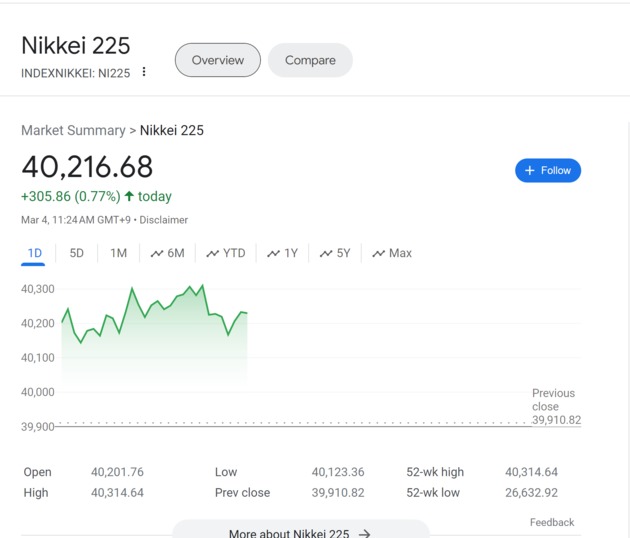

Photo/Google Finance

On March 4th, the Nikkei 225 index achieved a historic milestone by surpassing the 40,000-point mark for the first time during the opening session. As of press time, the Nikkei 225 had risen by 0.77%, reaching 40,216 points.

The driving force behind this surge lies in a piece of news: the Japanese government is contemplating formally ending deflation. For over two decades, Japan has grappled with deflationary pressures. Investors are now closely monitoring the possibility of Japan overcoming deflation, which could lead to a pivotal moment—the first interest rate hike by the Bank of Japan since 2007.

In fact, Japan’s stock market performance in 2023 has been remarkably robust. The Nikkei 225 index recorded a 28.24% annual gain, second only to the Nasdaq among major global indices, which saw a remarkable 43.42% surge.

Jesper Koll, an economist and advisor at the Japan Catalyst Fund, attributes the stock market’s strength to several factors. Firstly, Japanese stocks remain underpriced, making them appealing to value investors. Secondly, corporate profits are on the rise, with increased mergers and investments attracting both value and growth investors. Additionally, international investors from regions like the Middle East and Europe view Japan as an attractive investment destination. Koll even suggests that a reasonable prediction is for the Nikkei 225 index to climb to 55,000 points by the end of 2025.

Regarding the normalization of monetary policy, Koll emphasizes that it will have a positive impact on Japan’s stock market. This shift is not about tightening financial conditions or initiating a new round of rate hikes; rather, it signifies a return to normalcy in monetary policy. Specifically, it targets short-term interest rates. It’s essential to recognize that rising short-term rates and declining government bond yields would be beneficial for Japanese insurance companies and banks.

Jeffrey Young, former head of foreign exchange strategy at Citigroup and co-founder and CEO of DeepMacro, recently concluded a several-week research trip to Japan. In an interview with the NBD, he said, "The market currently expects the Bank of Japan (BOJ) to end its negative interest rate policy on April 26 or June 14. However, we believe it will be more likely in June, or even July, by which time Japanese interest rates could rise to 0%."

川公网安备 51019002001991号

川公网安备 51019002001991号