CHENGDU, Dec. 2 (NBD) -- China Securities Regulatory Commission is cracking down on various types of market manipulation by launching special enforcement actions.

NBD reporter noticed that by the middle of October this year, the shares of more than 130 listed companies are unloaded by major shareholders after high-yield dividend stocks were introduced. For some companies, sliding performances followed.

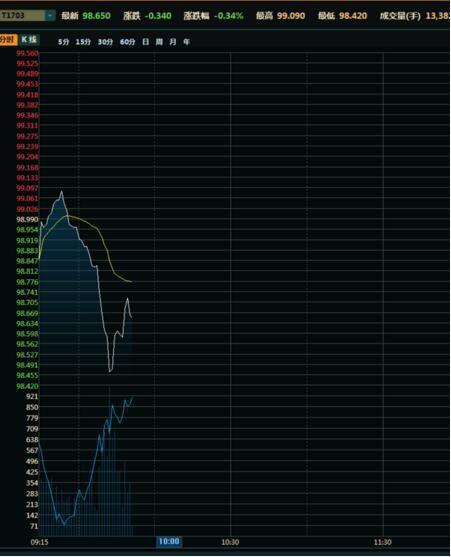

Pi Haizhou, a financial commentator said, “some companies with bad or sliding performances also introduced high-yield dividend stocks. In fact, they were used to drive up stock prices so as to facilitate big shareholders to unload their shares. In the end, common shareholders are hurt. Spreading information about high-yield dividend stocks is a typical way to manipulate information. Worse still, some big shareholders on secondary markets even conspired to manipulate share prices”.

Analists said that spreading information about high-yield dividend stocks is a major way to manipulate information, because companies have the final say on how and when to introduce such kind of stock.

In the end, the common shareholders will be badly hurt. Information manipulation is likened to a manipulator who controlled the casino dealer. Under such circumstances, other players may have little chance to win.

川公网安备 51019002001991号

川公网安备 51019002001991号