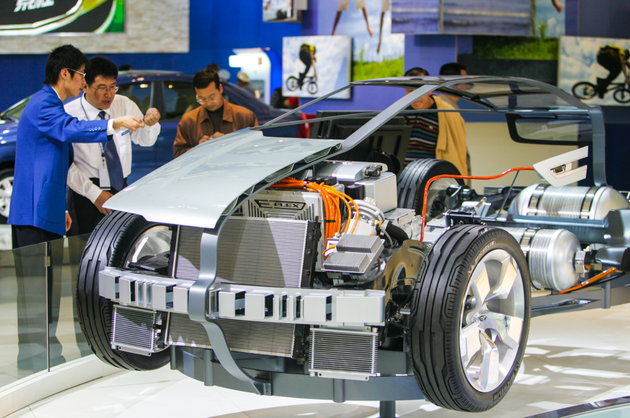

Photo/Dfic

Feb.18 (NBD) -- Contemporary Amperex Technology Co. Ltd. ("CATL"), supplier of electric vehicles batteries, is planning to expand capacity of its battery plant in Erfurt, eastern Germany, revealed Matthias Zentgraf, president of European Business at CATL in an auto seminar.

The annual output of the facility will increase by over sevenfold by 2026 from 14 GWh in 2022, making it the largest battery factory around the world.

Last July, the company entered into a partnership with the government of Thuringiato to supply lithium-ion batteries to car makers in the country. An investment of 240 million euros (275.7 million U.S. dollars) will be made in the first phase of the project to build a lithium-ion battery manufacturing plant. It will create 600 positions for the area and be put into operation in 2021.

BMW purchasing head Markus Duesmann said the carmaker is to source 4 billion euros (4.6 billion U.S. dollars) of battery cells from CATL over the next few years, with 1.5 billion euros (1.7 billion U.S. dollars) coming from the Erfurt site.

Apart from BMW, the production base will offer supporting services for other celebrated auto brands such as Volkswagen, Daimler, Jaguar Land Rover and Groupe PSA.

The number of pre-orders the plant receives continues to grow and the company hopes to gain leadership in the competition of battery production in Europe, Zentgraf introduced.

The new facility is the first step of CATL's foray into the region, Zeng Yuqun, chairman of the battery maker, noted, adding that CATL expects to serve all European OEMs in the future.

In fact, CATL's counterparts LG Chem and Samsung SDI also show their ambition for market expansion in Europe.

Last November, LG Chem reportedly injected 571 million U.S. dollars in its Polish facility that began manufacturing lithium-ion batteries from early 2018 in a bid to increase production capacity to 70GWh per year.

Samsung SDI's new electric vehicle battery factory with total investment reaching 800 million euros (918.8 million U.S. dollars) has been operational since the second quarter of 2018.

CATL's new move comes on the heels of the start of construction of Tesla's Shanghai Gigafactory in early January this year.

Japan's Panasonic, which is the supplier of power battery for the U.S. electric car firm, is one of the major rivals for CATL in the Asia market.

In an effort to compete with Panasonic, CATL teamed with Japanese vehicle maker Honda to develop an electric car. The collaboration mainly involves development of batteries and related technologies for the new model.

The product is seen as key to Honda's global strategy and is scheduled to debut in China and elsewhere in the first half of 2020.

While facing the fierce global rivalry, CATL sees sliding gross profit margin.

Due to rising costs of the raw material cobalt and falling battery product prices, the company's gross margin has declined from 43.71 percent in 2016 to 31.38 percent for the first three quarters of last year.

But the new research report from Shenwan Hongyuan Securities maintained bullish on CATL, pointing out that the core competitiveness of the new-energy vehicle battery manufacturing industry lies in technology and cost. For CATL, the energy density of its mass produced battery pack is higher than many other companies and it keeps relatively high gross margin by adopting the OEM model to reduce the supply cost.

Email: zhanglingxiao@nbd.com.cn

川公网安备 51019002001991号

川公网安备 51019002001991号