File Photo/NBD

On Wednesday, February 21, in the after-market session, Nvidia released its fourth-quarter earnings report for fiscal year 2024, ending January 28, 2024. Both revenue and profit increased significantly year-over-year, exceeding analysts’ expectations, and setting new records for the third consecutive quarter. In addition, Nvidia guided revenue for the first quarter of fiscal year 2025 to be $24 billion (±2%), higher than the market expectation of $21.9 billion.

Some analysts believe that Nvidia’s business growth momentum may have been underestimated, which explains why Nvidia has consistently exceeded expectations.

In the earnings call, Nvidia CEO Jensen Huang said that generative AI has reached a “tipping point”. Nvidia CFO Colette Kress said, “We estimate that about 40% of data center revenue in the past year came from AI.” The market demand for Nvidia’s next-generation products far exceeds the supply.

Driven by this, Nvidia’s stock price rose as much as 10% in the aftermarket session and was up 9.04% as of press time.

Photo/Google Finance

Dan Ives, managing director and senior stock analyst at Wedbush, said in an email to NBD that a robust quarter and guidance crushing Street and whisper expectations that further solidifies the AI Revolution is just starting and not peaked.

The better-than-expected fourth-quarter report makes Nvidia’s $2 trillion market value goal a matter of time. However, the record valuations of AI-related stocks, including Nvidia, remind people of the telecom stocks during the dot-com bubble. The Financial Times reported that it compared Nvidia today with Cisco, the telecom stock leader during the dot-com bubble, and warned investors and institutions to remember history.

What does Nvidia rely on to beat analysts’ expectations?

The earnings report showed that, benefiting from the surge in demand for server AI chips, Nvidia achieved revenue of $22.1 billion in the fourth quarter of fiscal year 2024, up 22% quarter-over-quarter and up 265% year-over-year, higher than analysts’ expectation of $20.41 billion, and even higher than the full-year revenue of 2021. During the reporting period, Nvidia achieved a net profit of $12.3 billion, up 769% year-over-year, and adjusted earnings per share of $5.16, higher than analysts’ expectation of $4.59. Revenue and profit set new records for the third consecutive quarter.

Photo/Nvidia

Some analysts believe that Nvidia’s business growth momentum may have been underestimated, especially its data center revenue generation capability.

The earnings report showed that Nvidia’s largest revenue source, the data center segment, achieved revenue of $18.4 billion in the fourth quarter, up 409% year-over-year, higher than analysts’ expectation of $17.21 billion. Nvidia said that the growth in data center revenue was mainly driven by the rebound in demand as global economic downturn worries eased. Nvidia CFO Colette Kress analyzed, “The fourth quarter data center revenue was mainly driven by generative AI and its related training. We estimate that about 40% of data center revenue in the past year came from AI.”

Nvidia’s founder and CEO Jensen Huang pointed out that accelerated computing and generative AI have reached a “tipping point”, and the demand from companies, industries and nations around the world is surging, which shows that Nvidia’s products and solutions in these areas are well received by the market.

Dan Ives, managing director and senior stock analyst at Wedbush, said in an email to NBD, “ a robust quarter and guidance crushing Street and whisper expectations that further solidifies the AI Revolution is just starting and not peaked.”

Ives pointed out that the first part of this puzzle was front and center the last few weeks as Big Tech stalwarts Microsoft, Alphabet, Meta, Amazon and others cited accelerating CapEx for AI build outs on their earnings calls over the last few weeks speaking to our view that AI monetization is now underway hitting the shores of the tech sector.

He said, “we believe 60%-70% of enterprises will ultimately head down the AI use case path as we estimate a $1 trillion of incremental AI spend over the next decade. Right now we are only talking about generative AI in the enterprise with the consumer piece also on the horizon being led by Alphabet, Meta, Amazon, Microsoft, and others.

Nvidia CFO Colette Kress said in the earnings call that the market demand for the company’s next-generation products far exceeds the supply, especially the new-generation chip B100 that the company expects to ship later this year. He said, “Building and deploying AI solutions has penetrated almost every industry”, and expects the data centre infrastructure scale to double in five years.

NBD that next month, Nvidia will host its flagship event GTC conference for AI developers. At that time, Nvidia may reveal the details of B100. Morgan Stanley analyst Joseph Moore said in a report earlier this month that based on some early disclosures of the system, B100 will be a “major advancement in cutting-edge technology”.

For Nvidia, new products are crucial for coping with increasingly fierce competition and maintaining profitability. Bank of America senior analyst Vivek Arya believes that the pricing of Nvidia’s upcoming B100 product will be at least 10% to 30% higher than the company’s currently popular H100 system.

Is Nvidia today equal to Cisco before the dot-com bubble burst?

NBD noted that, driven by strong chip demand, Nvidia’s stock price has risen 40% this year, and its market value has increased by more than $400 billion, reaching $1.67 trillion. In the 30 trading days ending February 20, Nvidia’s average daily trading volume was about $30 billion, surpassing Tesla, whose average daily trading volume was $22 billion during the same period.

Photo/ Google Finance

Nvidia is favoured by funds in the secondary market, reflecting the market’s strong interest in AI and the underlying computing chips. However, the record valuations of AI-related stocks, including Nvidia, remind people of the telecom stocks’ surge and subsequent plunge during the dot-com bubble.

According to the Financial Times, When the internet first became widely used, networking hardware was king. Servers needed to be built and connected using routers. Companies began building and buying hardware on the basis that extreme demand for servers would continue indefinitely. Telecom gear stocks such as Cisco surged more than 30-fold in the years to its 2000 peak.

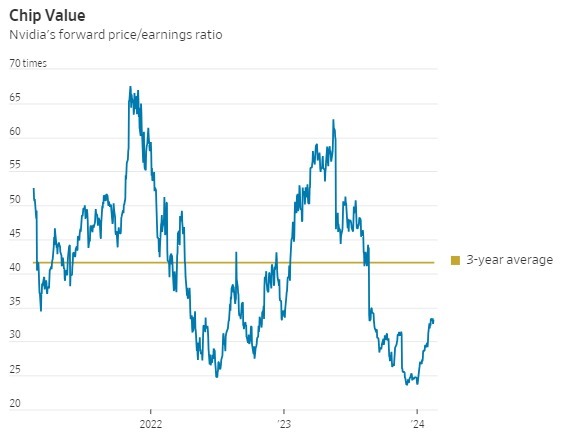

Nvidia’s forward P/E ratio is still relatively low

The hot market for AI computing GPUs proves that Nvidia may soon achieve a market value of $2 trillion.

About eight months ago, shortly after Nvidia’s 30th anniversary, it became the first chip company to break through a market value of $1 trillion. Last week, thanks to the continued momentum, Nvidia’s market value surpassed Amazon and Alphabet, the parent company of Google, and its market value is now close to $1.8 trillion, making it the third-largest listed company in the US market, second only to Microsoft and Apple.

Currently, in addition to tech giants such as Amazon and Alphabet, almost all AI startups in the world are competing for Nvidia’s limited high-end computing GPUs. This also explains why Nvidia, which relied mainly on selling gaming graphics cards five years ago, can achieve such a high market value. It is reported that Amazon and Alphabet will invest tens of billions of dollars in capital budget for high-end computing GPUs every year.

However, according to FactSet data, at a market value of $2 trillion, Nvidia’s forward P/E ratio will be around 38 times, which is about 9% lower than the average level of the past three years. Among the 30 components of the Philadelphia Semiconductor Index, only seven stocks currently have a higher expected P/E ratio than 38 times, including Nvidia’s competitor AMD.

Nvidia’s forward P/E ratio changes over the past three years (Photo/ The Wall Street Journal)

“The bears will continue to argue over the valuations of Nvidia, Microsoft, Palantir, MongoDB and other pure AI companies. Investors who missed Amazon, Netflix, Meta, Apple, Alphabet and other major transformative tech stocks in the past decade will stubbornly stick to the forward P/E valuation method on these tech companies today.” Ives said.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before using.

川公网安备 51019002001991号

川公网安备 51019002001991号