Photo/NBD

On June 13th local time, Apple Inc. regained its position as the world's most valuable company, surpassing Microsoft. This achievement is attributed to Apple's recent unveiling of its latest masterpiece in the field of artificial intelligence (AI), "Apple Intelligence," at the Worldwide Developers Conference (WWDC) a few days earlier. Starting from June 11th, Apple's stock price has surged for three consecutive trading days, demonstrating the market's firm confidence in Apple's AI strategy.

Daniel Ives, Managing Director at Wedbush Securities, predicted in an interview with NBD: "We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft." Although Microsoft is considered to have taken the lead in the generative AI field, and Apple's development in the AI field was relatively lagging before, now Wall Street's view of Apple is changing.

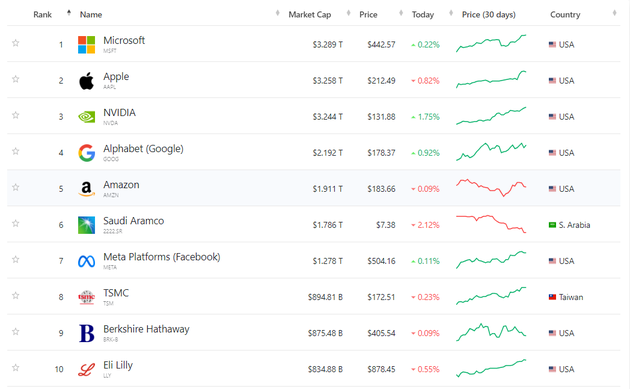

However, just one day later, Apple's "world's most valuable company" throne was replaced again. As of the close on the 14th, the top three US stock market values were: Microsoft, Apple, and Nvidia, with market values of $3.29 trillion, $3.26 trillion, and $3.24 trillion, respectively.

With AI at the heart of competition among these tech behemoths, the battle for the ‘market cap supremacy’ is intensifying. Now, with Apple, Microsoft, and NVIDIA all members of the exclusive $3 trillion market cap club, the question arises: who is the ‘Big Brother’ of U.S. stocks?

AI companies dominate the top 10 US stock market capitalization rankings, with global rankings constantly changing

As of the close of US stocks on the 13th, Apple's total market capitalization was approximately $3.29 trillion, surpassing Microsoft. This is the first time Apple's closing market capitalization has exceeded Microsoft's since January, and the ranking of large-cap stocks on Wall Street has been reshuffled again. However, on the 14th, Microsoft's market capitalization surpassed Apple again, reaching $3.29 trillion, while Apple's market capitalization fell to $3.26 trillion.

Currently, Microsoft, Apple, and Nvidia occupy the top three positions in the ranking of US stock market capitalization. With the three tech giants competing in AI, the battle for the title of "largest global market capitalization" has also entered a hottest stage.

Photo/companiesmarketcap.com

NBD noticed that among the top 10 US stock market capitalization rankings, as many as 8 companies are related to AI.

"People are very confident that they will be AI winners, and in this market, it seems that if you are an AI winner, you will be hyped up," said Rhys Williams, chief strategist at Wayve Capital Management. "Microsoft and Apple are both competing, and Nvidia is also in the game."

AI has played a major role in the three aforementioned companies' rise to the top three in terms of market capitalization.

On June 10th, Apple announced a new AI assistant named “Apple Intelligence” at its annual WWDC event. This assistant will be deeply integrated into various operating systems such as iOS, macOS, and visionOS, marking Apple’s official unveiling of its long-rumored AI capabilities. From June 11th to June 13th, Apple’s stock price saw a three-day rally, with an increase of over 10%, the largest since August 2020.

Photo/Yahoo Finance

The rivalry for the title of “America’s top stock” between the tech giant Microsoft and Apple has never ceased. Holding the star company OpenAI, Microsoft has been leading the generative AI market, shining brightly. With the GPT series models, Microsoft has launched and updated a series of applications: Microsoft 365, New Bing (Copilot), and Azure intelligent cloud, finding new breakthroughs for its revenue growth.

In January this year, Microsoft became the second company to reach a market value of $3 trillion, following Apple, marking a new milestone. Since then, Microsoft has repeatedly surpassed Apple, taking the top spot in Wall Street’s market value rankings. Before Apple reclaimed the number one spot on the 13th, Microsoft held that position. So far this year, Microsoft’s stock has risen close to 20%.

Photo/Yahoo Finance

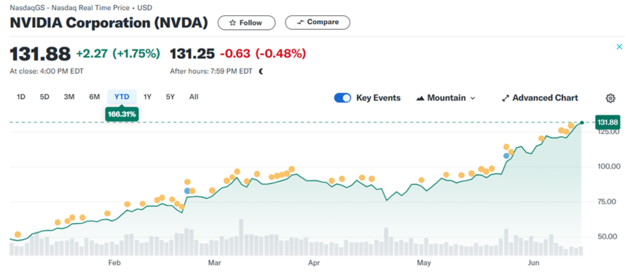

Outside of the “frenemy” relationship between Microsoft and Apple, NVIDIA has also joined the battle for the top market value on Wall Street. With the generative AI wave led by ChatGPT, NVIDIA has made remarkable achievements with its flagship GPUs. This year, NVIDIA’s stock price has already increased by over 160%, with last year’s increase nearing 240%.

Photo/Yahoo Finance

On June 5th this year, NVIDIA’s market value broke through the $3 trillion mark, joining the $3 trillion market value club. Looking back at NVIDIA’s market value journey, on May 30th last year, the company’s market value exceeded $1 trillion for the first time, becoming the first chip company in the US stock market to do so; on March 1st this year, NVIDIA surpassed the $2 trillion mark.

Just a year ago, NVIDIA’s market value was less than $1 trillion, ranking towards the end of the list of tech giants. From June 2023 to June 2024, NVIDIA’s market value achieved a leap from $1 trillion to $3 trillion.

The $4 Trillion Market Cap Race Heats Up: Who Will Be the ‘Big Brother’ of U.S. Stocks?

“We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft,” Daniel Ives, Managing Director at Wedbush, told NBD.

Despite Microsoft’s early lead in generative AI, Apple has been criticized for lacking a clear AI narrative, falling behind its competitors. However, a new voice in the debate over who is the ‘Big Brother’ of U.S. stocks is emerging on Wall Street.

This week, Apple’s market performance following the official announcement of “Apple Intelligence” signals a shift in attitude. On June 10th, due to Apple’s emphasis on Apple Intelligence at the WWDC, and with ChatGPT unexpectedly becoming just an auxiliary feature, Apple’s stock price fell by 2%.

Yet, the dramatic turn came the next day, with Apple’s stock surging by 7% to a historic high on June 11th. For a tech giant with a market cap exceeding $3 trillion, such a stark contrast in investor sentiment can only be attributed to one reason: in the era of large models, Apple may not be as far behind as commonly perceived.

“The delayed but positive reaction from Wall Street indicates that investors are beginning to fully understand that the AI revolution will materialize through Apple’s consumer devices in the next year,” says Ives. “Apple will create a new AI app store in the coming years, which will become the primary way consumers interact with generative AI. We believe this will be another major growth point for Apple in the coming years. Although Apple started late in the AI field, it has the world’s largest consumer base, giving Cook and his team a unique advantage in monetizing AI.”

As the global smartphone industry enters the AI era, Apple, with its solid ecosystem barriers, may be the only company capable of quickly integrating AI experiences and transitions across all hardware endpoints.

Meanwhile, Wall Street remains bullish on Microsoft. By improving product services with ChatGPT and exporting AI capabilities through cloud services, Microsoft has rapidly overtaken its competitors. Currently, Microsoft is also attempting to build its own AI empire. In recent months, Microsoft has been diversifying its bets, investing in startups globally and building its internal AI capabilities.

InvestorPlace believes that Microsoft’s Azure cloud business will benefit more from AI, becoming the next exciting venture. Microsoft is most likely to be the first company to break through the $4 trillion valuation. However, the road to $4 trillion may not be smooth for Microsoft at its current level.

For NVIDIA, the short-term outlook suggests that tech companies need to continue investing in computing power and resources, with chip demand remaining high. MarketWatch posits that NVIDIA’s GPUs are essentially the new gold/oil of the tech sector and could become the first stock to reach a $4 trillion market cap.

Yet, amidst the optimism, some analysts argue that neither closed-source models like ChatGPT nor open-source models from Meta and Google have yet to find a stable path to commercialization. Considering the price and market business models, as well as the tech giants’ move towards in-house chip development, NVIDIA’s future chip procurement presents uncertainties.

Apple took two years to grow from $1 trillion to $2 trillion in market value, Microsoft took two years and two months, while NVIDIA took only eight months. From $2 trillion to $3 trillion, Apple took one year and five months, Microsoft took two years and seven months, and NVIDIA took just over three months—104 days!

Jensen Huang of NVIDIA took less than a year to achieve what Tim Cook took three years and five months to accomplish, growing from $1 trillion to $3 trillion in market value. As the race to the $4 trillion market cap intensifies, the question remains: who will cross the finish line first?

川公网安备 51019002001991号

川公网安备 51019002001991号