Photo/VCG

The Red Sea crisis is still ongoing. According to CCTV News, the White House issued a statement on January 17 local time, saying that it has re-designated the Yemeni Houthi rebels as “specially designated global terrorists”. The statement said that the designation will take effect in 30 days; if the Houthi rebels stop their attacks in the Red Sea, the United States will immediately reassess the designation.

Houthi spokesperson Mohammed Abdulsalam on Wednesday told Reuters that the designation would not affect operations, which the group says are in support of the Palestinians and target Israeli ships or ships heading to Israel.

The continued tension in the situation has forced more and more tanker owners to bypass the Red Sea. CCTV News reported that from January 1 to 11 this year, the Suez Canal ship traffic volume dropped by 30% compared with the same period last year; since late November last year, the average transportation cost of long containers of about 12 meters worldwide has almost doubled.

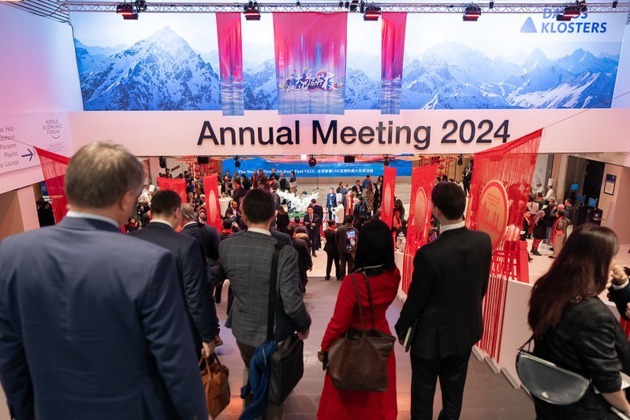

At the World Economic Forum (WEF) 2024 annual meeting held in Davos, Switzerland, institutions and enterprises such as the International Energy Agency and Maersk made important judgments on the Red Sea crisis and its impact on the oil market and other fields.

Image source: World Economic Forum

IEA: The oil market will be “comfortable and balanced” this year

Fatih Birol, executive director of the International Energy Agency (IEA), said at a forum hosted by Reuters during the WEF annual meeting on Wednesday that it believes that “if there are no major geopolitical surprises,” the oil market will be in a “comfortable and balanced position” this year.

Birol said that the IEA expects that as global demand growth slows down, the oil production of the United States, Canada, Brazil and Guyana will increase significantly this year. The Houthi rebels’ attacks on Red Sea ships have forced many companies to transfer goods to various places in Africa, increasing transportation time and costs. He pointed out that so far, production has not been affected. Oil prices are expected not to be significantly affected unless one or more major oil-producing countries are directly involved in the conflict. “I expect oil prices will not change significantly, because there is enough oil in the market.”

The IEA expects global oil demand to grow by 1.1 million barrels per day in 2024. It expects non-OPEC supply growth to reach 1.2 million barrels per day next year. The Organization of Petroleum Exporting Countries (OPEC) predicts that demand growth in 2024 will be 2.25 million barrels per day.

Birol said that in the context of high inflation, “moderate oil prices” will benefit economic growth.

Maersk CEO: Expect Red Sea shipping disruption to last “at least a few months”

Vincent Clerc, chief executive of Maersk, said on Wednesday that the disruption to global shipping caused by the Red Sea ship attacks could last “at least a few months”.

Maersk and other large shipping companies have instructed hundreds of merchant ships to stay away from the Red Sea and sent ships to longer routes around Africa to cope with the attacks on shipping by Iranian-backed Houthi militants.

Clerc said at an event hosted by Reuters during the WEF annual meeting: “Therefore, for us, this will mean longer transportation time, possible supply chain disruptions for at least a few months, hopefully shorter, but possibly longer, because how this situation actually develops is unpredictable.”

According to the World Container Index of maritime consultancy Drewry, freight rates have more than doubled since early December last year, while insurance sources said that war insurance premiums for transportation through the Red Sea are also rising.

Banking executives said they were worried that the crisis could cause inflationary pressures, which could eventually delay or reverse interest rate cuts.

“This is very destructive, because nearly 20% of global trade is done through the Strait of Mandeb. It is one of the most important arteries of global trade and global supply chains, but it is now blocked,” Clerc said.

Saudi Aramco CEO: Oil market will tighten, OPEC spare capacity will be an important reliance

Amin Nasser told Reuters he expected the oil market to tighten after consumers depleted stocks by 400 million barrels in the last two years, which left OPEC's spare capacity as the main source of additional supply to meet rising demand.

Nasser said he saw oil demand at 104 million barrels a day (bpd) in 2024, meaning growth of roughly 1.5 million bpd after growing by 2.6 million bpd in 2023. And demand growth, combined with low stocks, will help tighten the market further, he added.

“If it's in the short term, tankers might be available ... But if it's longer term, it might be a problem,” Nasser said in an interview on the sidelines of this week's World Economic Forum in the Swiss ski resort of Davos. “There will be a need for more tankers and are they going to have to take a longer journey.”

DHL CEO: Red Sea disruption may cause container shortage

DHL chief executive Tobias Meyer on Wednesday warned the ongoing disruptions to global trade caused by Houthi rebel attacks in the Red Sea could lead to shipping container shortages in Asia in the coming weeks.

Meyer said at a panel discussion during the WEF annual meeting that there may be a shortage because the containers returning to Asia may not reach a sufficient number. “We have to keep a close eye on this.” However, he also added that the current situation is definitely not comparable to the supply chain difficulties three or four years ago.

川公网安备 51019002001991号

川公网安备 51019002001991号