange rate affects the real economy most directly through changes in the demand for exports and imports. A real depreciation of the domestic currency makes exports more competitive abroad and imports less competitive domestically, thereby increasing demand for domestically produced goods."

Bank of America Corp. sees intervention risk rising if it reaches the 152-to-155 range, while a Bloomberg survey of economists found the median estimate of the yen level that would push the finance ministry to intervene is 155.

At present, the yen’s exchange market is clearly on edge: as the yen falls to a new 34-year low, not only has the risk of Japanese government intervention in the currency market significantly increased, but nearly 3 billion US dollars’ worth of USD/JPY options are about to expire, leaving traders anxious.

According to Bloomberg, traders have sold USD/JPY options expiring on March 28, with a strike price of 150.5 and a nominal value of 2.85 billion US dollars. This is the largest option expiry for USD/JPY since the beginning of the year at the Depository Trust & Clearing Corporation. If they need to hedge their positions, they would prefer as little volatility as possible, and comments from the Japanese Ministry of Finance could shatter this hope.

In fact, the yen has already caused traders much distress this year. Many hedge funds began buying options in 2024, which would appreciate if the USD/JPY fell, but in the first three weeks of the year, the USD/JPY rose by as much as 5.5%. Earlier this month, due to market speculation that the yen would strengthen after the Bank of Japan raised interest rates, they re-entered similar positions. However, as the Bank of Japan promised to maintain loose policies, the yen experienced a significant decline.

The BoJ ended its extraordinary easing, as expected, but USDJPY reached new YTD highs and is testing the 152 intervention “threathold.” In the absence of a deep US cutting cycle, only a steeper hiking cycle in Japan relative to current market pricing could afford lasting support to the yen. With yield differentials remaining wide, we expect USDJPY to remain within the 145-150 range throughout our forecast horizon,” Fiotakis wrote.

川公网安备 51019002001991号

川公网安备 51019002001991号