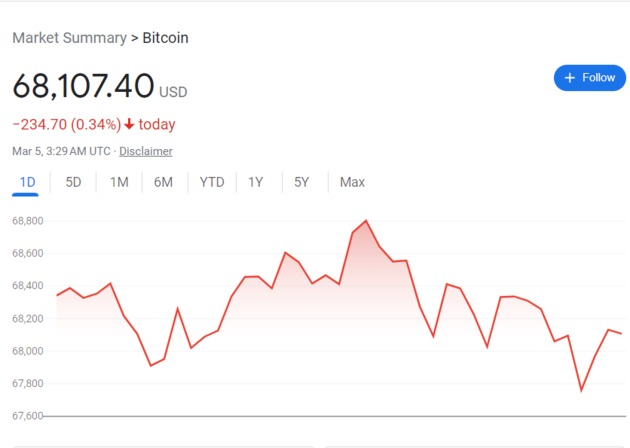

Photo/Google Finance

On the morning of March 5th, Beijing time, Bitcoin surged above $68,000, up approximately $6,800 in the past 24 hours, nearing its all-time high of $68,991.85 on November 10, 2011.

Notably, the significant volatility in Bitcoin prices led to liquidations for some speculative traders. According to CoinGlass data, the Bitcoin market witnessed liquidations totaling $152 million in the past 24 hours, affecting a total of 141,730 cryptocurrency traders, with a combined liquidation amount of $437 million.

Bitcoin has entered an accelerated upward phase this year. In just one month, Bitcoin’s price has surged by over 50%. When converted to Chinese yuan, Bitcoin briefly approached ¥500,000 per coin.

The upcoming Bitcoin “halving” event in April is expected to be a crucial catalyst for further price acceleration. The halving occurs approximately every four years and reduces the mining reward. On April 23, 2024, the block reward will decrease from 6.25 BTC to 3.125 BTC.

Historically, such supply reductions have favored Bitcoin prices. Ahead of the halving event in April, traders are flocking to the Bitcoin market in anticipation of profit opportunities during the supply reduction-induced price surge. However, the key trigger for the recent bull market was the approval of Bitcoin exchange-traded funds (ETFs) in January 2024. On January 11, the U.S. Securities and Exchange Commission (SEC) officially approved 11 Bitcoin spot ETF applications, including those from institutions like BlackRock.

This decision allows ordinary investors to conveniently buy and sell Bitcoin, similar to trading stocks and mutual funds. Prior to this, the cryptocurrency market was primarily dominated by individual investors, but the entry of major asset management firms signals a shift toward mainstream adoption. The ETF approval lowers the barrier to Bitcoin investment and attracts more institutional and retail investors. Additionally, listing approval enhances the legitimacy of crypto assets, further driving Bitcoin’s gradual price ascent.

Currently, the demand for Bitcoin spot ETFs significantly exceeds daily supply, resulting in a decoupling of supply and demand dynamics. On February 28, Bitcoin spot ETF purchases reached 11,211 coins, surpassing the daily mining capacity of 900 BTC. This divergence indicates that Bitcoin spot ETFs are drawing substantial capital into the cryptocurrency realm.

As Bitcoin’s price continues to climb, the question remains: Is there further upside potential? Experts believe that in the short term, Bitcoin’s price has significant room for further increases. Long-term prospects are also positive, as consensus around Bitcoin expands, leading more institutions and individuals to view it as an asset management and allocation tool. However, macroeconomic factors, including global monetary policies and inflation rates, can significantly impact Bitcoin’s price. While optimism prevails, potential investors should weigh the high returns against the underlying risks and avoid being swayed solely by FOMO (fear of missing out).

川公网安备 51019002001991号

川公网安备 51019002001991号