Photo/Hao Shuai (NBD)

In March 2022, Takahashi Island (pseudonym), a man in his early 50s, resigned from his job at a company in Japan. This decision was somewhat surprising, as Japan has an aging population and many people over 60 continue to work.

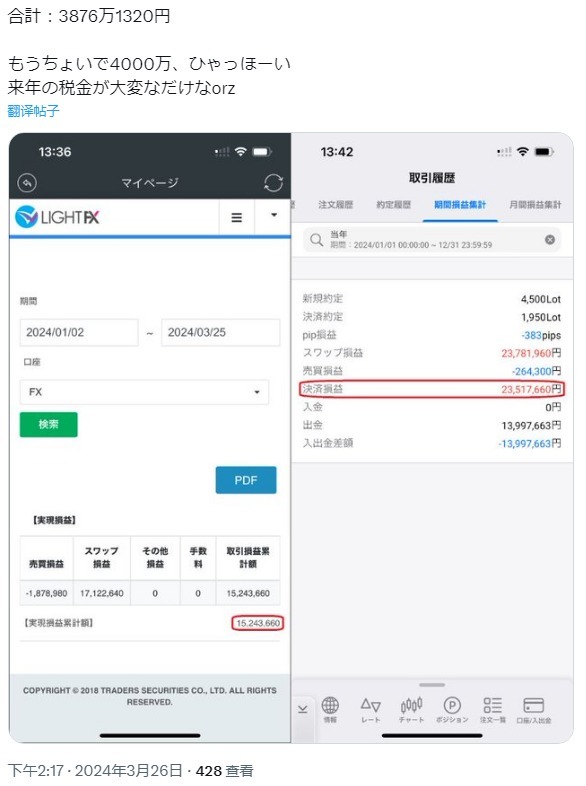

Takahashi was able to retire early because of his success in forex trading. By using 10x leverage and taking advantage of market movements, he was able to make over 38 million yen (about $340,000) in profits in just three months.

Takahashi is not the only one who is making money from forex trading. In fact, there is a growing trend of middle-aged men in Japan who are using forex trading apps to speculate on the currency. These "Mrs. Watanabe" traders now control a massive $80 trillion in assets.

On March 19, the Bank of Japan officially end its eight-year negative interest rate policy. On March 27, the yen hit a new low since the collapse of Japan's asset bubble in July 1990, and Japanese Finance Minister Shunichi Suzuki has released an intervention signal.

In this regard, Shigeto Nagai, chief Japanese economist at Oxford Economics, told NBD that so far foreign investors have interpreted the BoJ’s message on March 19th as dovish which has resulted in the weakening of the yen.

"We project the zero-interest rate policy will continue for another year and rate hikes in the following years will be gradual and limited," Takeshi added.

If the yen continues to weaken, what will happen to Japan's huge foreign exchange market and overseas assets that account for more than 70% of GDP?

“Mrs. Watanabe” resurfaced, propelling an $80 trillion market

On March 26, a trader named Takahashi shared screenshots of his profits on various forex trading platforms. As of March 25, his total arbitrage gains from all his forex positions exceeded 38 million Japanese yen.

Photo/X

Takahashi primarily engages in arbitrage trading between the Mexican peso and the Japanese yen, as well as the South African rand and the Japanese yen. On a Japanese forex trading platform called “FXダイレクト,” he disclosed his trading activity from February 1 to March 21. During this period, he purchased a total of 630,000 Mexican pesos, which, based on the exchange rate of 1 peso to 9.1369 yen as of press time, amounted to approximately 5.756 million yen. These Mexican pesos helped him achieve a profit of over 200,000 yen.

The resurgence of interest in yen-based carry trades comes after a series of interest rate hikes by the Federal Reserve, highlighting the yield differential between the Japanese yen and the US dollar. Traditionally, carry trades involve borrowing yen at low rates to invest in higher-yielding assets elsewhere, aiming for substantial returns.

The term “Mrs. Watanabe” originally referred to Japanese housewives who engaged in forex trading. However, nowadays, this group mainly consists of middle-aged men trading through apps, capitalizing on intraday currency market volatility.

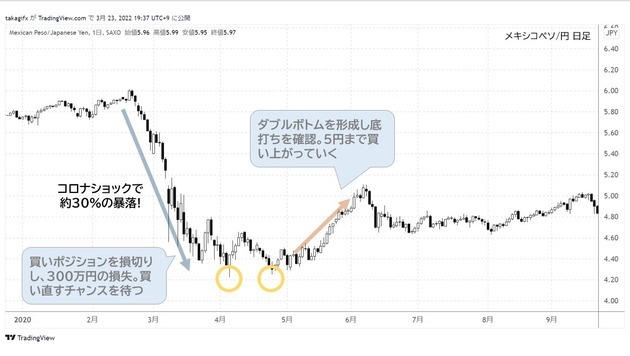

Takahashi, like many retail investors, entered the forex market in 2018 for carry trade opportunities. His initial investment in the Turkish lira faced challenges due to a subsequent depreciation. However, he shifted his focus to the Mexican peso against the yen, leveraging up to 10 times. During April to May 2020, when the peso hit a low against the yen, Takahashi continued buying. He stated, “I regularly purchased 250,000 pesos every Monday at 10 a.m., even during market downturns. In total, I’ve invested 52 million yen, generating passive income of 36,000 yen per day.”

Photo/TradingView

Investors like Takahashi have become a significant force driving Japan's forex trading volume. According to data from the Japan Financial Futures Association, retail forex trading in 2023 remained close to the historical high of $8 trillion in 2022, with Japan accounting for approximately 30% of global retail forex trading.

On March 19, the Bank of Japan officially ended its eight-year-long negative interest rate policy by raising rates by 10 basis points. This policy shift has added uncertainty to the yen’s trajectory and has implications for the massive trading community in Japan.

As the yen depreciates, the stock market also responds. The fate of the yen, as well as the behavior and asset allocation of investors like "Mrs. Watanabe," remains closely tied to macroeconomic and structural forces. While the end of negative rates hasn’t shaken Takahashi’s investment strategy, it remains to be seen how the yen will evolve in the face of changing global interest rate cycles.

34-year low! Will Japanese Yen continue to depreciate?

Opinions on the yen's future trajectory are divided.

Some analysts believe that the yen's depreciation will be limited. Christopher Willcox, Head of Trading and Investment Banking at Nomura Holdings, predicts that the yen will strengthen against the US dollar later this year. He suggests that the USD/JPY exchange rate could return to 1 US dollar to 140 Japanese yen, driven by the Federal Reserve's accommodative monetary policy and Japan's tightening measures.

On the other hand, there are views that as the Bank of Japan raises interest rates, the yen's depreciation could intensify. For instance, Goldman Sachs has revised its expectations for the USD/JPY exchange rate, anticipating pressure on the yen due to favorable macroeconomic conditions in the coming months. They state that "over time, the moderate macro risk environment should weigh on the yen. We also do not believe that cautious rate cuts by the Federal Reserve, driven by cooling inflation, will boost the yen. The adjustment in rate expectations has reduced the likelihood of recession risk, which typically activates the yen’s safe-haven appeal."

On March 27, the USD/JPY exchange rate briefly touched 1 US dollar to 151.972 Japanese yen, marking a new low since the burst of Japan’s asset bubble in July 1990, seemingly confirming the second viewpoint.

Oxford Economics' Chief Japan Economist, Shigeto Nagai, shared a similar perspective during an interview with NBD. He believes that so far foreign investors have interpreted the BoJ’s message as dovish which has resulted in the weakening of the yen.

Considering the Federal Reserve's actions is crucial for understanding the yen's trajectory. Nagai adds, "We think over the medium term, some yen appreciation is likely, but it's too early to have an outright bullish yen view, and this may only take shape after the Fed has actually begun its rate cutting rates starting later this year."

He further explains, "The timing of the first rate cut remains uncertain, and even if there are three rate cuts, it does not fundamentally constitute an easing cycle but rather a normalization cycle. This means that the macro and structural forces causing yen weakness will persist for most of this year."

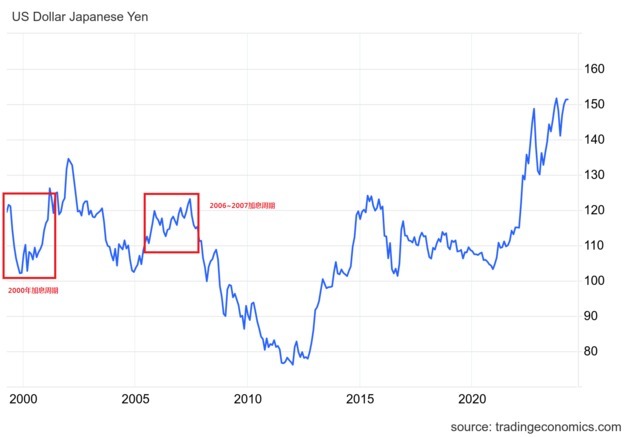

Comparing the yen's behavior during previous Japanese central bank rate hikes reveals interesting patterns. After the Bank of Japan raised rates in August 2000, the yen initially appreciated by 5% but soon entered a depreciation cycle. Similarly, after rate hikes in July 2006 and February 2007, the yen experienced a period of appreciation lasting nearly five years, accumulating a total gain of nearly 40%.

Photo/Trading Economics

Regarding the “Watanabe wives,” Nagai suggests that if the yen appreciates significantly over the long term, these investors’ behavior and asset allocation strategies may need to change, although this transformation has not yet materialized.

Currently, the end of the negative interest rate policy does not appear to shake Hiromi Takahashi’s investment strategy. He continues to actively share his trading insights on the FX Direct platform, where many others follow suit.

Nagai concludes,“For the yen to appreciate substantially over the longer term, some tectonic plates need to shift in terms of investor behaviour and asset allocation, and we do not think we are there yet.”

Currently, the end of the negative interest rate policy doesn’t seem to have shaken Takahashi’s investment strategy. He remains active on the X platform, sharing his trading insights. NBD noticed that there are many others like him on the FX Direct forex trading platform.

"We project the zero-interest rate policy will continue for another year and rate hikes in the following years will be gradual and limited. Even as the turn in the global rate cycle begins in the summer, the greenback's status as one of the top carry currencies in G10 – even if the gap has narrowed recently – will buttress it in the near term, " Nagai added.

Foreign demand and economic recovery will continue to drive Japanese stocks

Following the logic of yen depreciation, the other end of the chain reaction is the Japanese stock market.

Since the beginning of this year, the Japanese stock market has been bullish. On March 4, the benchmark index of the Japanese stock market, the Nikkei 225, hit the 40,000-point mark, a record high. This is the second time that the Japanese stock market has broken through a key level, following the Nikkei 225 index's recovery of its December 1989 high on February 22.

Last year, the Japanese stock market had already experienced a round of rapid growth. Naoyuki Yoshino, former president of the Asian Development Bank Institute, told NBD in an interview at the time that the sharp rise in the Japanese stock market was related to the large amount of foreign capital flowing into the market, and ultimately pointed to the major factor of yen depreciation. With the United States and European countries tightening monetary policy, Japanese stocks have become a safe haven for foreign investors.

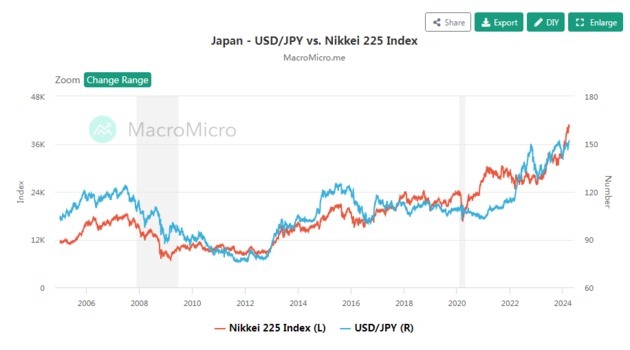

NBD noticed that by comparing the historical trends of the Nikkei 225 index and the yen, it can be seen that the Japanese stock market often rises during the period of yen depreciation. From this point of view, the trend of the yen may determine the views of investors on Japanese stocks.

Photo/ MacroMicro.me

NBD checked data released by the Japan Exchange Group and found that in recent years, foreign capital has dominated the trading activity of Japanese stocks, accounting for about 60% of the total trading volume and trading value.

With the Bank of Japan exiting its negative interest rate policy, how will foreign investors interpret this policy? Will there be any changes in their investment in Japanese stocks?

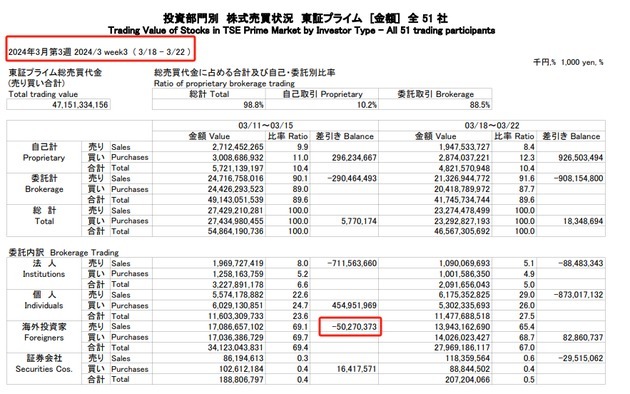

According to the latest trading data released by the Japan Exchange Group for the week of March 18-22, foreign investors had a small net outflow during the week, with a total net sell-off of 50.27 million yen. However, NBD also noticed that in previous weeks, foreign investors also occasionally sold off in different amounts.

Foreign capital outflows for the week of March 18-22

Photo/Japan Exchange Group

Based on the judgment that the weak yen trend will continue for the time being, Shigeru Nagai believes that the strong demand for Japanese stocks may continue. He analyzed that foreign investors believe that the Japanese economy is becoming increasingly vibrant due to the long-term labor shortage, and the strong growth of wages and labor mobility are proof of this. At present, enterprises are also eager to improve their profitability by increasing labor costs. This constitutes the driving force behind the strong demand for Japanese stocks.

Japanese overseas assets will not return in any meaningful way

Japan's overseas assets are another focus of discussion in the context of yen depreciation. According to data from the Japanese Ministry of Finance, as of the end of 2022, Japan's net overseas assets were 418.6 trillion yen, while Japan's GDP for that year was about 546 trillion yen.

With the Bank of Japan exiting its negative interest rate policy, there is a growing analysis on the internet that: after the interest rate hike, Japan's overseas capital may start to flow back, thereby exacerbating the depreciation of the yen, forming a cycle.

NBD asked Shigeru Nagai for his opinion on this issue. In his view, any impact will be based on the extent of the Bank of Japan's rate hike and the direction of the Fed and the US economy.

He predicts that the (Bank of Japan's) first rate hike will take place in April 2025, but that rate hikes in the next few years will be cautious and limited. Based on this, he firmly believes that "Japanese overseas investment will not flow back in any meaningful way unless a US recession follows, or unless the yen itself appreciates significantly to create a feedback loop in which negative values at market prices create further demand for spot yen, leading to asset sales."

In fact, the importance of overseas investment to Japanese companies is clear. According to Nikkei Chinese website, the record high of Japanese stock market is behind the change of economic structure, and the good performance of enterprises is supported by their overseas profitability. In the past 30 years, the source of profit for Japanese companies has shifted from trade to investment, and by 2023, their overseas profits have increased by 33 trillion yen.

Despite the rise in Japanese stocks, the fruits of growth have yet to benefit the economy as a whole. In the fourth quarter of 2023, Japan's real GDP fell by 0.4%, the second consecutive quarter of negative growth.

Based on his prediction of the magnitude of rate hikes, Shigeru Nagai believes that the impact of interest rate changes on the economy will be very limited. "There remains considerable uncertainty on the growth and inflation front in the short and medium term. The magnitude and scope of wage increases will be constrained by Japan's demographics and stagnant productivity growth.."

According to previous reports, the Japanese Trade Union Confederation, Japan's largest trade union, said that according to preliminary statistics, in this year's "spring struggle" labor-management negotiations, companies will increase wages by an average of 5.28%, the largest wage increase in Japan in more than 30 years.

"However, the extent and scope of wage increases will be limited by Japan's population structure and stagnant productivity growth. Consumption growth needs to continue to maintain the expected wage-driven inflation process so that companies can maintain a certain pricing power and provide funds for wage increases. This is why we believe that rate hikes will be cautious and limited in the next few years," he explained.

On the other hand, from the perspective of the weak yen, it is beneficial for large Japanese companies to carry out global business, because it increases the value of overseas profit repatriation, and can also improve the purchasing power of inbound tourists, thereby promoting the development of the tourism industry.

However, the downside is that since most Japanese companies have transferred their production overseas, and Japan is heavily dependent on imports for goods such as fuel, raw materials and mechanical parts, the weak yen makes import costs higher, which hurts consumers.

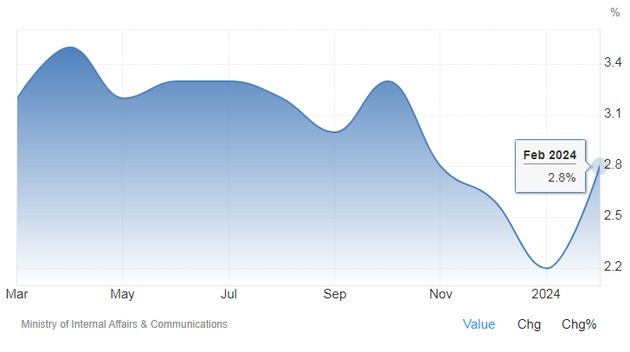

Nagai predicts that "CPI will stabilize at around 2% only in 2028." (Editor's note: A CPI increase of around 2% to 3% is generally considered a moderate and reasonable range, and is a manifestation of orderly market operation and stable economic prosperity.)

"At the same time, the BoJ will be able to raise rates only gradually not to threaten the wage-driven inflation process and the terminal rate will unlikely to exceed 1%," he told NBD.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before using.

川公网安备 51019002001991号

川公网安备 51019002001991号