File Photo/NBD

This year, the global economic recovery has driven prices of commodities like oil, gold, and silver to levels not seen in years.

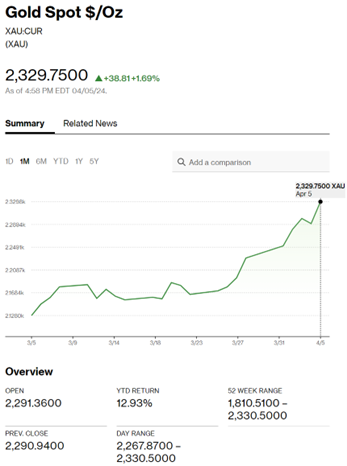

In April, fueled by expectations of Fed rate cuts and geopolitical tensions, commodities, especially gold, have surged. The COMEX June gold futures and London spot gold both broke through $2,300 per ounce this week, reaching historic highs. Additionally, Brent crude oil climbed above $90 per barrel for the first time in five months.

In stark contrast, U.S. stocks have underperformed since April, reflecting market concerns about resurging inflation. The ISM Manufacturing PMI recently exceeded 50 for the first time in 16 months, and March non-farm payroll numbers far exceeded expectations. Despite this, the Federal Reserve faces a conundrum: should they cut rates or hold steady?

In an email to National Business Daily (NBD), the team of Shamik Dhar, chief economist at New York Mellon Bank, pointed out that the main downside risk is a second wave of inflation, which could lead to another round of unexpected monetary tightening.

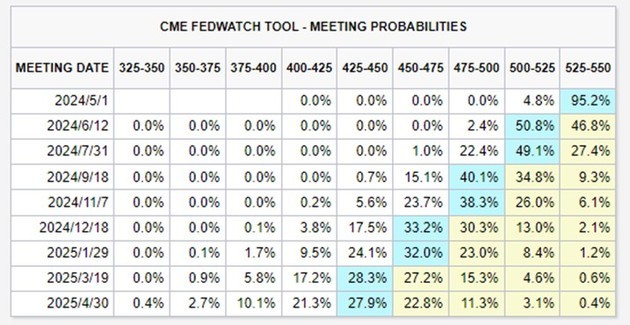

Fed Chairman Powell tried to ease market concerns this week by strengthening the prospect of rate cuts, but several Fed officials spoke out the next day, and some even said that there is a chance that there will be no rate cuts this year. After the release of the March non-farm payroll data, the CME Group's "Fed Watch" tool showed that as of press time, the futures market's bets on a Fed rate cut in June had fallen from about 63% before the non-farm data was released to 50.8%.

Gold Breaks $2,300, Brent Oil Tops $90 for First Time in Five Months

Gold prices have continued to rise this year. In March, the price of New York gold futures rose by 9.8%, the largest monthly increase in more than three years.

In April, gold prices hit new highs several times: on April 1, spot gold in London and COMEX gold both broke through the $2,260 and $2,280 mark, respectively; on April 3, the COMEX June gold futures price was reported at $2,315.0 per ounce, setting a new closing high for the fifth consecutive trading day; on April 4, spot gold also broke through $2,300 per ounce; on April 5, after a brief setback, spot gold broke through the $2,330 per ounce mark, and COMEX gold futures rose above $2,350 per ounce.

Photo/Bloomberg

With the continuous rise in gold, global commodity futures have also risen. Wind data shows that this week, COMEX silver rose as much as 10.77%, and LME zinc rose 7.5% for the week. LME nickel and LME copper rose more than 5% for the week.

The reason why the price of gold can rise sharply is supported by many factors, including the previous expectation of the Federal Reserve’s interest rate cut, the intensification of Middle East geopolitical conflicts, and the continuous increase in gold holdings by central banks in many countries.

However, NBD noticed that although the price of gold has repeatedly hit record highs, the holdings of global gold ETFs have been declining. Data compiled by ING Bank of the Netherlands shows that as of April 4, the holdings of gold ETFs have dropped from 856,000 ounces at the beginning of the year to about 820,000 ounces. ING believes that there is still a lot of room for buying gold at present, but investors may need to wait until the Federal Reserve really starts to cut interest rates before they swarm in.

A research report from Soochow Securities pointed out that the bull market in gold has not stopped, but the dependence on grand narratives and unattractive holding returns are testing the sustainability of the rise. If referring to the historical experience of gold breaking $1000 per ounce in 2009, $2400 per ounce may be an important resistance level.

Changes in the Middle East situation are also profoundly affecting the performance of the oil market. Not only that, OPEC+ also decided to maintain the current production cut plan on the same day, which indicates that the market supply will be tight in the future.

WTI crude oil rose 4.5% this week, reporting $86.91 per barrel, and Brent crude oil rose 4.22%, reporting $91.17 per barrel. This is the first time in five months that Brent crude oil has broken through the $90 mark. Next, the market focus will shift to the OPEC+ ministerial meeting held in June, and whether the production cut plan will be extended to the second half of the year will become the key to whether the oil price can break through three digits.

An article published on the CME official website on April 5 stated that due to recent attacks involving major oil-producing countries, geopolitical events are affecting oil supply. In the short term, the focus of the crude oil market is still on the tense situation in the Middle East. Next week, international oil prices will remain high and fluctuate. If the geopolitical situation continues to deteriorate, it is not ruled out that there will be a possibility of continuing to surge. It is expected that the mainstream operating range of WTI will be $83-88 per barrel, and the mainstream operating range of Brent will be $86-92 per barrel.

Rebecca Babin, a senior energy trader at CIBC Private Wealth US, believes that the escalation of tensions in Iran and Ukraine, coupled with OPEC+'s confirmation of production cuts until June, has driven the expansion of the increase. Babin also said that although the outlook for the next few months is positive, downside risks include OPEC+ possibly restoring some production, demand may weaken, and the Federal Reserve’s interest rate cut is lower than expected.

U.S. Stocks Sluggish, "Second Wave of Inflation is the Downside Risk"

In contrast to the strong performance of commodities, U.S. stocks started April on a weak note. Over the past month, U.S. stocks have continued to perform strongly overall: the Dow Jones Industrial Average rose by 2.08%, the Nasdaq Composite Index rose by 1.79%, and the S&P 500 Index rose by 3.1%.

This week, the Dow Jones Industrial Average fell for the first four days, the S&P 500 Index and the Nasdaq Composite Index both fell for three days, and all three major indexes rose on Friday. The Dow Jones Industrial Average fell by 2.27%, its biggest weekly decline since the week of March 10, 2023, the week Silicon Valley Bank collapsed; the Nasdaq Composite Index fell by 0.8%, down for two weeks in a row; the S&P 500 Index fell by 0.95%, its second-biggest weekly decline of the year after the first week of the new year, and its fifth weekly decline in the 14 weeks since the start of the year.

In response to the sluggishness of U.S. stocks since the beginning of the second quarter, a team led by Shamik Dhar, chief economist at New York Mellon Bank, pointed out in an email to NBD that as U.S. inflation slows, U.S. stocks have lost some of their attraction. However, we expect U.S. stock earnings growth to start supporting a rebound, but valuation expansion may be limited by rising interest rates. Dhar believes that the main downside risk is a second wave of inflation (which we estimate to have a 20% probability), which could lead to another round of unexpected monetary tightening.

Behind the decline in U.S. stocks is actually the market's concern about the resurgence of U.S. inflation and the weakening of expectations for interest rate cuts.

The U.S. Institute for Supply Management (ISM) manufacturing PMI for March, released earlier this week, was 50.3, far exceeding economists' expectations of 48.4, and the first time in 16 months that it has exceeded the critical 50 mark.

On April 5, data released by the U.S. Bureau of Labor Statistics showed that non-farm payrolls in the U.S. surged by 303,000 in March, the largest increase since May last year, exceeding all analysts' expectations. In addition, the unemployment rate fell slightly from 3.9% in February to 3.8% in March, as expected. So far, the unemployment rate has remained below 4% for 26 consecutive months, the longest streak since the late 1960s. According to the "Phillips Curve" theory, the decline in the U.S. unemployment rate indicates that the Fed's work to combat inflation is not over yet.

The Federal Reserve is in dilemma: to cut or raise interest rates?

The expansion of the manufacturing industry, the unexpected surge in the number of non-farm jobs added in March, and the decline in the unemployment rate all indicate that the labor market is still active, seemingly providing support for the view that “the Fed is not in a hurry to cut interest rates.”

Brian Coulton, Chief Economist at Fitch Ratings, said in an email to NBD that "another strong expansion in payrolls suggests there is no slowdown in labor demand growth. The average jobs gain over the last 3 months has been 276,000, well above trend and well above pre-pandemic rates. Moreover the gap that had been opening up with the household measure of employment has narrowed, as the latter saw a huge 498,000 jump in March. There is not much evidence of labor market imbalances improving either – the unemployment rate went down and wage growth on a three-month-on-three month annualized basis picked up to 4.4%, the fast rate since last September. Nothing in this print to unlock ‘greater confidence’ in disinflation at the Fed."

Federal Reserve Chairman Powell tried to alleviate external concerns about the signs of inflation rebounding that might suppress the space for interest rate cuts within the year, but subsequently, many senior officials of the Federal Reserve spoke intensively, believing that the current U.S. inflation is still too high. The Fed needs to see more progress in inflation before cutting interest rates and is not in a hurry to cut interest rates. Neel Kashkari, the Minneapolis Fed President who predicted two rate cuts this year in March, believes that the Fed may not cut rates at all this year.

After the release of the non-farm employment data in March, the “Fed Watch” tool of the Chicago Mercantile Exchange showed that as of press time, the futures market’s bets on the Fed’s June rate cut have dropped from about 63% before the non-farm data was released to 50.8%. The expected total number of rate cuts within the year is still four times, consistent with before the release of the non-farm data.

Photo/CME

川公网安备 51019002001991号

川公网安备 51019002001991号