Mar.22 (NBD) -- Home-made products have become a new consumption trend in China since last year. It's noted that the number of people who search for home-made products on T-mall increased 14.73 percent, according to a report released by the online retailer.

The trend is also seen in the cosmetics industry.

Shanghai Jahwa, a provider of daily-used chemical products, made "home-made" the theme of its coming brand meeting, trying to attract more consumers with local elements. Personal care company L'Oréal Group released the top 10 consumption trends last month, and "China Chic" was on the list.

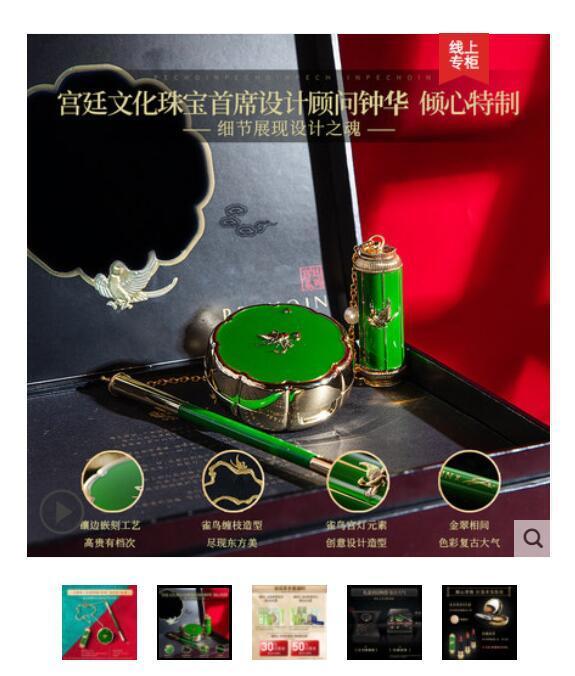

The crossover marketing of cosmetics and the Palace Museum is also an evidence of trend. Skin-care brand Pechoin once joined hands with jewelry designers of the Palace Museum to co-launch compact powder and make-up packages. Yue Sai, leading cosmetics brand on the high-end Chinese market, also released limited products together with a cultural creativity brand of the museum.

Photo/Tmall page of Pechoin

As the quality and marketing of home-made products improve, they become more attractive to consumers. More importantly, the changes of consumption habits and thoughts of the post-90s back the rise of home-made products.

The Internet makes people become more informed, which stops people to pursue big brands blindly. Guo Yunlong, deputy general manager of the e-commerce unit of Proya, said the rise of more brands means consumers value the functions of products more. In addition, the availability and high price-performance ratio of home-made cosmetics also win favor of youngsters in town.

Despite the growing popularity of home-made cosmetics, it is yet to be sure-footed on the global market. Taking a look at the global cosmetics market, it is found that local cosmetics brands are not appealing enough for international capital.

Zhen Tao, executive director of the cosmetic group of Fosun, noted that in the domestic market, most cosmetics companies gained investments from domestic companies. In contrast, in the international market, most cosmetics companies that draw investments are America, European or Japanese brands and they have been established for a long time.

Zhen believes that the "beauty" is largely defined by the west and international brands are advantageous in branding. Although the production of domestic brands can reach 80-90 percent of the international metric, those companies lag behind in management and packaging.

Photo/Shetuwang

Currently, China has become the second largest cosmetics market. Home-made cosmetics brands still stand a chance to catch up as they are advantageous in distribution, consumer insight, and marketing.

Shen Weiliang, general manager of domestic skin-care company OSM, told news platform Jiemian that the running modes and distribution of domestic cosmetics are different with that of international brands. It is hardly possible to develop customer satisfaction channel (CS channel) well in China with foreign philosophies.

However, it is worth noting that CS channel generates the most growth for the cosmetics industry except for e-commerce. For example, the growth of skin-care products on CS channel presented a growth of 23.6 percent last year, which is obviously a good sign. It is noted that many Sino-foreign joint ventures, such as Unilever and Shiseido are also deploying their own CS channels.

Riding the wave of home-made fever, Chinese elements will offer differential advantages for cosmetics brands. Shen noted that to rival foreign brands, Chinese companies can attract consumers with unique skin care products, such as the ones with traditional Chinese medicines and pearls.

Email: tanyuhan@nbd.com.cn

川公网安备 51019002001991号

川公网安备 51019002001991号