Photo/Zheng Yuhang (NBD)

Since last year, the US tech giants led by Nvidia and Microsoft have soared amid the boom and hype of generative AI, boosting the US stock market further. Data shows that the seven largest US stocks by market value in 2023 (Magnificent Seven) - Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, Tesla - contributed two-thirds of the increase for the S&P 500 index.

At the beginning of this month, the total market value of the “Magnificent Seven” reached 12.5 trillion US dollars, which is the sum of the market values of Japan, France and Britain. Among them, Nvidia, with its absolute dominance in the underlying infrastructure of generative AI - computing chips, continued to growth since the beginning of 2024, even surpassed Amazon and Google this week, becoming the third largest listed company in the US by market value.

However, behind the rapid growth of the “Magnificent Seven”, are the valuations reasonable and is there any risk in continuing to invest? In this regard, Daniel Ives, managing director and senior stock analyst at Wedbush, said in an email to NBD that “While the bears will continue to fret about tech valuations, we believe Street numbers (and valuations) for 24/25 will move higher as this AI spending tidal wave hits the tech industry. It's all about the use cases exploding which is driving this tech transformation being led by software and chips into 2024 and beyond and thus speaks to our tech bull thesis for 2024/2025.”

Market value of the US “Magnificent Seven” equals sum of Japan, France and Britain’s stock markets

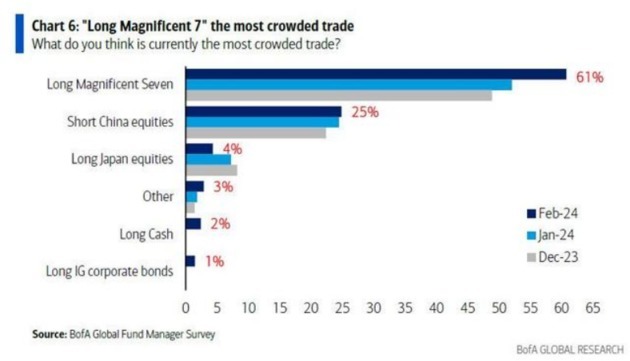

The latest monthly global fund manager survey by Bank of America shows that almost everyone on Wall Street is buying into the “Magnificent Seven”. In the survey, 61% of the fund managers surveyed said that buying US “Magnificent Seven” is the most crowded trade at the moment. The proportion of fund managers holding this view far exceeds the surveys in December last year and January this year.

For the leader of the US stock market, 41% of the managers surveyed said it was large-cap growth. 18% of the respondents said it was small-cap growth.

Photo/Bank of America

In fact, it is not surprising that funds are rushing to these “Magnificent Seven” - these seven companies contributed 45% of the increase for the S&P 500 index in the whole month of January, and their total market value reached 12.5 trillion US dollars at the beginning of this month, exceeding the GDP of international metropolises such as Tokyo and New York, and even equivalent to the sum of the market values of Japan, France and Britain.

It is not difficult to find that the growth of the “Magnificent Seven” market value is more or less related to the outbreak of generative AI. In addition to the “AI leader” Nvidia, cloud service providers Microsoft, Amazon and Google’s parent company Alphabet benefited from the growth of data center business driven by AI demand in 2023.

As for why the US “Magnificent Seven” can continue to grow, Daniel Ives, managing director and senior stock analyst at Wedbush, said in an email to NBD that “Heading into 2024 there was building hype and excitement for AI which we view as the biggest tech transformation since the start of the Internet. For the Street and the AI skeptics it all came down to "show me the money" and give me evidence of AI monetization. To this point, tech earnings season so far has delivered in Kelce-like fashion as the jaw dropping monetization and Copilot success seen at Redmond is the tip of the spear for AI across the broader tech industry as we predict $1 trillion of incremental tech spending over the next decade.”

Ives said that although the bears are still worried about the valuations of these AI tech companies, they believe that as AI spending continues to soar, Wall Street’s earnings data (and valuations) for fiscal year 2024-2025 will rise. He believes that this is all due to the explosive growth of AI applications, which will drive the technology transformation led by software and chips, and continue into 2024 and beyond, because we predict that 2024-2025 will still be a bull market for tech stocks.

“Based on our recent work in this field, we believe that within the next three years, more than 60% of Microsoft’s installed base will ultimately be used for AI functions in the enterprise/business sector, which will change Microsoft and its future prospects. Although AI applications will increase significantly in fiscal year 2024, for Microsoft, fiscal year 2025 will be the real turning point for AI growth.” Ives added in his email to the reporter.

At the same time, Ives predicted that “Google (Google Cloud Platform, GCP) and Amazon (AWS) cloud platforms are also expected to get huge development opportunities from this unprecedented AI wave in the next year to a year and a half. And from the perspective of AI chips, the beginning is Huang Renxun and Nvidia’s dominance, and then it is the second, third and fourth contention in this transformation.”

NBD also noticed that while funds are madly buying into the US “Magnificent Seven”, some analysts also pointed out that some of the individual companies are controversial.

For example, while other giants rose recently, Tesla fell, and the company also warned recently that the situation may not improve in the near future. After doubling its share price last year, Tesla has fallen 22% since the beginning of 2024, which is particularly eye-catching compared with Nvidia’s 46% increase and Meta’s 32% increase over the same period. In fact, Tesla has become the worst-performing stock among the “Magnificent Seven” since the beginning of the year.

Data compiled by Bloomberg shows that despite Tesla’s share price decline, the “Magnificent Seven” still have a record 29.5% weight in the S&P 500 index. Although Musk has been trying to position Tesla as an artificial intelligence company, the reality is that Tesla faces a series of unique challenges.

Matthew Maley, chief market strategist at Miller Tabak + Co, said, “Although Musk may disagree, investors do not treat Tesla as an artificial intelligence concept stock like they do the other six giants. The demand trend for Tesla products is fading, while the demand for those companies that are more closely linked to artificial intelligence is exploding.”

Among the Wall Street analysts covering Tesla, only about 33% of them recommend investors to buy Tesla shares, while the average proportion of the other six giants is 85%. In addition, in the past 12 months, analysts have cut Tesla’s average net profit forecast for 2024 by nearly half, while the earnings expectations of the other six giants have either been raised or remained flat.

In addition, the continued growth of the US “Magnificent Seven” has also raised concerns about “Internet 2.0” and excessive concentration. Bernstein analysts warned in a report that the valuations of the US “Magnificent Seven” are too extreme: “If these seven giants are truly unique, then their remarkable performance may be reasonable. Unfortunately, this is not the case, and instead there are more and more signs that investors’ enthusiasm for these seven stocks reflects the speculative, momentum-driven market of today.”

Goldman Sachs: European “11 giants” are more attractive than US “Magnificent Seven”

Looking at the global market, the US is not the only one that relies on a few giants to support its stock market.

Goldman Sachs recently released a report saying that the top 11 stocks by market value in Europe in 2020 have performed very well in recent years, and these “11 giants” (GRANOLAS) accounted for 60% of the total increase in European stocks in the past year, and their risk level is much lower than the US “Magnificent Seven”.

Goldman Sachs pointed out that considering the unique characteristics of these stocks, such as strong earnings growth, low volatility, high and stable profit margins, and robust balance sheets, it is expected that the European “11 giants” will dominate this round of stock market cycle.

Specifically, the European “11 giants” mentioned by Goldman Sachs are GlaxoSmithKline, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP and Sanofi. According to Goldman Sachs’ calculations, the total market value of the European “11 giants” exceeded 2.6 trillion euros, accounting for a quarter of the total market value of the Stoxx Europe 600 index, equivalent to the sum of the market values of heavyweight industries such as energy, basic resources, finance and automobiles in the index.

In summarizing the changing trends of the European market, Goldman Sachs pointed out that 20 years ago, it was traditional industries such as telecommunications and oil that led the market, while today it is consumer and pharmaceutical industries.

Goldman Sachs analyst Peter Oppenheimer wrote in a report to clients on February 12, “20 years ago, in early 2000, the 10 largest companies by market value in Europe were all telecommunications and oil companies, with only HSBC being an exception. And today, there are no banks, oil or telecommunications companies among the 10 largest companies by market value in Europe.”

In terms of performance, in the past 12 months, the European “11 giants” mentioned by Goldman Sachs had a total revenue of more than 500 billion US dollars, with an annual growth rate of 8%. And in the past year, the average share price increase of the European “11 giants” was 15%, far exceeding the 5% increase of the Stoxx Europe 600 index over the same period, and its contribution rate to the increase of the Stoxx Europe 600 index was about 60%.

What makes many investors envious is that the price-earnings ratio of the European “11 giants” is only 20 times. Although this is already a premium compared to the overall European market, this is the standard of growth companies, and compared with the 30 times price-earnings ratio of the US “Magnificent Seven”, it is equivalent to a 30% discount.

In addition, the average dividend yield of the European giants in the “GRANOLAS” list is 2.5%, which is much higher than the average dividend yield of 1.5% of the S&P 500 index constituents, and also makes the average dividend yield of 0.3% of the US “Magnificent Seven” pale in comparison.

Nevertheless, the European giants in the “GRANOLAS” are not without risks. Goldman Sachs pointed out that overall, the revenue of the European “11 giants” from Europe itself is less than 20%, so their performance is closely linked to the global market dynamics. Exchange rate fluctuations, especially the strength of the euro, may hit these giants harder than other European companies. In addition, the “11 giants” exposure to the US average of 37% will also bring tariff risks, especially if Trump wins the election again.

Disclaimer: The content and data of this article are for reference only and do not constitute investment advice. Please verify before using.

川公网安备 51019002001991号

川公网安备 51019002001991号