LeTV and its founder Jia Yueting were ordered to pay 2.04 billion yuan to A-share investors, but LeTV has already left the A-share market with a dismal performance, and Jia Yueting himself is now engaged in Faraday Future (FF) car business in the United States. Can his overseas assets be executed to repay his debts?

In this regard, Li Jianbo, director of Xinhexin Law Firm, told National Business Daily (NBD) that creditors can seek recognition and execution of Chinese effective judgment documents by U.S. courts in accordance with Article 287 of the Civil Procedure Law. This provides a possible path for investors to recover compensation.

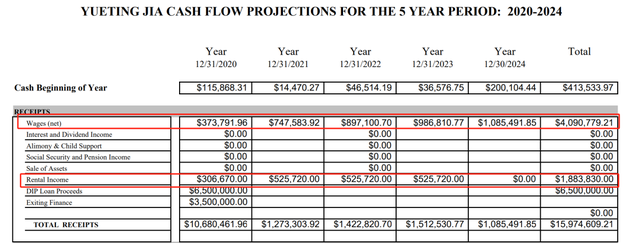

However, what is the situation of Jia Yueting’s assets in the United States? Jia Yueting had estimated his cash flow for 2020-2024, and by the end of 2024 he would have only more than $60,000 in cash. And among FF’s shareholders, Jia Yueting’s direct shareholding ratio is less than 1%. Does that mean he doesn’t have much assets in the United States either? The truth is not that simple.

Jia Yueting holds less than 1% stake in FF

To sort out Jia Yueting’s assets, his stake in FF is undoubtedly the most important.

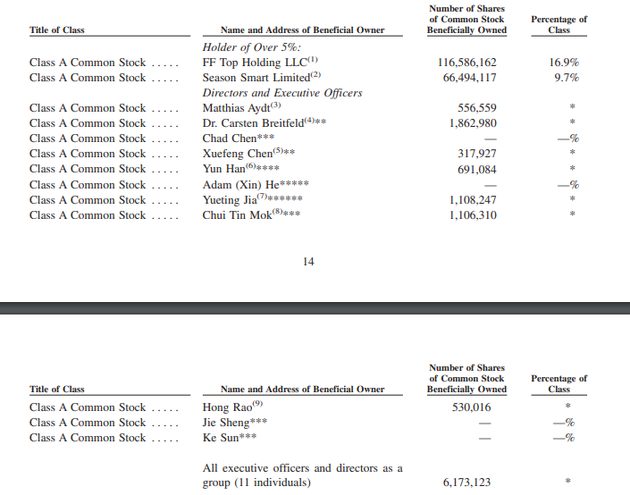

NBD found on the official website of the U.S. Securities and Exchange Commission (SEC) a proxy statement filed by FF in March this year, which disclosed information on beneficial ownership of its common stock as of February 3, 2023.

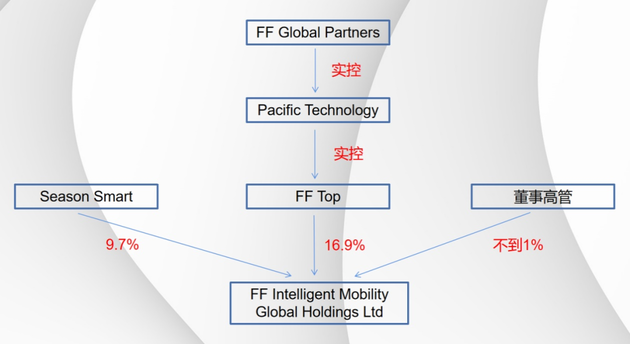

The document shows that FF Top Holding LLC is FF’s largest shareholder, holding 117 million shares of common stock, accounting for 16.9%; Evergrande Group’s indirect subsidiary Season Smart Limited is FF’s second largest shareholder, holding 66.4941 million shares of common stock, accounting for 9.7%.

Among directors and executives, Jia Yueting personally holds only 1.1082 million shares, former CEO Bi Fukang holds 1.863 million shares; current China CEO Chen Xuefeng holds 317.9 thousand shares; new global CEO Matthias Aydt holds 556.6 thousand shares, all four of them hold less than 1%. Overall, FF directors and executives (11 people) hold a total of 6.1731 million shares, accounting for less than 1%.

But in the latest document, FF did not disclose the specific equity structure of Pacific Technology, nor did it mention Jia Yueting’s creditor trust, only stating that “FF Global is Pacific Technology’s actual controller”.

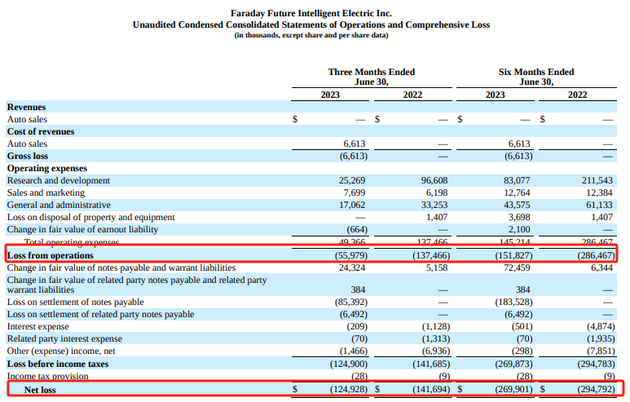

So what is FF’s current financial situation? The reporter checked the financial report and found that FF’s losses are narrowing. According to FF’s second quarter financial report for 2023 released by FF, FF’s operating loss for the quarter was $55.979 million, compared to a loss of $137 million in the same period last year; net loss for the second quarter was $125 million, compared to a loss of $142 million in the same period last year.

And FF’s cash balance is also gradually rising. As of June 30, 2023, FF’s cash balance was $17.893 million, compared to $16.968 million in the same period last year.

Besides FF, what are the sources of income of Jia Yueting?

In addition to equity, does Jia Yueting have any other sources of income?

On October 14, 2019, in order to get rid of debt disputes and accelerate equity financing, Jia Yueting, who was heavily indebted, applied for personal bankruptcy reorganization in the United States. According to the reorganization plan, he set up a creditor trust and transferred all his FF equity and related income rights into it.

NBD found on the bankruptcy company document management website Epig 11 that in the fourth revised bankruptcy reorganization disclosure statement regarding Jia Yueting approved by the U.S. Bankruptcy Court for the Central District of California on March 2020, Jia Yueting had estimated his cash flow for 2020-2024, and his income mainly came from two parts: one is salary, and the other is rent. And according to previous media reports, Jia Yueting has no deposits, cars, real estate or other assets in China.

Specifically, from 2020 to 2024, Jia Yueting’s net salary is expected to be about $373.8 thousand, $747.6 thousand, $897.1 thousand, $986.8 thousand and $1.0855 million respectively, totaling $4.0908 million.

As for rental income, from 2020 to 2023 it is expected to be $306.7 thousand, $525.7 thousand and $525.7 thousand respectively, totaling $1.8838 million.

During these five years, Jia Yueting’s total income is expected to be about $15.9746 million: in 2020, Jia Yueting’s average monthly income is estimated to be about $89 thousand; from 2021 to 2023, his monthly income is expected to be $106.1 thousand, $118.6 thousand and $126 thousand respectively; in 2024, due to less rental income, his monthly income is expected to drop to $90.5 thousand.

As for expenses, Jia Yueting’s personal expenses can be said to be not small. In 2020 and 2021, his personal expenses are estimated at $535.3 thousand each year; in 2022 this figure will reach $1.0768 million; in 2023 it will be $1.093 million; in 2024 it will be $1.1097 million. Among them, child support and parental support are $462 thousand per year.

In addition, Jia Yueting also has hundreds of thousands of dollars in legal fees and $6 thousand in business entertainment fees each year.

According to Jia Yueting’s cash flow forecast for 2020-2024 years, by the end of 2023 his personal net cash flow will be only $163.5 thousand and his cash balance at the end of the year will be $200.1 thousand. And by 2024 years due to less rental income his net cash flow will be -$130.2 thousand and his cash balance at the end of the year will be only $69.9 thousand.

How will Jia Yueting's overseas assets compensate A-share investors?

Can Jia Yueting's overseas assets be executed to repay his debts?

Li Jianbo said th NBD that creditors can seek recognition and execution of Chinese effective judgment documents by U.S. courts in accordance with Article 287 of the Civil Procedure Law. This provides a possible path for investors to recover compensation.

However, Li Jianbo also stated that if the defendant does not file an appeal within the appeal period, the first-instance judgment will take effect, and if the plaintiff applies, the execution process will begin. Currently, the first-instance judgment has not taken effect, and there is a possibility of a second trial.

Li Jianbo further explained to NBD that according to the provisions of the US bankruptcy law regarding debt restructuring, when Jia Yueting applies for personal bankruptcy protection in Delaware, USA, he may use this law to carry out debt restructuring, which may have an impact on creditors. "For example, because the bankruptcy process will determine how assets are distributed among creditors, Jia Yueting may negotiate a settlement plan in order to repay the debt in a more favorable way for himself. This may mean that creditors can only receive partial debt repayment or rearrange their debt structure."

"However, the specific bankruptcy restructuring plan needs to be approved by the relevant US court. If creditors do not agree with the plan, they can raise objections. In addition, if Jia Yueting's bankruptcy restructuring plan does not receive the consent of creditors or the approval of the court, he may need to take other measures to repay the debt. Therefore, whether Jia Yueting can protect his overseas assets through bankruptcy restructuring will depend on the specific circumstances of the case, the assets involved, and the decisions made in the bankruptcy process," Li Jianbo added.

川公网安备 51019002001991号

川公网安备 51019002001991号