Photo/Zhang Jian (NBD)

Tesla's production and delivery report for the first quarter of 2024 was released before the market opened on Tuesday, April 2, Eastern Time, shocked the market.

During the reporting period, Tesla delivered a total of 386,810 vehicles, which was far lower than the average analyst expectation of 449,080 vehicles, the largest deviation from expectations in history. This is also the first time since the third quarter of 2022 that Tesla's deliveries have fallen below the 400,000 mark, and the first time since the second quarter of 2020 that they have fallen year-on-year, down more than 8.5% from 422,875 deliveries in the first quarter of last year.

Daniel Ives, managing director and senior equity analyst at Wedbush, said in an email to NBD, "While we were anticipating a bad 1Q, this was an unmitigated disaster 1Q that is hard to explain away. We view this as a seminal moment in the Tesla story for Musk to either turn this around and reverse the black eye 1Q performance. Otherwise, some darker days could clearly be ahead that could disrupt the long-term Tesla narrative."

Affected by the delivery data, Tesla fell 4.9% on Tuesday, and its market value evaporated by 27.36 billion US dollars (about 198 billion yuan) in a single trading day. Over the entire first quarter, Tesla's stock price fell by 29%, the largest quarterly decline since its IPO in 2010. However, Cathie Wood, known as the "female Buffett", was not deterred by Tesla's sharp decline and instead increased her position. According to the trading information released daily by its Ark Fund, Ark Fund bought a total of 234,998 Tesla shares through three actively managed ETFs on the day. Calculated at Tesla's closing price on the day, the transaction value was about 39.16 million US dollars.

Currently, Musk is planning to launch an electric car priced at $25,000. The new car is reportedly going to use a new process called "unbox," which is different from the traditional assembly line operation mode. The new process is more like "assembling Lego blocks." If successful, the process will revolutionize the automotive manufacturing industry.

Deliveries greatly falls behind expectations

In specifics, Tesla produced a total of 412,376 Model 3/Y vehicles in the first quarter, with 369,783 vehicles delivered. The total production of other models (Model S/X) was 20,995, with 17,027 delivered.

According to a CNBC report, Tesla’s Q1 deliveries were even lower than the most pessimistic analyst expectations. Based on the average estimate compiled by FactSet from 11 analysts, it was expected that Tesla would deliver a total of 457,000 vehicles in the entire first quarter. The 11 analysts’ estimates for Tesla’s Q1 deliveries ranged from 414,000 to 511,000 vehicles. Independent automotive industry researcher Troy Teslike, closely watched by Tesla fans, had predicted deliveries would be around 409,000 vehicles.

Over the weekend, Tesla’s Investor Relations Director, Martin Viecha, sent some investors the company’s consensus expectations compiled based on the forecasts of 30 analysts: the average expectation for this quarter’s deliveries was 443,027 vehicles, with a median of 431,125 vehicles.

As can be seen, the actual delivery data of less than 387,000 vehicles in the first quarter was much lower than expected. Tesla is scheduled to hold an earnings call on April 23, Eastern Time, to discuss Q1 performance.

Deutsche Bank analyst Emmanuel Rosner wrote in a report: “The difference between deliveries and production means that Tesla has about 46,000 vehicles in inventory, which suggests that in addition to the known production bottlenecks at Fremont and Berlin factories, Tesla may also have serious demand issues.”

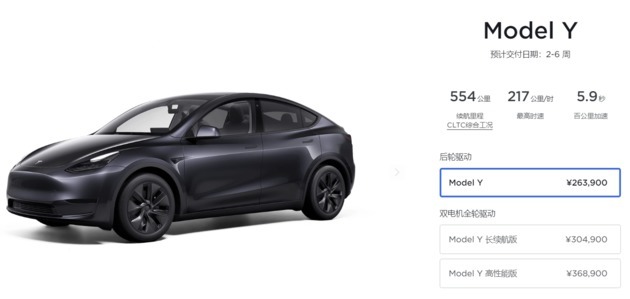

Photo/ Tesla China Official Website

NBD noticed that before the delivery report was released, Tesla raised the price of all Model Y models in the U.S. market by $1,000. Earlier this week in the Chinese market, Tesla also raised the price of the Model Y Long Range and Performance versions by 5,000 yuan each, with the current prices of the Model Y Long Range and Performance versions being 304,900 yuan and 368,900 yuan respectively.

In response, Rosner said, “Although, as previously expected, Tesla has raised prices in the U.S. and Chinese markets, we believe Tesla may have to drop back to previous prices, which poses further downside risk to the average selling price for the rest of the year.”

Tesla embattled

Tesla has had a tumultuous first quarter.

In January, the Red Sea crisis disrupted Tesla’s parts supply and temporarily halted production at its Berlin factory. In March, environmental activists set fire to infrastructure near the same factory, depriving Tesla of sufficient operational capacity and causing production to stop again. Additionally, Tesla stated in a declaration that the decline in sales was partly due to the early stage of Model 3 production after the upgrade of its Fremont factory, as well as the rerouting of transportation caused by the Red Sea conflict and the arson attack on the Berlin Gigafactory leading to factory shutdowns.

In the Chinese market, Tesla is facing fierce competition from many car companies, including the old car company BYD and the “new electric car player” Xiaomi. In January and February of this year, Tesla’s sales in the Chinese market were sluggish. Subsequently, Tesla reduced the production of Model 3 and Model Y at its Shanghai factory and shortened workers’ working hours from six and a half days a week to five days.

In the domestic US market, people’s evaluations of Tesla’s electric pickup truck, Cybertruck, are mixed. CNBC reported that for Tesla, a series of discounts and incentives seem to be less effective in driving sales than before. Reuters cited survey data from Caliber reporting that in the first quarter of this year, Tesla’s potential customer base in the United States is shrinking. The report believes that this decline is partly attributed to Musk’s personal image.

Daniel Ives pointed out in an email to reporters, “For Tesla, the delivery data for the first quarter is a nightmare, and the demand in the Chinese market was very weak at the beginning of this year. Unlike before, Tesla’s lackluster performance growth this quarter is due to compressed profit margins, increasingly fierce competition, and other factors. The criticism of Tesla from the outside world is reasonable. For Musk, he must get Tesla through this turbulent period, otherwise more troublesome days will come. With the continuous deterioration of profit margins, capacity, and other macro events, Musk needs to make improvements as soon as possible to regain confidence in Tesla in the next few important quarters.”

Even though he considers Tesla’s first-quarter delivery to be an “absolute disaster,” Daniel Ives still maintains a OUTPERFPRM rating for Tesla.

“Tesla’s new vehicle strategy: the revolutionary ‘Unbox’ assembly process”

Tesla is planning a new vehicle that will adopt a novel “unbox” assembly process. Despite the widespread price reduction in new energy vehicles, Tesla has chosen to raise prices. However, Tesla is also planning to launch an electric car priced at $25,000 to increase its market share.

In a financial report conference call in January, Musk stated that Tesla has “come a long way” in the manufacture of affordable cars. The new $25,000 car will use a “revolutionary manufacturing system” that is “far more advanced than any car manufacturing system in the world, and significantly ahead.” However, he did not provide any specific details.

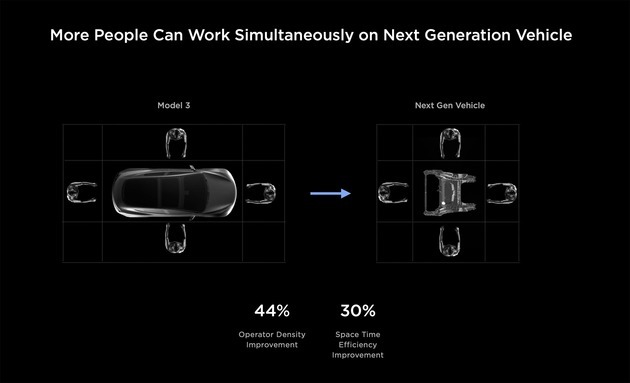

According to a recent Bloomberg report, Tesla is gradually transitioning to a new process called “unbox.” Unlike the traditional assembly line operation, this new process is more like “assembling Lego blocks”: the car body does not need to be assembled piece by piece on a conveyor belt as before. Tesla plans to assemble different parts of the vehicle in a dedicated area of the factory at the same time, and finally assemble these large sub-assemblies together.

Tesla stated that if the new assembly process is successful, compared with traditional car factories with the same output, this new process is expected to halve production costs and reduce the land area required for manufacturing by more than 40%. Lars Moravy, Vice President of Tesla Automotive Engineering, stated at Investor Day in March 2023: “If we want to scale up the way we want, we must rethink manufacturing.”

Photo/Bloomberg

Mathew Vachaparampil, CEO of engineering and automotive benchmarking company Caresoft, revealed that their engineers spent 200,000 hours building a digital simulation of Tesla’s “unbox” assembly method, proving the technical feasibility of this process. Once successfully implemented, this process will save Tesla a lot of manufacturing costs and have “significant financial significance.”

For example, in all car factories, painting has always been the most expensive part. The high temperature required for car painting is energy-intensive and has strict emission requirements. Car factory experts pointed out that the throughput of the painting workshop largely determines the total output of the factory.

Tesla’s “unbox” process will not send the entire rectangular body to the paint shop, but will paint accordingly before the car is assembled. Caresoft predicts that with Tesla’s new process, the investment in the paint shop of the new factory alone can be reduced by at least 50%.

However, it should be pointed out that this is not the first time that Tesla has made major changes and disrupted the automotive manufacturing industry. Previously in the production of Model Y, Tesla did not choose to stamp various parts, but used a die-casting machine to directly die-cast the front and rear of the vehicle, eliminating the need for hundreds of parts and welds, and even sparked the pursuit of integrated die-casting in the industry.

In addition to the new electric car priced at $25,000, recently, the much-anticipated Tesla Model 3 high-performance version - the Ludicrous model’s uncamouflaged real car pictures have finally surfaced. This new car is boldly displayed in the public eye with three distinct colors, seemingly indicating that it will soon officially land on the market and meet with a large number of car fans.

Photo/Teslarati

川公网安备 51019002001991号

川公网安备 51019002001991号