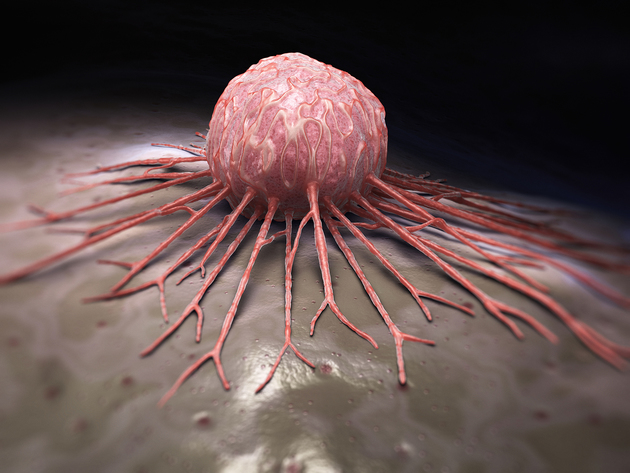

Photo/VCG

Tempest Therapeutics, Inc. (hereafter referred to as Tempest), a clinical-stage oncology company based in California, saw its stock price surge nearly 4000% in a single trading day on Wednesday, October 11th.

Photo/Tempest

The company’s market capitalization skyrocketed from less than $2.3 million to $130 million as a result of an influx of up to $500 million in funds.

Tempest was founded in 2011 and is a clinical-stage cancer company. On October 11th, Tempest announced the latest positive results from its global randomized clinical trial of TPST-1120, an oral selective PPARα small molecule antagonist.

The results showed that the “triple therapy” consisting of TPST-1120, atezolizumab (a humanized monoclonal antibody that blocks PD-L1), and bevacizumab (a vascular-targeting drug) significantly improved the progression-free survival (PFS) of patients with unresectable hepatocellular carcinoma (uHCC).

Compared to the “standard treatment” consisting of atezolizumab and bevacizumab, the “triple therapy” increased patients’ PFS by more than 60%. (Note: PFS refers to the “length of time during and after treatment for cancer or other diseases that a patient lives with the disease but it does not get worse.”)

William Blair analyst Matt Phelps said that due to investors’ skepticism about Tempest’s research results prior to this announcement, Tempest’s valuation was “almost unbelievably low” before the data was released.

He wrote in a report on Wednesday that “the company’s valuation is still clearly undervalued in terms of its opportunities for anti-liver cancer drugs.”

Bloomberg data shows that analysts covering Tempest are generally bullish on the company, with four analysts rating it as a buy.

In addition, the average of three target prices given by analysts for Tempest suggests that the stock could more than quadruple from its current level of $4 per share. HC Wainwright & Co. analyst Pan Ginis also expects Tempest to soar to a market value of around $770 million. However, Ginis said his valuation is based on a 25% probability of trial success, which he called “conservative.”

He raised his target price to $47 this week, which is the highest among the three analysts’ target prices. He believes that there is still huge upside potential for Tempest in the liver cancer treatment drug market and that the company’s drugs may become part of first-line treatment for liver cancer patients. As of this Friday, Tempest closed at $3.64.

According to statistics from the International Agency for Research on Cancer, more than 900,000 people worldwide were diagnosed with liver cancer and nearly 830,000 people died from liver cancer in 2020; assuming that current incidence and mortality rates remain unchanged, scientists estimate that there may be 1.4 million people diagnosed with liver cancer and 1.3 million people die from liver cancer by 2040. Research has shown that primary liver cancer is the sixth most common cancer and the fourth leading cause of cancer death worldwide.

From 2007 to 2016, the incidence rate of liver cancer increased at an annual rate of 2% to 3%, and the mortality rate also increased rapidly.

In recent years, it has gradually stabilized, but liver cancer is still one of the malignant tumors with the lowest five-year survival rate (18%), with more than 900,000 new cases of primary liver cancer in 2020 and approximately 830,000 deaths.

It is estimated that after 2025, more than one million people worldwide will be diagnosed with liver cancer each year.

川公网安备 51019002001991号

川公网安备 51019002001991号