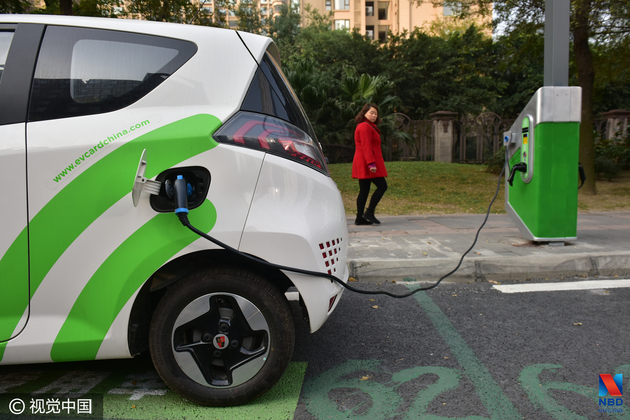

Photo/VCG

Although the growing market for new energy vehicles has intensified rivalry among power battery manufacturers, China remains at a technological disadvantage compared to the top-notch products of Japan and South Korea.

China's battery demand is estimated to grow to 31 Gwh this year, with a hope it can reach 125 Gwh within the next three years.

The surging market bringing opportunities to domestic manufacturers also challenges Chinese producers to increase their capacities and cement competitiveness in facing veteran conglomerates like Japan's Panasonic and South Korea's Samsung.

However, the major problem impeding development among domestic battery manufacturers is their tardy response to smart manufacturing.

"South Korea has raked in a substantial part of the investments used to install smart facilities for power batteries," said Liao Zhenggen, presidential assistant of Far East New Energy Co. Ltd.

According to him, although automation is well developed among domestic manufacturers, the lack of unified standards has left them somewhat disconnected in seizing the market advantage.

Some industrial insiders point out the root cause of less competitive domestic manufacturing lies with producers' insufficient involvement in research and development. As a result, they have to spend lavishly on purchasing equipment once it becomes apparent their capacity can hardly fulfill growing orders, not to mention their inability to establish systematic assembly lines with upstream partners.

Besides, the autarkic mindset shown by domestic manufacturers' unwillingness to share their technologies for fear of being accused of plagiarism impedes the inter-connection and inclusive growth of the industry.

However, China has issued more stringent rules to highlight inclusive development and manufacturing capabilities, especially, the smart manufacturing, which will lead to life-and-death competition for domestic producers .

As a result, a transformation is underway.

The Li-ion battery produced by Funeng Technology (Ganzhou) Co Ltd, a high-tech firm presided over by returned overseas doctorate Wang Yu, shows better energy density than those made by Panasonic for Tesla, for example. Since its partnership with BAIC Motors began in 2016, battery life has been extended to 300 kilometers and the figure is expected to reach 550 kilometers in 2018.

Despite its supply to the world's leading limousines, such as Mercedes-Benz and BMW, Funeng Tech has insisted on adopting domestic products, such as its cooperation with Sinsun Robot Automation Co Ltd, one of the country's leading robot manufacturers, to establish a smart processing line.

By providing its key technologies to the assembly line, Funeng Tech has lowered costs and removed the barriers that had been holding up connectivity in battery manufacturing.

And this endeavor of Funeng is no longer an exception.

Jiangxi-based DBK Co Ltd has worked with the US-based Hybrid Kinetic Motors Corp. in hope of developing a Li-ion battery made of graphene titanate, a material expected to further increase energy density, so that batteries can be fully charged within six minutes and repeat the charge-discharge cycles for about 20,000 times.

Because of its low voltage, the new battery, if it proves feasible, could have an edge over the widely-used ternary Li-ion batteries in regard to safety.

Besides, many domestic power battery producers are following their international counterparts to review different approaches in hope of inventing an all-solid battery that would prove non-combustible and not subject to corrosion and evaporation of leakage, substantially reducing the danger of spontaneous ignition.

At the end of 2016, the Ministry of Industry and Information Technology launched a standard, requiring power battery manufacturers to have a capacity of 8 Gwh, in hope that the top-end domestic manufacturers could become more competitive and keep low-end manufacturers at bay.

However, in 2017, the industry landscape looks more worrisome. There is a surplus in low-end capacity, yet high-end manufacturing can hardly fulfill market demand. A case in point is the vehicle doyen BYD, which reported a profit drop of 23.75 percent.

History may repeat itself as a fierce price war just like that the photovoltaic industry has undergone in the past few years is looming large in the battery industry, Liao warned.

Email: lansuying@nbd.com.cn

川公网安备 51019002001991号

川公网安备 51019002001991号