File photo/Zheng Yuhang (NBD)

In a recent interview with National Business Daily (NBD), Fitch Ratings' Chief Economist Brian Coulton warned that President-elect Trump's proposed tariffs could significantly impact the US economy. Trump announced a 25% tariff on all products from Mexico and Canada, prompting strong reactions from both countries, with Mexico threatening retaliatory tariffs and Canada considering similar measures.

Contrary to Trump's claims that the tariffs would create jobs, reduce the federal deficit, and lower food prices, a poll by The Guardian revealed that about half of Americans are unaware who pays the tariffs, indicating a lack of understanding of the consequences.

Coulton highlighted to NBD that if the new tariffs are implemented, they could be passed on to US consumers, increasing the cost of living.

He further explained that a significant increase in tariffs could lead to a short-term decrease in US GDP by 0.4%~0.8%. If trade partners reciprocate with higher tariffs, the GDP could drop by as much as 1.1%, a more prolonged effect. Referring to the US GDP of $27.36 trillion in 2023, even a 0.4% drop equates to a loss of about $109 billion annually, and a 1.1% drop translates to over $300 billion.

The National Retail Federation (NRF) study in November projected that Trump's tariff plan could cost US consumers up to $78 billion annually, affecting a wide range of consumer goods including clothing, toys, furniture, appliances, footwear, and travel goods. NRF's Vice President for Supply Chain and Customs Policy, Jonathan Gold, stated that tariffs would disproportionately burden low-income families.

Goldman Sachs' Chief Economist Jan Hatzius reported that Trump's proposed tariffs would lead to a significant rise in consumer prices. He estimated that a 1 percentage point increase in effective tariff rates would raise core PCE prices by 0.1%, suggesting a 0.9% increase if the tariffs are implemented.

The data shows that US core PCE grew by 2.8% year-on-year in October, already above the Federal Reserve's 2% target. Trump's tariffs are expected to further stoke inflation, complicating the Fed's rate-cutting path.

Deutsche Bank's Chief US Economist Matthew Luzzetti anticipates that the Fed will cut rates by 25 basis points in December and then pause, with inflation expectations likely to be revised higher.

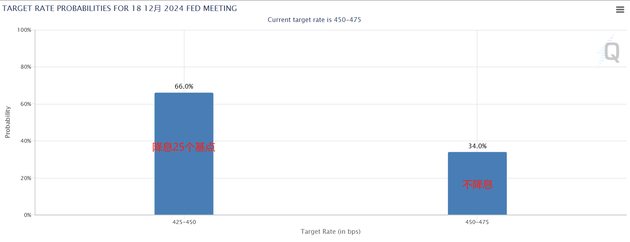

According to the CME's FedWatch tool, there is a 66% probability of a rate cut in December, with a 34% chance of rates remaining unchanged.

川公网安备 51019002001991号

川公网安备 51019002001991号